Proctor and Gamble 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

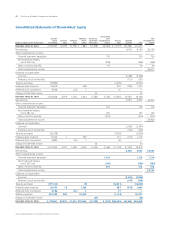

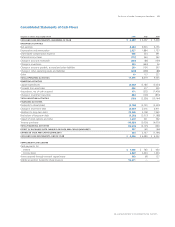

Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements

The Procter &Gamble Company and Subsidiaries

52

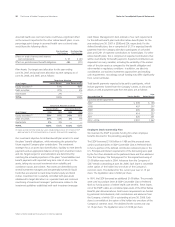

NOTE 5

SHORT-TERM AND LONG-TERM DEBT

June 30 2006 2005

SHORT-TERM DEBT

Current portion of long-term debt $1,930 $2,606

USD commercial paper —5,513

Non-USD commercial paper —18

Bridge credit facility —3,010

Other 198 294

2,128 11,441

The weighted average short-term interest rates were 5.3% and 3.5%

as of June 30, 2006 and 2005, respectively, including the effects of

interest rate swaps discussed in Note 6.

June 30 2006 2005

LONG-TERM DEBT

4.75% USD note due June 2007 $ 1,000 $1,000

3.50% USD note due October 2007 500 —

6.13% USD note due May 2008 500 500

Bank credit facility expires July 2008 19,555 —

4.30% USD note due August 2008 500 500

3.50% USD note due December 2008 650 650

6.88% USD note due September 2009 1,000 1,000

Bank credit facility expires August 2010 1,857 —

3.38% EUR note due December 2012 1,779 —

4.95% USD note due August 2014 900 900

4.85% USD note due December 2015 700 700

4.13% EUR note due December 2020 763 —

9.36% ESOP debentures due 2007 – 2021 (1) 1,000 1,000

6.25% GBP note due January 2030 917 904

5.50% USD note due February 2034 500 500

5.80% USD note due August 2034 600 600

Capital lease obligations 632 273

All other long-term debt 4,553 6,966

Current portion of long-term debt (1,930) (2,606)

35,976 12,887

(1) Debt issued by the ESOP is guaranteed by the Company and must be recorded as debt of the

Company as discussed in Note 9.

Long-term weighted average interest rates were 3.6% and 3.2% as

of June 30, 2006 and 2005, respectively, including the effects of

interest rate swaps and net investment hedges discussed in Note 6.

The fair value of the long-term debt was $36,027 and $13,904 at

June 30, 2006 and 2005, respectively. Long-term debt maturities

during the next five years are as follows: 2007– $1,930; 2008– $2,210;

2009 – $20,739; 2010 – $2,013 and 2011 – $1,896.

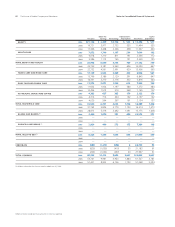

NOTE 6

RISK MANAGEMENT ACTIVITIES

As a multinational company with diverse product offerings, we are

exposed to market risks, such as changes in interest rates, currency

exchange rates and commodity prices. To manage the volatility related

to these exposures, we evaluate exposures on a consolidated basis to

take advantage of logical exposure netting and correlation. For the

remaining exposures, we enter into various financial transactions,

which we account for under SFAS 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended and interpreted.

The utilization of these financial transactions is governed by our

policies covering acceptable counterparty exposure, instrument types

and other hedging practices. We do not hold or issue derivative

financial instruments for speculative trading purposes.

At inception, we formally designate and document qualifying

instruments as hedges of underlying exposures. We formally assess,

both at inception and at least quarterly on an ongoing basis, whether

the financial instruments used in hedging transactions are effective at

offsetting changes in either the fair value or cash flows of the related

underlying exposure. Fluctuations in the value of these instruments

generally are offset by changes in the fair value or cash flows of the

underlying exposures being hedged. This offset is driven by the high

degree of effectiveness between the exposure being hedged and the

hedging instrument. Any ineffective portion of a change in the fair

value of a qualifying instrument is immediately recognized in earnings.

Credit Risk

We have established strict counterparty credit guidelines and normally

enter into transactions with investment grade financial institutions.

Counterparty exposures are monitored daily and downgrades in

credit rating are reviewed on a timely basis. Credit risk arising from

the inability of a counterparty to meet the terms of our financial

instrument contracts generally is limited to the amounts, if any, by

which the counterparty‘s obligations exceed our obligations to the

counterparty. We do not expect to incur material credit losses on our

risk management or other financial instruments.

Interest Rate Management

Our policy is to manage interest cost using a mixture of fixed-rate and

variable-rate debt. To manage this risk in a cost-efficient manner, we

enter into interest rate swaps in which we agree to exchange with

the counterparty, at specified intervals, the difference between fixed

and variable interest amounts calculated by reference to an agreed-

upon notional principal amount.