Proctor and Gamble 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter &Gamble Company and Subsidiaries

40 Management’s Discussion and Analysis

Our market risk exposures relative to interest rates, currency rates and

commodity prices, as discussed below, have not changed materially

versus the previous reporting period. In addition, we are not aware of

any facts or circumstances that would significantly impact such

exposures in the near term.

Interest Rate Exposure. Interest rate swaps are used to hedge exposures

to interest rate movement on underlying debt obligations. Certain

interest rate swaps denominated in foreign currencies are designated

to hedge exposures to currency exchange rate movements on our

investments in foreign operations. These currency interest rate swaps

are designated as hedges of the Company’s foreign net investments.

Based on our overall interest rate exposure as of and during the year

ended June 30, 2006, including derivative and other instruments

sensitive to interest rates, we believe a near-term change in interest

rates, at a 95% confidence level based on historical interest rate

movements, would not materially affect our financial statements.

Currency Rate Exposure. Becausewemanufactureandsellproducts

in a number of countries throughout the world, we are exposed to

the impact on revenue and expenses of movements in currency

exchange rates. The primary purpose of our currency hedging activities

is to reduce the risk that our financial position will be adversely

affected by short-term changes in exchange rates. Corporate policy

prescribes the range of allowable hedging activity. We primarily use

forward contracts and options with maturities of less than 18 months.

In addition, we enter into certain currency swaps with maturities of up

to five years to hedge our exposure to exchange rate movements on

intercompany financing transactions. We also use purchased currency

options with maturities of generally less than 18 months and forward

contracts to hedge against the effect of exchange rate fluctuations on

intercompany royalties and to offset a portion of the effect of

exchange rate fluctuations on income from international operations.

Based on our overall currency rate exposure as of and during the year

ended June 30, 2006, including derivative and other instruments

sensitive to currency movements, we believe a near-term change in

currency rates, at a 95% confidence level based on historical currency

rate movements, would not materially affect our financial statements.

Commodity Price Exposure. We use raw materials that are subject to

price volatility caused by weather, supply conditions, political and

economic variables and other unpredictable factors. In addition to fixed

price contracts, we use futures, options and swap contracts to manage

the volatility related to the above exposures. The impact of commodity

hedging activity is not considered material to our financial statements.

Measures Not Defined By U.S. GAAP

Our discussion of financial results includes several “non-GAAP”

financial measures. We believe these measures provide our investors

with additional information about our underlying results and trends, as

well as insight to some of the metrics used to evaluate management.

When used in MD&A, we have provided the comparable GAAP

measure in the discussion. These measures include:

Organic Sales Growth. Organic sales growth measures sales growth

excluding the impacts of acquisitions, divestitures and foreign exchange

from year-over-year comparisons. The Company believes this provides

investors with a more complete understanding of underlying results

and trends by providing sales growth on a consistent basis.

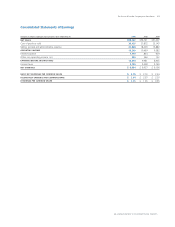

The following table provides a numerical reconciliation of organic sales

growth to reported sales growth for fiscal 2006:

Total

Company Beauty Health Care

Reported Sales Growth 20% 7% 29%

Less: Acquisitions &Divestitures Impact -14% -2% -21%

Less: Foreign Exchange Impact 1% 1% 1%

Organic Sales Growth 7% 6% 9%

Free Cash Flow. Free cash flow is defined as operating cash flow less

capital spending. The Company views free cash flow as an important

measure because it is one factor in determining the amount of cash

available for dividends and discretionary investment. Free cash flow is

also one of the measures used to evaluate senior management and is

a factor in determining their at-risk compensation.

Free Cash Flow Productivity. Free cash flow productivity is defined as

the ratio of free cash flow to net earnings. The Company’s target is to

generate free cash flow at or above 90% of net earnings. Free cash flow

productivity is one of the measures used to evaluate senior management.

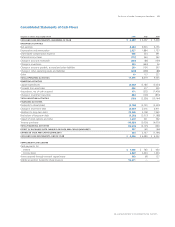

The following table provides a numerical reconciliation of free cash flow:

Free

Operating Capital Free Net Cash Flow

Cash Flow Spending Cash Flow Earnings Productivity

2006 $11,375 $(2,667) $8,708 $8,684 100%

2005 $ 8,679 $(2,181) $6,498 $6,923 94%