Proctor and Gamble 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

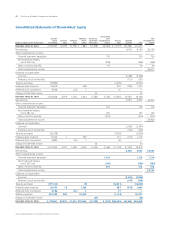

Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements

The Procter &Gamble Company and Subsidiaries

54

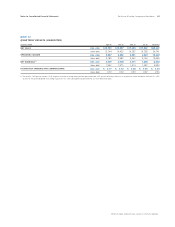

NOTE 7

EARNINGS PER SHARE

Net earnings less preferred dividends (net of related tax benefits) are

divided by the weighted average number of common shares outstanding

during the year to calculate basic net earnings per common share.

Diluted net earnings per common share are calculated to give effect

to stock options and other stock-based awards and assuming

conversion of preferred stock (see Note 9).

Net earnings and common shares used to calculate basic and diluted

net earnings per share were as follows:

Years ended June 30 2006 2005 2004

NET EARNINGS $8,684 $6,923 $6,156

Preferred dividends,

net of tax benefit (148) (136) (131)

NET EARNINGS AVAILABLE TO

COMMON SHAREHOLDERS 8,536 6,787 6,025

Preferred dividends,

net of tax benefit 148 136 131

Preferred dividend impact on

funding of ESOP —(1) (4)

DILUTED NET EARNINGS 8,684 6,922 6,152

Shares in millions; Years ended June 30 2006 2005 2004

Basic weighted average

common shares outstanding 3,054.9 2,515.6 2,580.1

Effect of dilutive securities

Conversion of preferred shares (1) 154.1 158.3 164.0

Exercise of stock options and

other unvested equity awards (2) 76.9 63.2 55.3

DILUTED WEIGHTED AVERAGE

COMMON SHARES OUTSTANDING 3,285.9 2,737.1 2,799.4

(1) Despite being included currently in diluted net earnings per common share, the actual

conversion to common stock occurs pursuant to the repayment of the ESOP debt

through 2021.

(2) Approximately 44 million in 2006, 48 million in 2005 and 43 million in 2004 of the

Company’s outstanding stock options were not included in the diluted net earnings per

share calculation because to do so would have been antidilutive (i.e., the total proceeds

upon exercise would have exceeded market value).

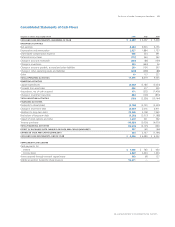

NOTE 8

STOCK-BASED COMPENSATION

We have a primary stock-based compensation plan under which

stock options are granted annually to key managers and directors

with exercise prices equal to the market price of the underlying shares

onthedateofgrant.Grantsweremadeunderplansapprovedby

shareholders in 2001, 2003 and 2004. A total of 249 million shares

of common stock were authorized for issuance under these plans of

which 123 million remain available for grant. Grants issued since

September 2002 are vested after three years and have a 10-year life.

Grants issued from July 1998 through August 2002 are vested after

three years and have a 15-year life, while grants issued prior to July 1998

are vested after one year and have a 10-year life. In addition to our

key manager and director grants, we make other minor stock option

grants to employees for which vesting terms and option lives are not

substantially different.

As discussed in Note 1, effective July 1, 2005, we adopted SFAS 123(R)

on a modified retrospective basis to account for our stock-based

compensation plans. Total stock-based compensation expense for

stock option grants was $526, $459 and $445 for 2006, 2005 and

2004, respectively. The total income tax benefit recognized in the

income statement for these stock-based compensation arrangements

was $140, $125 and $120 for 2006, 2005 and 2004, respectively.

We also make minor grants of restricted stock, restricted stock units

and other stock-based grants to certain employees. Total compensation

cost for these restricted stock, restricted stock units and other stock-

based grants, which are generally expensed at grant date, was $59,

$65 and $46 in 2006, 2005 and 2004, respectively.

In calculating the compensation expense for options granted, we have

estimated the fair value of each grant issued through December 31, 2004

using the Black-Scholes option-pricing model. Effective January 1, 2005,

we utilize a binomial lattice-based model for the valuation of stock

option grants. The utilization of the binomial lattice-based model did not

have a significant impact on the valuation of stock options as compared

to the Black-Scholes model. Assumptions utilized in the model, which are

evaluated and revised, as necessary, to reflect market conditions and

experience, are as follows:

Years ended June 30 2006 2005 2004

Interest rate 4.5%–4.7% 3.2% – 4.5% 3.8%

Weighted average

interest rate 4.6% 4.4% —

Dividend yield 1.9% 1.9% 1.8%

Expected volatility 15%– 20% 15% – 20% 20%

Weighted average volatility 19% 20% —

Expected life in years 998

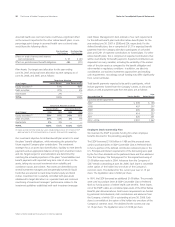

Because lattice-based option valuation models incorporate ranges of

assumptions for inputs, those ranges are disclosed for the period of

time that lattice-based models were employed. Expected volatilities

are based on a combination of historical volatility of our stock and

implied volatilities of call options on our stock. We use historical data