Qantas 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

161

QANTAS ANNUAL REPORT 2013

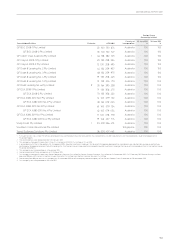

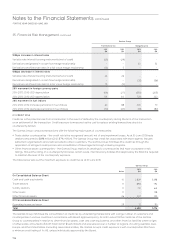

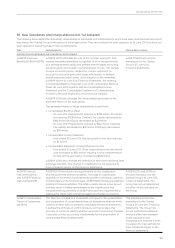

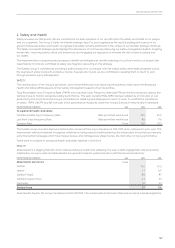

38. New Standards and Interpretations Not Yet Adopted

The following table details the standards, amendments to standards and interpretations which have been identied as those which

may impact the Qantas Group in the period of initial application. They are available for early adoption at 30 June 2013, but have not

been applied in preparing these Financial Statements.

Topic Key Requirements Effective Date for Qantas

Australian Accounting Standards and Interpretations Not Yet Adopted

AASB 119 Employee

Benets (2011) (AASB 119)

AASB 119 (2011) eliminates the use of the ‘corridor approach’ and

instead mandates immediate recognition of all re-measurements

of a dened benet liability and dened benet assets (including

actuarial gains and losses) in comprehensive income. The Qantas

Group’s accounting policy utilises the ‘corridor approach’ to

accountfor actuarial gains and losses with respect to dened

benetsuperannuation plans. Upon adoption of the amended

AASB 119 for the 30 June 2014 Financial Statements, the opening

Consolidated Balance Sheet (30 June 2012), comparative Balance

Sheet (30 June 2013) together with the Consolidated Income

Statementand the Consolidated Statement of Comprehensive

Incomefor the year ended 30 June 2013 will be restated.

AASB 119 (2011) also changes the measurement principles for the

expected return on the plan assets.

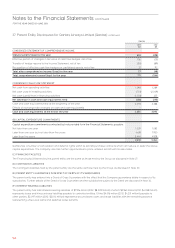

The estimated impact of these restatements is as follows:

»Consolidated Balance Sheet

— 30 June 2012: Prepayments reduced by $293 million, Provisions

increased by $308 million, Deferred Tax Liability decreased by

$180 million and Equity decreased by $421 million.

— 30 June 2013: Prepayments reduced by $162 million, Deferred

Tax Liability decreased by $49 million and Equity decreased

by $114 million.

»Consolidated Income Statement

— Year ended 30 June 2013: Statutory prot for the year reduced

by $4 million.

»Consolidated Statement of Comprehensive Income

— Year ended 30 June 2013: Other comprehensive income for the

year increased by $312 million resulting in total comprehensive

income for the year being increased by $308 million.

AASB 119 (2011) also changes the denition of short-term and long-term

employee benets. This change in classication is not expected to

have a material impact on the nancial statements.

AASB 119 (2011) will become

mandatory for the Qantas

Group’s 30 June 2014

FinancialStatements.

AASB 9 Financial

Instruments (2010)

and AASB 9 Financial

Instruments (2009)

AASB 9 (2010) introduces new requirements for the classication

and measurement of nancial assets. The basis of classification

depends on the entity’s business model and the contractual cash flow

characteristics of the financial asset. AASB 9 (2011) introduces additions

relating to nancial liabilities. The IASB currently has an active project

that may result in limited amendments to the classication and

measurement requirements of AASB 9 and add new requirements to

address the impairment of nancial assets and hedge accounting.

AASB 9 (2010 and 2009) will

become mandatory for the

Qantas Group’s 30 June 2016

Financial Statements. The

Group has not yet determined

the effect of this standard on

theGroup.

AASB 10 Consolidated

Financial Statements

(AASB 10)

The objective of AASB 10 is to establish principles for the presentation

and preparation of consolidated financial statements when an entity

controls another entity to present consolidated financial statements.

It defines the principle of control and sets out how to apply this

principle of control to identify whether an investor controls an investee.

It also sets out the accounting requirements for the preparation of

consolidated financial statements.

This standard will become

mandatory for the Qantas

Group’s 30 June 2014 Financial

Statements. The Group has

not yet performed a detailed

analysis of the new standard,

related guidance and

interpretations, however it does

not expect the new standard to

have a material impact on the

nancial statements.