Proctor and Gamble 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements

The Procter &Gamble Company and Subsidiaries

60

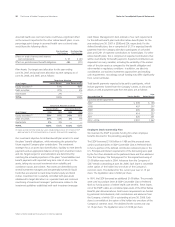

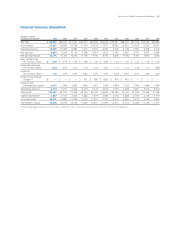

The income tax provision consisted of the following:

Years ended June 30 2006 2005 2004

CURRENT TAX EXPENSE

U.S. federal $1,961 $1,466 $1,477

International 1,702 886 817

U.S. state and local 178 142 113

3,841 2,494 2,407

DEFERRED TAX EXPENSE

U.S. federal 226 215 281

International and other (338) 349 61

(112) 564 342

TOTAL TAX EXPENSE 3,729 3,058 2,749

A reconciliation of the U.S. federal statutory income tax rate to our

actual income tax rate is provided below:

Years ended June 30 2006 2005 2004

U.S. federal statutory

income tax rate 35.0% 35.0% 35.0%

Country mix impacts of

foreign operations -3.6% -4.8% -3.9%

AJCA repatriation tax charge —2.8% —

Income tax reserve adjustments -1.5% -2.3% —

Other 0.1% -0.1% -0.2%

EFFECTIVE INCOME TAX RATE 30.0% 30.6% 30.9%

Income tax reserve adjustments represent changes in estimated

exposures related to prior year tax positions. Tax benefits credited to

shareholders‘ equity totaled $174 and $237 for the years ended June

30, 2006 and 2005, respectively. These primarily relate to the tax

effects of net investment hedges and the minimum pension liability,

as well as excess tax benefits from the exercise of stock options.

The American Jobs Creation Act of 2004 (the “AJCA”) permitted U.S.

corporations to repatriate earnings of foreign subsidiaries at a one-

time favorable effective federal statutory tax rate of 5.25% as

compared to the highest corporate tax rate of 35%. For the year

ended June 30, 2006, we repatriated $7.20 billion in earnings

previously considered indefinitely invested. We provided for $295 of

deferred income tax expense associated with this repatriation in the

year ended June 30, 2005.

We have undistributed earnings of foreign subsidiaries of approximately

$16 billion at June 30, 2006, for which deferred taxes have not been

provided. Such earnings are considered indefinitely invested in the

foreign subsidiaries. If such earnings were repatriated, additional tax

expense may result, although the calculation of such additional taxes

is not practicable.

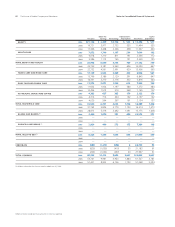

Deferred income tax assets and liabilities were comprised of the

following:

June 30 2006 2005

DEFERRED TAX ASSETS

Stock-based compensation $ 1,063 $998

Loss and other carryforwards 615 406

Pension and postretirement benefits 547 295

Unrealized loss on financial and

foreign exchange transactions 507 503

Advance payments 219 257

Accrued marketing and promotion expense 183 137

Accrued Gillette exit costs 173 —

Fixed assets 87 127

Other 1,044 900

Valuation allowances (398) (386)

4,040 3,237

DEFERRED TAX LIABILITIES

Goodwill and other intangible assets $12,036 $1,396

Fixed assets 1,861 1,487

AJCA repatriation —303

Other 436 597

14,333 3,783

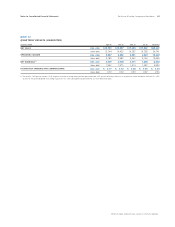

Net operating loss carryforwards were $2,134 and $1,418 at June 30,

2006 and 2005, respectively. If unused, $474 will expire between

2007 and 2026. The remainder, totaling $1,660 at June 30, 2006,

may be carried forward indefinitely.

NOTE 11

COMMITMENTS AND CONTINGENCIES

Guarantees

In conjunction with certain transactions, primarily divestitures, we

may provide routine indemnifications (e.g., retention of previously

existing environmental, tax and employee liabilities) whose terms

range in duration and often are not explicitly defined. Generally, the

maximum obligation under such indemnifications is not explicitly

stated and, as a result, the overall amount of these obligations cannot

be reasonably estimated. Other than obligations recorded as liabilities

at the time of divestiture, we have not made significant payments for

these indemnifications. We believe that if we were to incur a loss on

any of these matters, the loss would not have a material effect on our

financial position, results of operations or cash flows.

In certain situations, we guarantee loans for suppliers and customers.

The total amount of guarantees issued under such arrangements is

not material.