Proctor and Gamble 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter &Gamble Company and Subsidiaries

26 Management’s Discussion and Analysis

as a separate reportable segment. In addition, our commercial products

organization, which primarily sells cleaning products directly to

commercial end users, was moved from Snacks and Coffee to our

Fabric Care and Home Care reportable segment. Finally, the adult

incontinence business was aligned with our feminine care business

and as a consequence was removed from Baby Care and Family Care

and moved to P&G Beauty. The balance of the Baby Care and Family

Care reportable segment was moved from the P&G Family Health

GBU to the P&G Household Care GBU, but will continue to be reported

as a separate reporting segment. In conjunction with these changes,

the P&G Beauty GBU was renamed “Beauty and Health,” the Snacks

and Coffee reportable segment was renamed “Pet Health, Snacks and

Coffee,” the P&G Household Care GBU was renamed “Household Care”

and the P&G Family Health GBU was eliminated. The accompanying

financial statements and management discussion of operating results,

including historical results, reflect the new management and

organization structure.

Under U.S. GAAP, the business units comprising the GBUs are

aggregated into seven reportable segments: Beauty; Health Care;

Fabric Care and Home Care; Baby Care and Family Care; Pet Health,

Snacks and Coffee; Blades and Razors; and Duracell and Braun.

The following provides additional detail on the reportable segments

and brand composition of each of our three GBUs:

Beauty and Health

Beauty: We are a global market leader in Beauty and compete in

markets which comprise over $220 billion in global retail sales. We are

the global market leader in hair care with approximately a 24% share

of the global market. We are also the global market leader in the

feminine care category with approximately a 36% share of the market.

Health Care: We compete in oral care, pharmaceuticals and personal

health. In oral care, there are several global competitors in the market,

of which we have the number two share position. In pharmaceuticals

and personal health, we have approximately 33% of the global

bisphosphonates market for the treatment of osteoporosis under the

Actonel brand. We also maintain leadership market share in

nonprescription heartburn medications and in respiratory treatments

behind Prilosec OTC and Vicks, respectively.

Household Care

Fabric Care and Home Care: This segment is comprised of a variety

of products including laundry products, fabric conditioners, dish care,

air fresheners and household cleaners. We generally have the

number one or number two share position in the markets in which

we compete, with particular strength in North America and Europe.

We are the global market leader in fabric care with global market

share of approximately 33%. Our global home care market share is

approximately 21% across the categories in which we compete.

Baby Care and Family Care: In baby care, we compete primarily in

diapers, training pants and baby wipes and have a global market

share of approximately 36%. We are the number one or number two

baby care competitor in most of the key markets in which we compete,

primarily behind the Pampers brand, the Company’s largest brand

with annual net sales in excess of $6 billion. Our Family Care business

is predominantly a North American business comprised primarily of

the Bounty and Charmin brands, with market shares of approximately

43% and 27%, respectively, in the United States.

Pet Health, Snacks and Coffee: In pet health, we compete in several

markets around the globe, primarily in the premium pet health

segment behind the Iams brand. In Snacks, we compete against both

global and local competitors and have a global market share of

approximately 13% in the potato chips market behind the Pringles

brand. Our coffee business competes almost solely in North America,

where we hold a leadership position with approximately 34% of the

U.S. market, primarily behind our Folgers brand.

Gillette GBU

The Gillette GBU was added on October 1, 2005, as a result of the

acquisition of The Gillette Company. This GBU is comprised of the

Blades and Razors and the Duracell and Braun reportable segments.

Blades and Razors: We hold leadership market share in Blades and

Razors on a global basis and across the majority of markets in which

we compete. Our global market share is approximately 72% primarily

behind the MACH3, Fusion, Venus and the Gillette franchise.

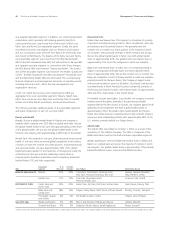

Reportable % of % of Net

GBU Segment Net Sales*Earnings*Key Products Billion-Dollar Brands

BEAUTY AND HEALTH Beauty 31% 33% Cosmetics, Deodorants, Feminine Care, Always, Head &Shoulders,

Hair Care, Personal Cleansing, Skin Care Olay, Pantene, Wella

Health Care 11% 13% Oral Care, Pharmaceuticals, Actonel, Crest, Oral-B

Personal Health Care

HOUSEHOLD CARE Fabric Care and 25% 25% Fabric Care, Air Care, Dish Care, Surface Care Ariel, Dawn, Downy, Tide

Home Care

Baby Care and 18% 14% Diapers, Baby Wipes, Bath Tissue, Kitchen Towels Bounty, Charmin, Pampers

Family Care

Pet Health, Snacks 6% 4% Pet Health, Snacks, Coffee Folgers, Iams, Pringles

and Coffee

GILLETTE GBU Blades and Razors 5% 8% Men’s and Women’s Blades and Razors Gillette, MACH3

Duracell and Braun 4% 3% Batteries, Electric Razors, Small Appliances Braun, Duracell

* Percent of net sales and net earnings for the year ended June 30, 2006. Figures exclude results held in the Corporate segment and include Gillette results only for the nine months ended June 30, 2006.