Proctor and Gamble 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter &Gamble Company and Subsidiaries 31Management’s Discussion and Analysis

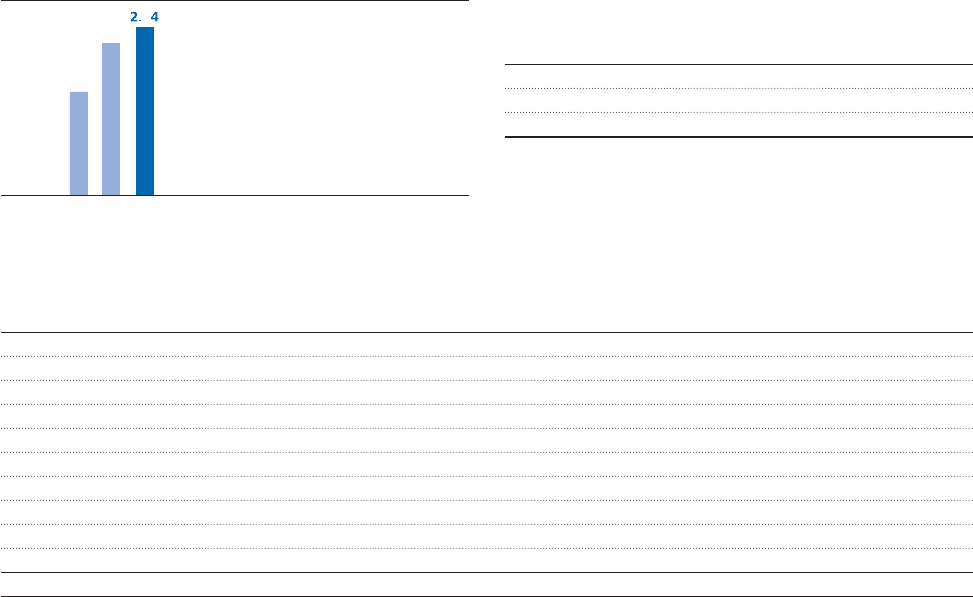

Net Earnings

In 2006, net earnings increased 25% to $8.68 billion. Net earnings

increased primarily behind the addition of Gillette as well as sales

growth and margin expansion on our base business. Net earnings

margin expanded 50-basis points as scale leverage from volume growth,

price increases and cost savings projects more than offset higher

commodity costs and acquisition-related expenses. In 2005, net earnings

increased 12% to $6.92 billion. Earnings grew primarily behind

volume growth and cost reduction efforts, which more than offset the

effects of higher commodity costs and increased marketing spending.

Diluted net earnings per share in 2006 were $2.64, an increase of 4%

versus the prior year. The Gillette acquisition had a dilutive impact on

our earnings per share of $0.20 – $0.23, which reduced earnings per

share growth by 8%–9% for the fiscal year. When we acquired Gillette

in October 2005, we exchanged 0.975 common shares of P&Gstock

for each share of Gillette stock. This increased the number of P&G

common shares outstanding by 962 million shares. The dilutive impact

of the additional shares and incremental acquisition-related expenses

was partially offset by the addition of Gillette’s earnings, initial cost

and revenue synergies and by our share repurchase activity. During the

year, we repurchased a total of $16.8 billion of P&G shares. In 2005,

diluted net earnings per share were $2.53, an increase of 15% compared

to the prior year. Diluted net earnings per share grew ahead of net

earnings in 2005 due to the Company’s share repurchase activity.

DILUTED NET EARNINGS

(per common share)

05

2.53

04

2.20

06

6

SEGMENT RESULTS

Results for the segments reflect information on the same basis we use

for internal management reporting and performance evaluation. These

results exclude certain costs included in the Consolidated Financial

Statements (e.g., interest expense, other financing costs, investing

activities and certain restructuring costs), which are reported in

Corporate. Within the Beauty and Health GBU, we provide data for

the Beauty and the Health Care reportable segments. In the Household

Care GBU, we provide data for the Fabric Care and Home Care, the

Baby Care and Family Care and the Pet Health, Snacks and Coffee

reportable segments. In the Gillette GBU, we provide data for the

Blades and Razors and the Duracell and Braun reportable segments.

As described in Note 12 to the Consolidated Financial Statements, we

have investments in certain companies over which we exert significant

influence, but do not control the financial and operating decisions and,

therefore, do not consolidate them (“unconsolidated entities”). Because

certain of these investments are managed as integral parts of the

Company‘s business units, they are accounted for as if they were

consolidated subsidiaries for management and segment reporting

purposes. This means pretax earnings in the business units include

100% of each pretax income statement component. In determining

after-tax earnings in the business units, we eliminate the share of

earnings applicable to other ownership interests, in a manner similar

to minority interest, and apply the statutory tax rates. Eliminations to

adjust each line item to U.S. GAAP are included in Corporate.

Beauty and Health

BEAUTY

Change vs. Change vs.

(in millions of dollars) 2006 Prior Year 2005 Prior Year

Volume*n/a +8% n/a +12%

Net Sales*$21,126 +7% $19,721 +14%

Net Earnings*$ 3,106 +13% $ 2,752 +23%

* Fiscal 2006 figures include results of Gillette personal care for the 9 months ended June 30, 2006.

Beauty unit volume increased 8% in 2006, including nine months of

Gillette personal care results. Organic volume, which excludes the

impact of acquisitions and divestitures, increased 6%. Volume growth

Volume

Volume with excluding

Acquisitions Acquisitions Foreign Net Sales Net Sales

Net Sales Change Drivers vs. Year Ago (2006 vs. 2005) &Divestitures &Divestitures Exchange Price Mix/Other Growth Growth ex-FX

BEAUTY AND HEALTH

Beauty 8%6%-1%0%0%7%8%

Health Care 26% 7% -1% 2% 2% 29% 30%

HOUSEHOLD CARE

Fabric Care and Home Care 8% 7% -1% 2% 0% 9% 10%

Baby Care and Family Care 3% 4% -1% 2% -1% 3% 4%

PetHealth,SnacksandCoffee 0%0%0%2%0%2%2%

GILLETTE GBU

Blades and Razors n/a n/a n/a n/a n/a n/a n/a

Duracell and Braun n/a n/a n/a n/a n/a n/a n/a

TOTAL COMPANY 19% 6% -1% 1% 1% 20% 21%

Sales percentage changes are approximations based on quantitative formulas that are consistently applied. Total company mix impact of 1% is driven largely by the addition of Gillette.