Qantas 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

119

QANTAS ANNUAL REPORT 2013

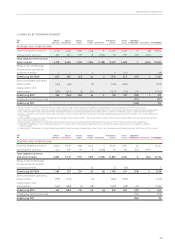

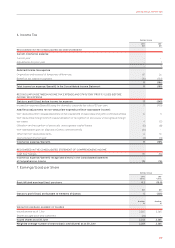

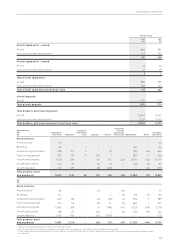

6. Income Tax

Qantas Group

2013

$M

2012

$M

RECOGNISED IN THE CONSOLIDATED INCOME STATEMENT

Current income tax expense

Current year ––

Adjustments for prior year –1

–1

Deferred income tax expense

Origination and reversal of temporary differences 87 24

Benet of tax losses recognised (76) (130)

11 (106)

Total income tax expense/(benet) in the Consolidated Income Statement 11 (105)

RECONCILIATION BETWEEN INCOME TAX EXPENSE AND STATUTORY PROFIT/LOSS BEFORE

INCOME TAX EXPENSE

Statutory prot/(loss) before income tax expense 17 (349)

Income tax expense/(benet) using the domestic corporate tax rate of 30 per cent 5(105)

Add/(less) adjustments for non-deductible expenditure/(non-assessable income):

Non-deductible/(non-assessable) share of net loss/(prot) of associates and jointly controlled entities 14 3

Non-deductible foreign branch losses/utilisation or recognition of previously unrecognised foreign

tax losses 4(2)

Utilisation and recognition of previously unrecognised capital losses (5) (8)

Non-assessable gain on disposal of jointly controlled entity (10) –

Other net non-deductible items 610

Over provision in prior year (3) (3)

Income tax expense/(benet) 11 (105)

RECOGNISED IN THE CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Cash ow hedges 35 (16)

Income tax expense/(benet) recognised directly in the Consolidated Statement

of Comprehensive Income 35 (16)

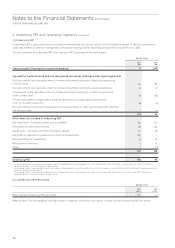

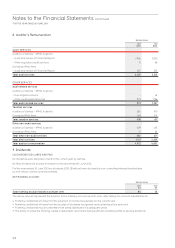

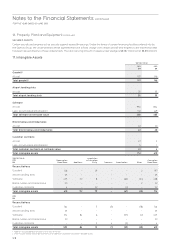

7. Earnings/(Loss) per Share

Qantas Group

2013

Cents

2012

Cents

Basic/diluted earnings/(loss) per share 0.2 (10.8)

$M $M

Statutory prot/(loss) attributable to members of Qantas 5 (245)

Number

M

Number

M

WEIGHTED AVERAGE NUMBER OF SHARES

Issued shares as at 1 July 2,265 2,265

Shares bought back and cancelled (23) –

Issued shares as at 30 June 2,242 2,265

Weighted average number of shares (basic and diluted) as at 30 June 2,249 2,265