Proctor and Gamble 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

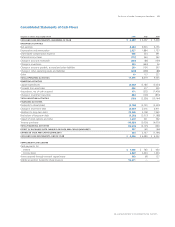

Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements The Procter &Gamble Company and Subsidiaries 55

to estimate option exercise and employee termination patterns within

the valuation model. The expected term of options granted is derived

from the output of the option valuation model and represents the

period of time that options granted are expected to be outstanding.

The interest rate for periods within the contractual life of the option is

based on the U.S. Treasury yield curve in effect at the time of grant.

In connection with the Gillette acquisition, we issued 70 million fully

vested Procter &Gamble stock options valued at $1.22 billion to current

and former Gillette employees in exchange for fully vested Gillette

stock options. We also issued 9 million unvested Procter &Gamble

stock options valued at $102 in exchange for Gillette stock options

that were not yet vested as of the acquisition date. Vesting terms

and option lives are not substantially different from our key manager

option grants.

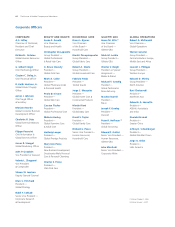

A summary of options under the plans as of June 30, 2006 and

activity during the year then ended is presented below:

Weighted Avg.

Remaining Aggregate

Weighted Avg. Contractual Intrinsic Value

Options in thousands Options Exercise Price Life in Years (in millions)

Outstanding,

beginning of year 287,183 $41.07

Issued in Gillette

acquisition 79,447 41.36

Granted 33,904 59.97

Exercised (36,623) 32.54

Canceled (1,559) 55.38

OUTSTANDING,

END OF YEAR 362,352 43.71 7.3 $4,472

EXERCISABLE 252,689 39.04 5.7 4,196

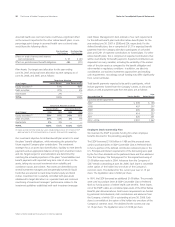

The weighted average grant-date fair value of options granted was

$16.30, $14.34 and $12.50 per share in 2006, 2005 and 2004,

respectively. The total intrinsic value of options exercised was $815,

$526 and $537 in 2006, 2005 and 2004, respectively. The total grant-

date fair value of options that vested during 2006, 2005 and 2004

was $388, $532 and $620, respectively. We have no specific policy to

repurchase common shares to mitigate the dilutive impact of options;

however, we have historically made adequate discretionary purchases,

based on cash availability, market trends and other factors, to satisfy

stock option exercise activity.

At June 30, 2006, there was $647 of compensation cost that has

not yet been recognized related to nonvested stock-based awards.

That cost is expected to be recognized over a remaining weighted

average period of 1.9 years.

Cash received from options exercised was $1,229, $455 and $555 in

2006, 2005 and 2004, respectively. The actual tax benefit realized for

the tax deductions from option exercises totaled $242, $149 and $161

in 2006, 2005 and 2004, respectively.

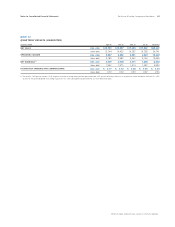

NOTE 9

POSTRETIREMENT BENEFITS AND

EMPLOYEE STOCK OWNERSHIP PLAN

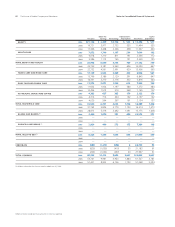

We offer various postretirement benefits to our employees.

Defined Contribution Retirement Plans

We have defined contribution plans which cover the majority of our

U.S. employees, as well as employees in certain other countries. These

plans are fully funded. We generally make contributions to participants’

accounts based on individual base salaries and years of service. For

the primary U.S. defined contribution plan, the contribution rate is set

annually. Total contributions for this plan approximated 15% of total

participants‘ annual wages and salaries in 2006, 2005 and 2004.

We maintain The Procter &Gamble Profit Sharing Trust (Trust) and

Employee Stock Ownership Plan (ESOP) to provide a portion of the

funding for the primary U.S. defined contribution plan, as well as other

retiree benefits. Operating details of the ESOP are provided at the end

of this Note. The fair value of the ESOP Series A shares allocated to

participants reduces our cash contribution required to fund the primary

U.S. defined contribution plan. Total defined contribution expense,

which is largely composed of the primary U.S. defined contribution plan,

was $249, $215 and $286 in 2006, 2005 and 2004, respectively.

Defined Benefit Retirement Plans and Other Retiree Benefits

We offer defined benefit pension plans to certain employees. These

benefits relate primarily to local plans outside the U.S., and to a lesser

extent, plans assumed in the Gillette acquisition covering U.S. employees.

We also provide certain other retiree benefits, primarily health care

and life insurance, for the majority of our U.S. employees who become

eligible for these benefits when they meet minimum age and service

requirements. Generally, the health care plans require cost sharing

with retirees and pay a stated percentage of expenses, reduced by

deductibles and other coverages. These benefits are primarily funded

by ESOP Series B shares as well as certain other assets contributed by

the Company.