Qantas 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

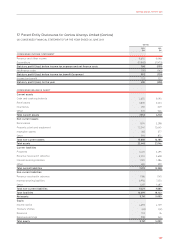

160

Qantas

2013

$M

2012

$M

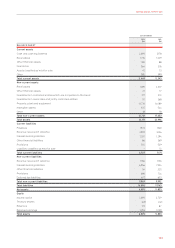

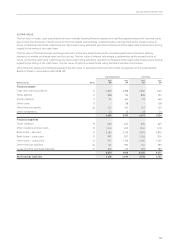

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

Statutory prot/(loss) for the year 694 (498)

Effective portion of changes in fair value of cash ow hedges, net of tax 106 (51)

Transfer of hedge reserve to the Income Statement, net of tax (50) (89)

Recognition of effective cash ow hedges on capitalised assets, net of tax 21 92

Total other comprehensive income/(loss) for the year 77 (48)

Total comprehensive income/(loss) for the year 771 (546)

CONDENSED CASH FLOW STATEMENT

Net cash from operating activities 1,298 1,289

Net cash used in investing activities (703) (2,009)

Net cash (used)/from in nancing activities (1,033) 425

Net decrease in cash and cash equivalents held (438) (295)

Cash and cash equivalents held at the beginning of the year 3,093 3,388

Effects of exchange rate changes on cash and cash equivalents – –

Cash and cash equivalents at the end of the year 2,655 3,093

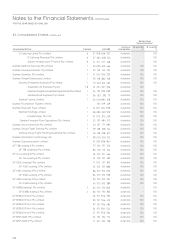

B CAPITAL EXPENDITURE COMMITMENTS

Capital expenditure commitments contracted but not provided for in the Financial Statements, payable:

Not later than one year 1,029 1,083

Later than one year but not later than ve years 4,618 7,930

Later than ve years 3,444 4,928

9,091 13,941

Qantas has a number of cancellation and deferral rights within its aircraft purchase contracts which can reduce or defer the above

capital expenditure. The Company also has further opportunities to place ordered aircraft with its associates.

C FINANCING FACILITIES

The Financing facilities held by the parent entity are the same as those held by the Group as disclosed in Note 27.

D CONTINGENT LIABILITIES

The Contingent liabilities held by the parent entity are the same as those held by the Group as disclosed in Note 30.

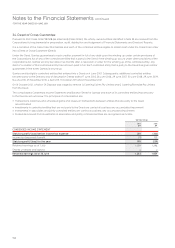

E PARENT ENTITY GUARANTEES IN RESPECT OF DEBTS OF ITS SUBSIDIARIES

The parent entity has entered into a Deed of Cross Guarantee with the effect that the Company guarantees debts in respect of its

subsidiaries. Further details of the Deed of Cross Guarantee and the subsidiaries subject to the Deed are disclosed in Note 34.

F INTERESTBEARING LIABILITIES

The parent entity has total interest-bearing liabilities of $7,976 million (2012: $8,539 million) of which $3,960 million (2012: $4,338 million)

represents lease and hire purchase liabilities payable to controlled entities. Of the $4,016 million (2012: $4,201 million) payable to

other parties, $2,097 million (2012: $2,100 million) represents secured bank loans and lease liabilities with the remaining balance

representing unsecured loans and deferred lease benets.

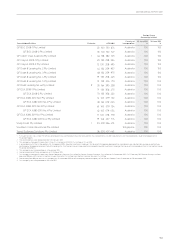

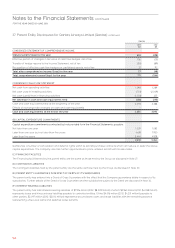

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013

37. Parent Entity Disclosures for Qantas Airways Limited (Qantas)

continue

d