Qantas 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

129

QANTAS ANNUAL REPORT 2013

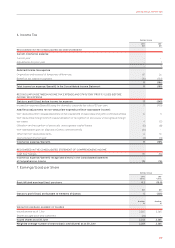

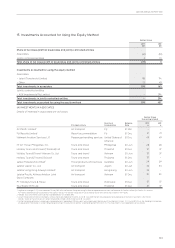

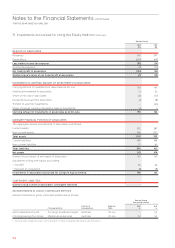

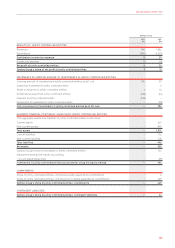

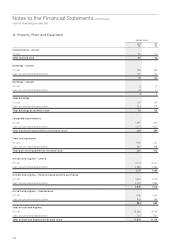

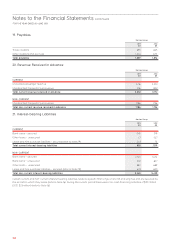

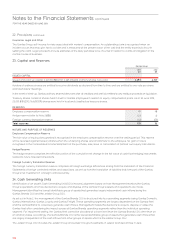

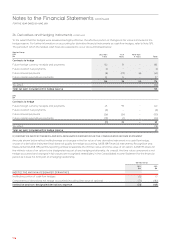

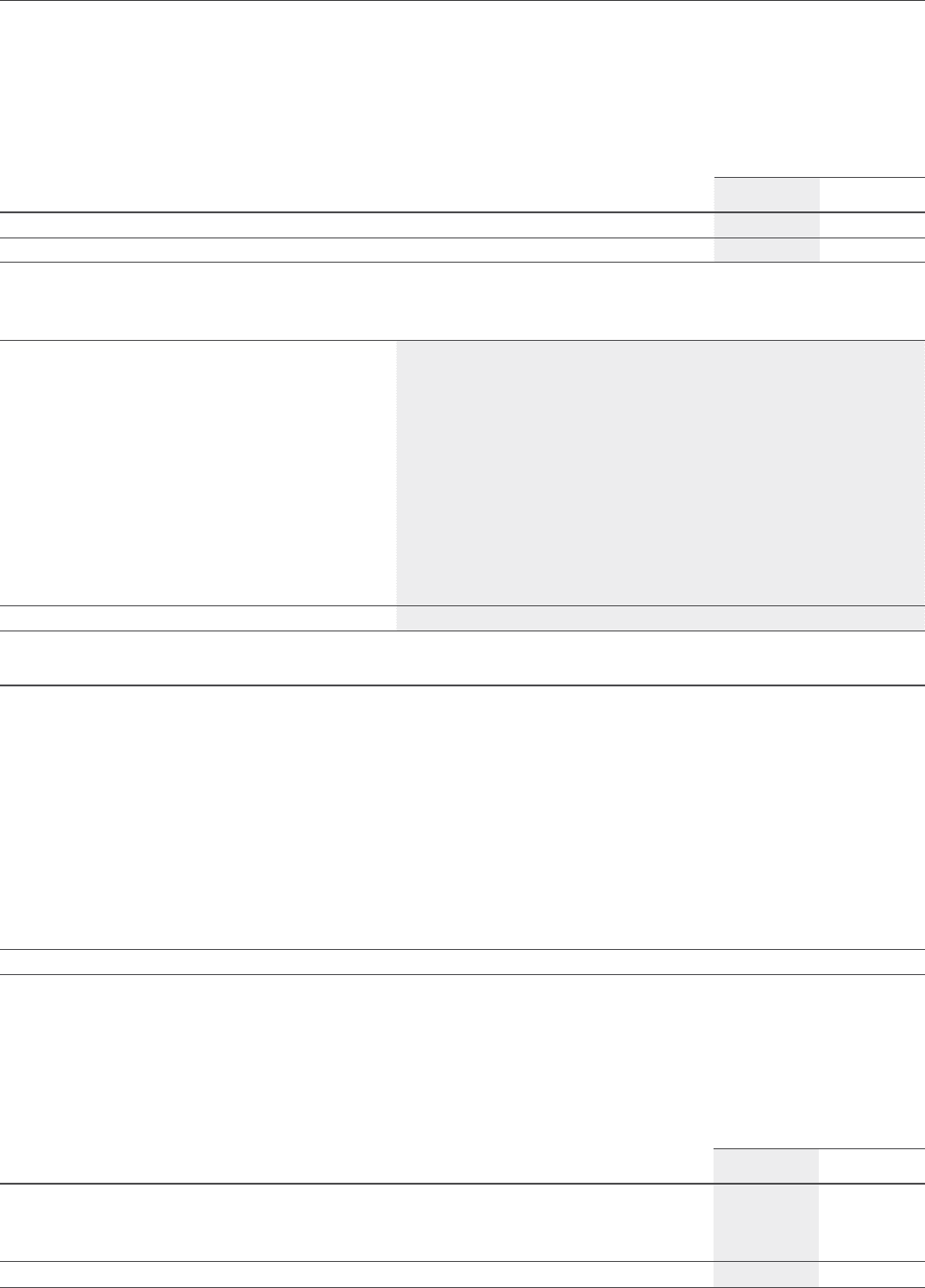

18. Deferred Tax Liabilities

Qantas Group

2013

$M

2012

$M

Deferred tax liabilities 673 644

Total deferred tax liabilities 673 644

Qantas Group

2013

$M Opening

Balance

Recognised in

the Consolidated

Income Statement

Recognised

in Other

Comprehensive

Income

Acquisition of

Controlled Entity

Closing

Balance

Reconciliations

Inventories (15) (1) – – (16)

Property, plant and equipment and intangible assets (1,797) (59) – – (1,856)

Payables 48 (10) – – 38

Revenue received in advance 619 20 – – 639

Interest-bearing liabilities (82) (1) – – (83)

Other nancial assets/liabilities (35) (29) (35) – (99)

Provisions 352 (33) – 16 335

Other items (211) 26 – 1 (184)

Tax value of recognised tax losses 477 76 – – 553

Total deferred tax liabilities (644) (11) (35) 17 (673)

2012

$M

Reconciliations

Inventories (16) 1 – – (15)

Property, plant and equipment and intangible assets (1,723) (74) – – (1,797)

Payables 59 (11) – – 48

Revenue received in advance 597 22 – – 619

Interest-bearing liabilities (99) 17 – – (82)

Other nancial assets/liabilities (30) (21) 16 – (35)

Provisions 279 73 – – 352

Other items (181) (30) – – (211)

Tax value of recognised tax losses 347 130 – – 477

Total deferred tax liabilities (767) 107 16 – (644)

At 30 June 2013 there is no recognised or unrecognised deferred tax liability for taxes that would be payable on the unremitted

earnings of the Qantas Group’s controlled entities, associates and jointly controlled entities (2012: nil).

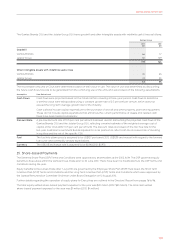

UNRECOGNISED DEFERRED TAX ASSETS

Deferred tax assets have not been recognised with respect to the following items because it is not probable that future taxable

prot will be available against which the Qantas Group can utilise these benets:

Qantas Group

2013

$M

2012

$M

Tax losses – New Zealand operations 17 13

Tax losses – Singapore operations 8

8

Tax losses – Hong Kong operations 7

5

Total unrecognised deferred tax assets – tax losses 32 26