Qantas 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

157

QANTAS ANNUAL REPORT 2013

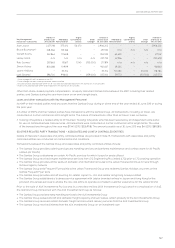

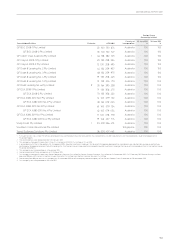

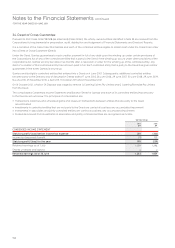

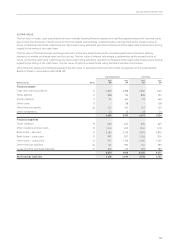

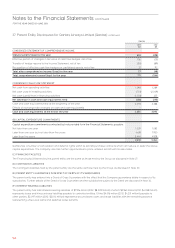

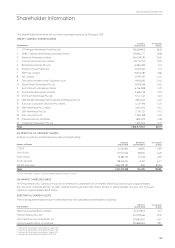

D FAIR VALUE

The fair value of cash, cash equivalents and non-interest-bearing nancial assets and liabilities approximates their carrying value

due to their short maturity. The fair value of nancial assets and liabilities is determined by valuing them at the present value of

future contracted cash ows. Cash ows are discounted using standard valuation techniques at the applicable market yield, having

regard to the timing of the cash ows.

The fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by

reference to market exchange rates and fuel prices. The fair value of interest rate swaps is determined as the present value of

future contracted cash ows. Cash ows are discounted using standard valuation techniques at the applicable market yield, having

regard to the timing of the cash ows. The fair value of options is determined using standard valuation techniques.

Other nancial assets and liabilities represent the fair value of derivative nancial instruments recognised on the Consolidated

Balance Sheet in accordance with AASB 139.

Carrying Amount Fair Value

Qantas Group Notes

2013

$M

2012

$M

2013

$M

2012

$M

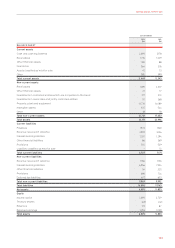

Financial assets

Cash and cash equivalents 10 2,829 3,398 2,837 3,413

Trade debtors 11 898 794 898 794

Sundry debtors 11 712 661 712 661

Other loans 11 –128 –128

Other nancial assets 26 207 105 207 105

Other investments 23 23 23 23

4,669 5,109 4,677 5,124

Financial liabilities

Trade creditors 19 655 645 655 645

Other creditors and accruals 19 1,204 1,231 1,204 1,231

Bank loans – secured 21 3,285 3,733 3,393 3,870

Bank loans – unsecured 21 992 877 1,056 924

Other loans – unsecured 21 927 1,216 1,065 1,225

Other nancial liabilities 26 140 593 140 593

Lease and hire purchase liabilities 21 876 723 942 789

8,079 9,018 8,455 9,277

Net nancial liabilities 3,410 3,909 3,778 4,153