Qantas 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

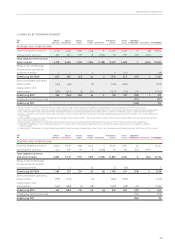

116

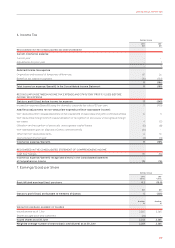

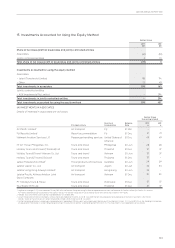

(iii) Underlying EBIT

Underlying EBIT is calculated using a consistent methodology as outlined above but excluding the impact of statutory net nance

costs and ineffective and non-designated derivatives relating to other reporting periods affecting net nance costs.

The reconciliation of Underlying PBT from Statutory PBT is detailed in the table below.

Qantas Group

2013

$M

2012

$M

Statutory prot/(loss) before income tax expense 17 (349)

Adjusted for ineffectiveness and non-designated derivatives relating to other reporting periods

Exclude current year derivative mark-to-market movements relating to underlying exposures

in future years 26 86

Exclude current year derivative mark-to-market movements relating to capital expenditure 12 9

Include prior years’ derivative mark-to-market movements relating to underlying exposures

in the current year (71) (51)

Include adjustment to depreciation expense relating to excluded capital expenditure

mark-to-market movements (6) (4)

Exclude ineffective and non-designated derivatives relating to other reporting periods affecting

net nance costs 76

(32) 46

Other items not included in Underlying PBT

Net impairment of property, plant and equipment186 147

Redundancies and restructuring2118 203

Impairment of goodwill and other intangible assets324 18

Net prot on disposal of investment in jointly controlled entity (30) –

Net impairment of investments (2) 19

Write down of inventory 413

Other 7(2)

207 398

Underlying PBT 192 95

1 As disclosed in Note 3, net impairment of property, plant and equipment for the year ended 30 June 2013 was $93 million (2012: $157 million), of which $86 million (2012: $147 million) is

presented as other items not included in Underlying PBT.

2 As disclosed in Note 3, redundancies and restructuring for the year ended 30 June 2013 was $122 million (2012: $206 million), of which $118 million (2012: $203 million) is presented as other

items not included in Underlying PBT.

3 As disclosed in Note 3, net impairment of goodwill and intangible assets for the year ended 30 June 2013 was $24 million (2012: $20 million), of which $24 million (2012: $18 million) is

presented as other items not included in Underlying PBT.

E UNDERLYING PBT PER SHARE

Qantas Group

2013

cents

2012

cents

Basic/diluted Underlying PBT per share 8.5 4.2

Refer to Note 7 for the weighted average number of shares used in the calculation of basic/diluted Underlying PBT per share.

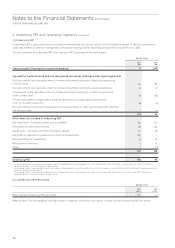

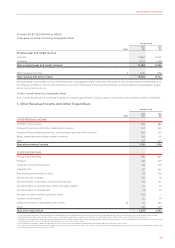

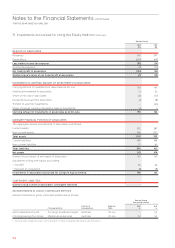

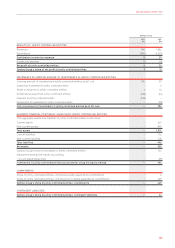

2. Underlying PBT and Operating Segments

continue

d

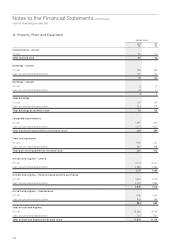

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013