Proctor and Gamble 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter &Gamble Company and Subsidiaries

34 Management’s Discussion and Analysis

Gillette GBU

As disclosed in Note 2 to the Consolidated Financial Statements, we

completed the acquisition of The Gillette Company on October 1, 2005.

This acquisition resulted in two new reportable segments for the

Company: Blades and Razors and Duracell and Braun. The Gillette oral

care and personal care businesses were subsumed within the Health

Care and Beauty reportable segments, respectively. Because the

acquisition was completed during the current fiscal year period, there are

no results for the two new reportable segments in our prior year period.

In order to provide our investors with more insight into the results of

the Blades and Razors and Duracell and Braun reportable segments,

we have previously provided supplemental pro forma net sales and

earnings data for these segments for each of the quarters in the year

ended June 30, 2005 (as presented in our Form 8-K released October 4,

2005). Management’s discussion of the current year results of these

two segments is in relation to such comparable prior year pro forma

net sales and earnings data. With respect to the earnings data, this

analysis is based on earnings before income taxes. The previously

disclosed Blades and Razors and Duracell and Braun pro forma

information reconciled “Profit from Operations,” the measure used by

Gillette in its historical filings, to Earnings before Income Taxes, the

comparable measure used by the Company. Gillette did not allocate

income tax expense to its reportable segments.

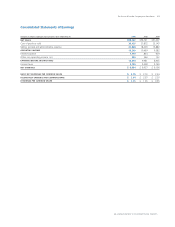

BLADES AND RAZORS

Change vs.

Comparable Prior

9 months ended Year Period

(in millions of dollars) June 30, 2006 Pro Forma

Net Sales $3,499 +1%

Earnings before income taxes $1,076 -13%

Sales for Blades and Razors since the acquisition closed on October 1,

2005 increased 1% to $3.50 billion versus the comparable prior year

period pro forma results, including a negative 1% foreign exchange

impact. Mid-single digit sales growth in North America behind the

launch of Fusion, coupled with double-digit growth in Latin America

and Central &Eastern Europe, was largely offset by declines in Western

Europe and Asia. Sales in Western Europe were negatively impacted

by a base period which included the launch of M3Power as well as a

current year period with significant retailer inventory reductions. In

several developing markets in Asia, sales declined as a result of

reduced distributor inventory levels following integration of Gillette

into existing P&G distributors. Global consumption in blades and

razors increased 5% during the year. Price increases contributed 2%

to sales growth. Earnings before income taxes declined 13% to $1.08

billion, including $294 million of acquisition-related charges that

negatively impacted earnings by 24% during the period. The acquisition-

related charges included $277 million of increased amortization

expense as a result of revaluing Gillette’s intangible assets to fair

market value. The balance of the charges were primarily due to

higher product costs from revaluing opening inventory balances at

fair value. Earnings were also impacted by an increase in the current

year marketing investment behind the launch of Fusion, offset by

synergy savings from current year cost reductions and base period

charges for severance and other exit charges associated with Gillette’s

Functional Excellence program, the European Manufacturing

Realignment program and other asset write-downs. Net earnings

were $781 million since the acquisition closed on October 1, 2005.

DURACELL AND BRAUN

Change vs.

Comparable Prior

9 months ended Year Period

(in millions of dollars) June 30, 2006 Pro Forma

Net Sales $2,924 0%

Earnings before income taxes $ 400 +9%

Sales for Duracell and Braun since the acquisition closed on October 1,

2005, were $2.92 billion, in line with the comparable prior year

period pro forma results, including a negative 2% foreign exchange

impact. In the Duracell business, market share growth in North

America and the impacts of price increases to compensate for rising

commodity costs were offset by sales declines in Western Europe due

to competitive activity. Braun sales increased in the low-single digits

globally as double-digit growth in Central &Eastern Europe/Middle

East/Africa and new product initiatives were largely offset by declines

in Western Europe due to strong competitive activity and in North

America due to a base period that included pipeline shipments for the

Braun Activator launch. Earnings before income taxes increased 9%

to $400 million, including acquisition-related charges of $60 million

that negatively impacted earnings by 16% in the period. The acquisition-

related charges primarily represented increased amortization expense

of $39 million as a result of revaluing Gillette’s intangible assets to fair

market value. The balance of the charges were primarily due to

increased product costs for revaluing opening inventory balances at

fair value. Current year earnings were favorably impacted by base

period charges for severance and other exit costs associated with

Gillette’s Functional Excellence program, including charges related to

the shutdown of a manufacturing facility, as well as current-year

synergy savings from cost reductions. Net earnings were $273 million

since the acquisition closed on October 1, 2005.

Corporate

Corporate includes certain operating and non-operating activities not

allocated to specific business units. These include: the incidental

businesses managed at the corporate level, financing and investing

activities, certain restructuring charges, other general corporate items

and the historical results of certain divested categories, including the

Juice business that was divested in August 2004 and certain Gillette

brands that were divested as required by the regulatory authorities in

relation to the Gillette acquisition. Corporate also includes reconciling

items to adjust the accounting policies used in the segments to U.S.

GAAP. The most significant reconciling items include income taxes (to

adjust from statutory rates that are reflected in the segments to the

overall Company effective tax rate), adjustments for unconsolidated

entities (to eliminate sales, cost of products sold and SG&A for entities

that are consolidated in the segments but accounted for using the

equity method for U.S. GAAP) and minority interest adjustments for

subsidiaries where we do not have 100% ownership. Because both

unconsolidated entities and less than 100% owned subsidiaries are

managed as integral parts of the Company, they are accounted for

similar to a wholly owned subsidiary for management and segment