Qantas 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

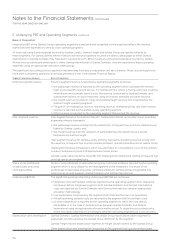

Notes to the Financial Statements

FOR THE YEAR ENDED 30 JUNE 2013

1. Statement of Signicant Accounting Policies

Qantas Airways Limited (Qantas) is a for-prot company limited by

shares, incorporated in Australia whose shares are publicly traded

on the Australian Securities Exchange (ASX) and which is subject to

the operation of the Qantas Sale Act as described in the Corporate

Governance Statement.

The Consolidated Financial Statements for the year ended

30June 2013 comprise Qantas and its controlled entities (together

referred to as the Qantas Group) and the Qantas Group’s interest

in associates and jointly controlled entities.

The Financial Statements of Qantas for the year ended

30June2013 were authorised for issue in accordance with

aresolution of the Directors on 6 September 2013.

A STATEMENT OF COMPLIANCE

The Consolidated Financial Statements are general purpose

nancial statements which have been prepared in accordance

with Australian Accounting Standards (AASBs) adopted by

the Australian Accounting Standards Board (AASB) and the

Corporations Act 2001. The Consolidated Financial Statements also

comply with International Financial Reporting Standards (IFRSs)

and interpretations adopted by the International Accounting

Standards Board (IASB).

B BASIS OF PREPARATION

The Consolidated Financial Statements are presented in Australian

dollars, which is the functional currency of the Group, and have

been prepared on the basis of historical cost except in accordance

with relevant accounting policies where assets and liabilities

are stated at their fair values. Assets classied as held for sale

are stated at the lower of carrying amount and fair value less

coststosell.

Qantas is a company of the kind referred to in Australian Securities

and Investments Commission (ASIC) Class Order 98/100 dated

10 July 1998. In accordance with that Class Order, all nancial

information presented has been rounded to the nearest million

dollars, unless otherwise stated.

The accounting policies set out in Note 1 have been consistently

applied to all periods presented in the Consolidated Financial

Statements.

C CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of the Consolidated Financial Statements in

conformity with AASBs requires management to make judgements,

estimates and assumptions that affect the application of

accounting policies and reported amounts of assets, liabilities,

income and expenses. The estimates and associated assumptions

are based on historical experience and various other factors that

are believed to be reasonable under the circumstances, the results

of which form the basis for making the judgements about carrying

values of assets and liabilities that are not readily apparent from

other sources. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised and in any future periods

affected. Judgements made by management in the application of

AASBs that have a signicant effect on the Financial Statements

and estimates with a signicant risk of material adjustment in future

periods are highlighted below.

Change in Accounting Estimate – Passenger Revenue

During the year a review was undertaken of the key judgements

and estimates impacting the timing of revenue recognition and

the measurement of revenue received in advance for tickets which

have passed the ticketed travel date.

To more appropriately align the Group’s revenue recognition and

liability measurement estimates with ticket terms and conditions

and historic experience, revenue increased by $134million for the

year ended 30 June 2013 through a reduction in revenuereceived

in advance.

Tickets that have passed the ticketed travel date will be recognised

as revenue in accordance with these revised estimates based on

the ticketed terms and conditions and historic experience.

D PRINCIPLES OF CONSOLIDATION

Controlled Entities

Controlled entities are entities controlled by Qantas. Control exists

when Qantas has the power, directly or indirectly, to govern the

nancial and operating policies of an entity so as to obtain benets

from its activities. In assessing control, potential voting rights that

are presently exercisable or convertible are taken into account.

The Financial Statements of controlled entities are included in

the Consolidated Financial Statements from the date that control

commences until the date that control ceases.

Intra-group transactions, balances and unrealised gains and

losses on transactions between group companies are eliminated

in preparing the Consolidated Financial Statements.

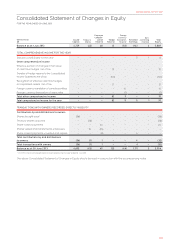

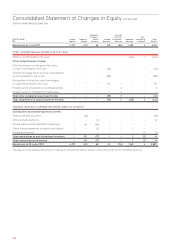

Non-controlling interests in the results and equity of controlled

entities are shown separately in the Consolidated Income Statement,

Consolidated Statement of Comprehensive Income, Consolidated

Statement of Changes in Equity and Consolidated Balance Sheet.

Associates and Jointly Controlled Entities

Associates are those entities in which the Qantas Group has

signicant inuence, but not control or joint control, over the

nancial and operating policies.

Jointly controlled entities are those entities over whose activities the

Qantas Group has joint control, established by contractual agreement.

Investments in associates and jointly controlled entities are

accounted for using the equity accounting method. The

investments are carried at the lower of the equity accounted

amount and the recoverable amount.

The Qantas Group’s share of the associates’ and jointly controlled

entities’ post-acquisition prot or loss is recognised in the

Consolidated Income Statement from the date that signicant

inuence or joint control commences until the date that signicant

inuence or joint control ceases. The Qantas Group’s share of

post-acquisition movements in reserves is recognised in other

comprehensive income. The cumulative post-acquisition movements

are adjusted against the carrying value of the investment. Dividends

reduce the carrying amount of the equity accounted investment.

When the Qantas Group’s share of losses exceeds its equity

accounted carrying value of an associate or jointly controlled

entity, the Qantas Group’s carrying amount is reduced to nil

and recognition of further losses is discontinued, except to the

extent that the Qantas Group has incurred legal or constructive

obligations or made payments on behalf of an associate or

jointly controlled entity.