Qantas 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

QANTAS ANNUAL REPORT 2013

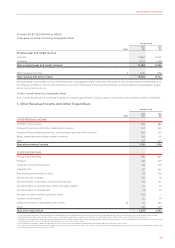

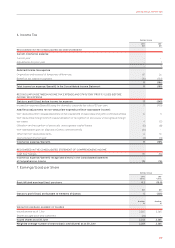

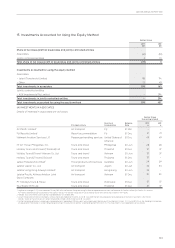

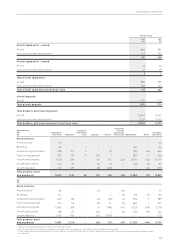

F ANALYSIS BY GEOGRAPHICAL AREAS

(i) Revenue and other Income by Geographic Areas

Qantas Group

Notes

2013

$M

2012

$M

Net passenger and freight revenue

Australia 10,864 10,447

Overseas 3,744 4,081

Total net passenger and freight revenue 14,608 14,528

Other revenue/income 3 1,294 1,196

Total revenue and other income 15,902 15,724

Net passenger and freight revenue is attributed to a geographic region based on the point of sale except where this information is

not directly available in which case allocation is on a pro rata basis. Other revenue/income is not allocated to a geographic region

as it is impractical to do so.

(ii) Non-current Assets by Geographic Areas

Non-current assets which consist principally of aircraft supporting the Groups’ global operations, are primarily located in Australia.

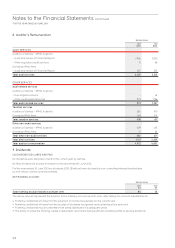

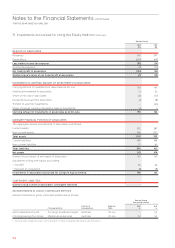

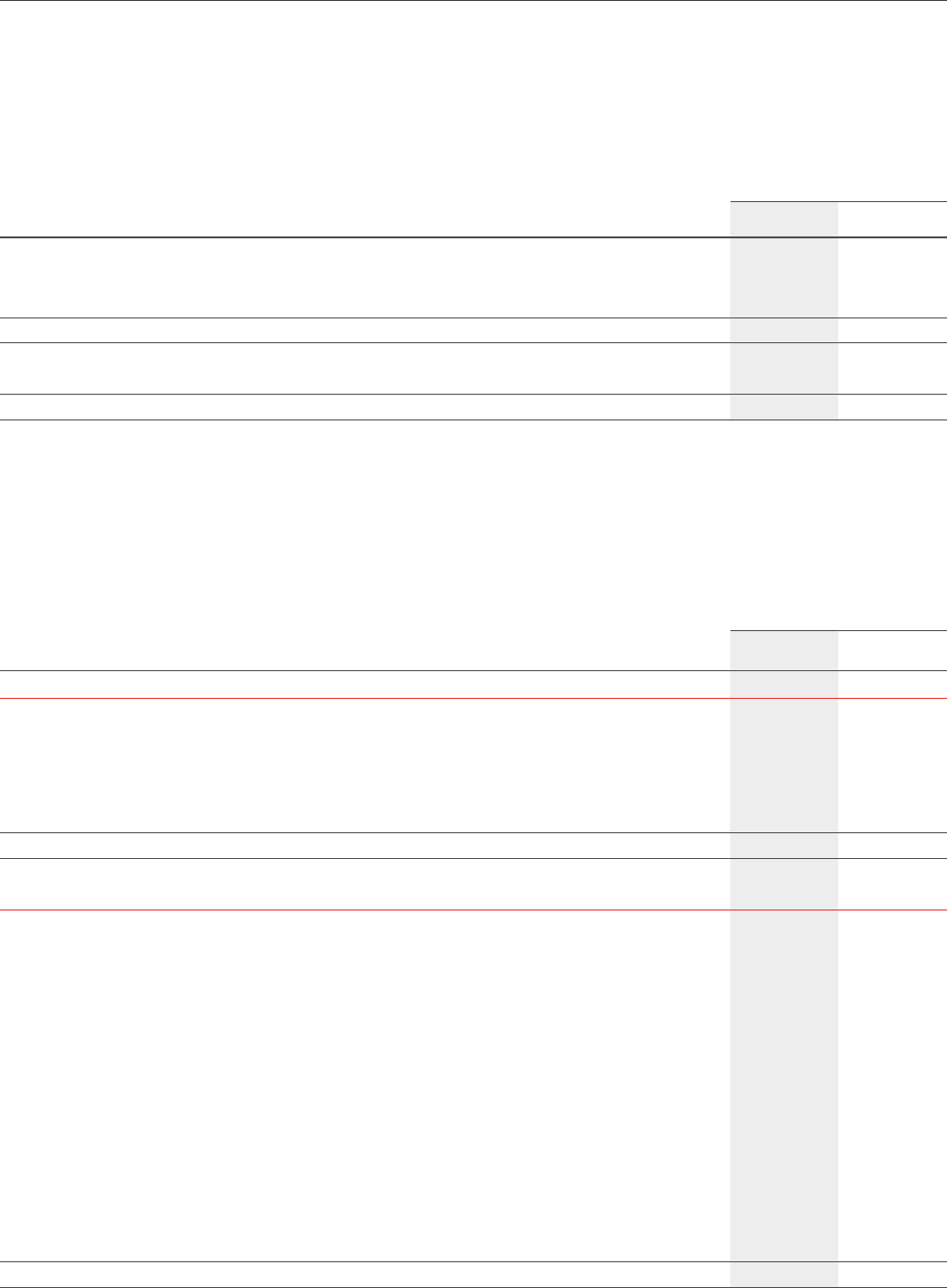

3. Other Revenue/Income and Other Expenditure

Qantas Group

Notes

2013

$M

2012

$M

OTHER REVENUE/INCOME1

Contract work revenue 296

380

Frequent Flyer store and other redemption revenue

2

257

245

Frequent Flyer marketing revenue

2

, membership fees and other revenue 268

235

Retail, advertising and other property revenue 148

131

Other 325

205

Total other revenue/income 1,294 1,196

OTHER EXPENDITURE

Selling and marketing 598 635

Property 482 429

Computer and communication 418 437

Capacity hire 311 266

Redundancies and restructuring 122 206

Airport security charges 145 131

Net impairment of property, plant and equipment

3

93 157

Net impairment of goodwill and other intangible assets

4

24 20

Net impairment of investments (2) 19

Net gain on sale of jointly controlled entity (30) –

Contract work material 65 79

Ineffective and non-designated derivatives 26 76 165

Other 337 449

Total other expenditure 2,639 2,993

1 During the year the Qantas Group restated the Consolidated Income Statement for the reclassication of ancillary passenger revenue, passenger service fees, lease revenue from

codeshare and charter revenue from Other revenue to Net passenger revenue and reclassication of freight lease revenue from Other revenue to Net freight revenue.

2 Frequent Flyer redemption revenue excludes redemptions on Qantas Group’s ights which are reported as net passenger revenue in the Consolidated Income Statement. Frequent Flyer

marketing revenue is net of intra-group marketing revenue within the Qantas Group.

3 Net impairment of property, plant and equipment arises from assets classied as held for sale and recognised at fair value less costs to sell.

4 Net impairment of goodwill and other intangible assets arises from obsolete software (2012 – Cairns and Riverside catering disposal group classied as assets and liabilities held for sale

and recognised at fair value less costs to sell).