Qantas 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Directors’ Report continued

FOR THE YEAR ENDED 30 JUNE 2013

To achieve this, Executive remuneration is set with regard to the size and nature of the role (with reference to market benchmarks)

and the performance of the individual in the role. In addition, remuneration includes at risk or performance related elements for

which the objectives are to:

»Link Executive reward with Qantas’ business objectives and nancial performance

»Align the interests of Executives with shareholders

»Support a culture of employee share ownership

»Support the retention of Executives

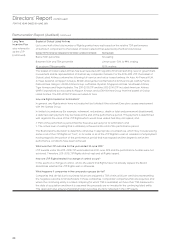

2 ROLE OF THE REMUNERATION COMMITTEE

The Remuneration Committee (a Committee of the Board, whose members are detailed on pages 50 to 53) has the role of

reviewing and making recommendations to the Board on specic Executive remuneration matters at Qantas and ensuring that

remuneration decisions are appropriate from the perspectives of business performance, governance, disclosure, reward levels

andmarket conditions.

In fullling its role, the Remuneration Committee is specically concerned with ensuring that its approach will:

»Motivate the CEO, Executive Management and the broader Executive team to pursue the long-term growth and success of Qantas

»Demonstrate a clear relationship between pay and performance

»Ensure an appropriate balance between xed and at risk remuneration, reecting the short and long-term performance

objectives of Qantas

»Differentiate between higher and lower performers through the use of a performance management framework

During 2012/2013, the Remuneration Committee appointed Ernst & Young (EY) as its primary remuneration consultant. The

Remuneration Committee has established protocols in relation to the appointment and use of remuneration consultants to support

compliance with the Corporations Act 2001 which are incorporated into the terms of engagement with EY.

The Remuneration Committee also appointed JWS Consulting to provide remuneration advice where this advice may be linked

to specic legal and regulatory requirements.

The Remuneration Committee did not request any remuneration consultants to provide a remuneration recommendation

during2012/2013.

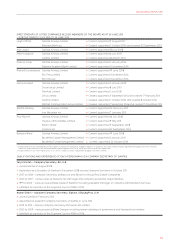

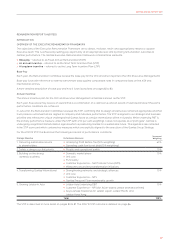

3 EXECUTIVE REMUNERATION FRAMEWORK

The Executive Remuneration Framework as it applies to the CEO and Executive Management contains three elements:

»Base pay – referred to as Fixed Annual Remuneration (FAR)

»An annual incentive – referred to as the Short Term Incentive Plan (STIP)

»A long term incentive – referred to as the Long Term Incentive Plan (LTIP)

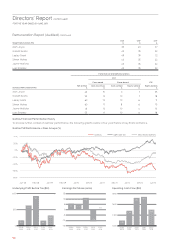

The “at target” pay for the CEO and Executive KMP is set with reference to external benchmark market data including comparable roles

in other listed Australian companies and international airlines. The primary benchmark is a revenue based peer group of other S&P/ASX

companies. The Board believes this is the appropriate benchmark, as it is the comparator group whose roles best mirror the complexity

and challenges in managing Qantas’ businesses and is also the peer group with whom Qantas competes forExecutive talent.

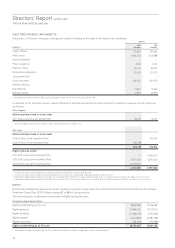

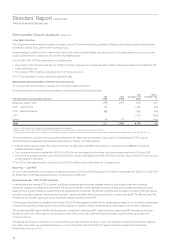

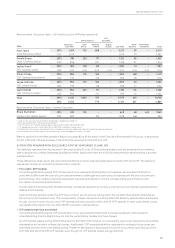

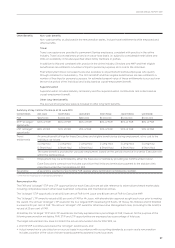

4 REMUNERATION OUTCOMES FOR THE YEAR ENDED 30 JUNE 2013

The remuneration decisions and outcomes at Qantas are clearly linked to Qantas’ performance via the STIP and LTIP

performancemeasures.

The Underlying PBT result for 2012/2013 was below the threshold set by the Board for the 2012/2013 year and therefore there was

no contribution to the 2012/13 STIP scorecard under this measure. Therefore, awards to individuals under the 2012/13STIP were

well below their “at target” levels. Results under the 2012/13 STIP are detailed on page 86.

LTIP awards did not vest during 2012/2013. The 2011–2013 LTIP was tested as at 30 June 2013. As performance hurdles were not

achieved, all Rights under this plan lapsed and Executives did not receive any shares or payment under this plan. Therefore,

theremuneration outcome for 2012/2013 under the LTIP was nil. The LTIP is detailed on pages 87 to 88.

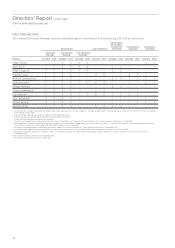

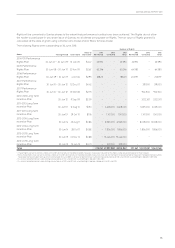

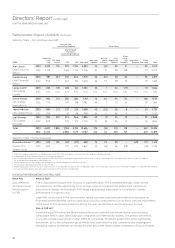

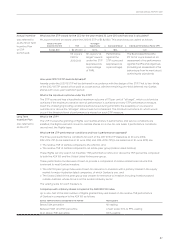

The following table summarises the remuneration decisions and outcomes for the CEO and Executive KMP for the year ended

30June 2013. The remuneration detailed in this table is aligned to the current performance periods and therefore is particularly

useful in assessing current year pay and its alignment with current year performance.

Remuneration Report (Audited)

c

ontinue

d