Proctor and Gamble 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements The Procter &Gamble Company and Subsidiaries 47

Cash Equivalents

Highly liquid investments with remaining stated maturities of three

months or less when purchased are considered cash equivalents and

recorded at cost.

Investments

Investment securities consist of auction rate securities that approximate

fair value and readily-marketable debt and equity securities that are

classified as trading with unrealized gains or losses charged to earnings.

Investments in certain companies over which we exert significant

influence, but do not control the financial and operating decisions,

are accounted for as equity method investments. Other investments

that are not controlled and over which we do not have the ability to

exercise significant influence are accounted for under the cost

method and are included in other noncurrent assets.

Inventory Valuation

Inventories are valued at the lower of cost or market value. Product-

related inventories are primarily maintained on the first-in, first-out

method. Minor amounts of product inventories, including certain

cosmetics and commodities, are maintained on the last-in, first-out

method. The cost of spare part inventories is maintained using the

average cost method.

Property, Plant and Equipment

Property, plant and equipment is recorded at cost reduced by

accumulated depreciation. Depreciation expense is recognized over the

assets‘ estimated useful lives using the straight-line method. Machinery

and equipment includes office furniture and equipment (15-year life),

computer equipment and capitalized software (3- to 5-year lives) and

manufacturing equipment (3- to 20-year lives). Buildings are depreciated

over an estimated useful life of 40 years. Estimated useful lives are

periodically reviewed and, where appropriate, changes are made

prospectively. Where certain events or changes in operating conditions

occur, asset lives may be adjusted and an impairment assessment may

be performed on the recoverability of the carrying amounts.

Goodwill and Other Intangible Assets

We have a number of acquired brands that have been determined to

have indefinite lives due to the nature of our business. We evaluate a

number of factors to determine whether an indefinite life is appropriate,

including the competitive environment, market share, brand history,

product life cycles, operating plan and the macroeconomic environment

of the countries in which the brands are sold. Where certain events

or changes in operating conditions occur, an impairment assessment

is performed and indefinite-lived brands may be adjusted to a

determinable life.

The cost of intangible assets with determinable useful lives is amortized

to reflect the pattern of economic benefits consumed, either on a

straight-line or accelerated basis over the estimated periods benefited.

Patents, technology and other intangibles with contractual terms are

generally amortized over their respective legal or contractual lives.

Customer relationships and other noncontractual intangible assets

with determinable lives are amortized over periods generally ranging

from 5 to 40 years. Where certain events or changes in operating

conditions occur, an impairment assessment is performed and lives of

intangible assets with determinable lives may be adjusted.

Goodwill and indefinite-lived brands are not amortized, but are evaluated

annually for impairment or when indicators of a potential impairment are

present. Our impairment testing of goodwill is performed separately

from our impairment testing of individual indefinite-lived intangibles.

The annual evaluation for impairment of goodwill and indefinite-lived

intangibles is based on valuation models that incorporate internal

projections of expected future cash flows and operating plans.

Fair Values of Financial Instruments

Certain financial instruments are required to be recorded at fair value.

The estimated fair values of such financial instruments, including certain

debt instruments, investment securities and derivatives, have been

determined using market information and valuation methodologies,

primarily discounted cash flow analysis. These estimates require

considerable judgment in interpreting market data. Changes in

assumptions or estimation methods could significantly affect the fair

value estimates. However, we do not believe any such changes

would have a material impact on our financial condition or results of

operations. Other financial instruments, including cash equivalents,

other investments and short-term debt, are recorded at cost, which

approximates fair value. The fair values of long-term debt and

derivative instruments are disclosed in Note 5 and Note 6, respectively.

New Accounting Pronouncements and Policies

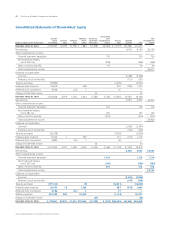

CHANGE IN TREASURY STOCK ACCOUNTING

On July 1, 2005, we elected to change our method of accounting for

treasury stock. We previously accounted for share repurchases as if

the treasury stock were constructively retired by reducing common

stock and retained earnings within Shareholders’ Equity. Our new

method of accounting presents treasury stock as a separate component

of Shareholders’ Equity. We believe that our new accounting method

is preferable as it more closely depicts the underlying intent of the share

repurchases in which the shares are not retired and are held for reissuance.

In addition, we believe that our new presentation of Shareholders’

Equity provides greater visibility of our share repurchase activity.

We reflected this new accounting method retrospectively by adjusting

prior periods under SFAS 154, “Accounting Changes and Error

Corrections.” This reclassification is limited to changes within Shareholders’

Equity and has no effect on our net earnings, cash flows or total assets.

ADOPTION OF SFAS 123(R), “SHARE-BASED PAYMENT”

We adopted SFAS 123(Revised 2004), “Share-Based Payment” (SFAS

123(R)) on July 1, 2005. This Statement requires that all stock-based

compensation, including grants of employee stock options, be accounted

for using the fair value-based method. We elected to adopt SFAS 123(R)

using the modified retrospective method under which prior years’

results were retrospectively adjusted to give effect to the value of

options granted in fiscal years beginning on or after July 1, 1995.

Under the modified retrospective method, the compensation expense

recognized for periods prior to adoption is consistent with the amounts

previously reported in our pro forma footnote disclosure for stock-

based compensation. Refer to Note 8 for additional information

regarding our stock-based compensation.