Proctor and Gamble 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Millions of dollars except per share amounts or otherwise specified.

Notes to Consolidated Financial Statements

The Procter &Gamble Company and Subsidiaries

50

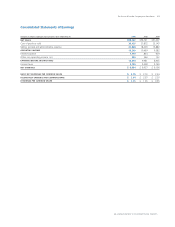

The preliminary purchase price allocation to the identifiable intangible

assets included in these financial statements is as follows:

Weighted

Average Life

INTANGIBLE ASSETS WITH

DETERMINABLE LIVES

Brands $ 1,607 20

Patents and technology 2,716 17

Customer relationships 1,445 27

BRANDS WITH INDEFINITE LIVES 23,968 Indefinite

TOTAL INTANGIBLE ASSETS 29,736

The majority of the intangible asset valuation relates to brands. Our

preliminary assessment as to brands that have an indefinite life and

those that have a determinable life was based on a number of factors,

including the competitive environment, market share, brand history,

product life cycles, operating plan and macroeconomic environment

of the countries in which the brands are sold. The indefinite-lived

brands include Gillette, Venus, Duracell, Oral-B and Braun. The

determinable-lived brands include certain brand sub-names, such as

MACH3 and Sensor in the Blades and Razors business, and other

regional or local brands. The determinable-lived brands have asset

lives ranging from 10 to 40 years. The patents and technology

intangibles are concentrated in the Blades and Razors and Oral Care

businesses and have asset lives ranging from 5 to 20 years. The estimated

customer relationship intangible asset useful lives ranging from 20 to

30 years reflect the very low historical and projected customer attrition

rates among Gillette’s major retailer and distributor customers.

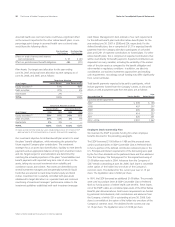

We are in the process of completing our analysis of integration plans,

pursuant to which we will incur costs primarily related to the elimination

of selling, general and administrative overlap between the two

companies in areas like Global Business Services, corporate staff and

go-to-market support, as well as redundant manufacturing capacity.

Our preliminary estimate of Gillette exit costs that have been recognized

as an assumed liability as of the acquisition date is $1.14 billion,

including $819 in separations related to approximately 5,600 people,

$57 in employee relocation costs and $264 in other exit costs. We

expect such activities to be substantially complete by June 30, 2008.

Wella Acquisition

On September 2, 2003, we acquired a controlling interest in Wella.

Through a stock purchase agreement with the majority shareholders

of Wella and a tender offer made on the remaining shares, we initially

acquired a total of 81% of Wella‘s outstanding shares, including 99%

of Wella‘s outstanding voting class shares. In June 2004, the Company

and Wella entered into a Domination and Profit Transfer Agreement

(the Domination Agreement) pursuant to which we are entitled to

exercise full operating control and receive 100% of the future earnings

of Wella. As consideration for the Domination Agreement, we agreed

to pay the holders of the remaining outstanding Wella shares a

guaranteed perpetual annual dividend payment. Alternatively, the

remaining Wella shareholders may elect to tender their shares to us

for an agreed price. The fair value of the total guaranteed annual

dividend payments was $1.11 billion, which approximated the cost if

all remaining shares were tendered. Because the Domination Agreement

transfers operational and economic control of the remaining outstanding

shares to the Company, it has been accounted for as an acquisition of

the remaining shares, with a liability recorded equal to the fair value

of the guaranteed payments. Because of the tender feature, the

remaining liability is recorded as a current liability in the accrued and

other liabilities line of the Consolidated Balance Sheets. Payments

made under the guaranteed annual dividend and tender provisions

are allocated between interest expense and a reduction of the

liability, as appropriate. The total purchase price for Wella, including

acquisition costs, was $6.27 billion based on exchange rates at the

acquisition dates. It was funded with a combination of cash, debt

and the liability recorded under the Domination Agreement. During

the year ended June 30, 2006, a portion of the remaining shares

was tendered, resulting in a $944 reduction in our liability under the

Domination Agreement. As a result of the tender, we now own

96.9% of all Wella outstanding shares.

The acquisition of Wella, with over $3 billion in annual net sales, gave

us access to the professional hair care category plus greater scale and

scope in hair care, hair colorants, cosmetics and fragrance products,

while providing potential for significant synergies. The operating results of

the Wella business are reported in Beauty beginning September 2, 2003.

China Venture

On June 18, 2004, we purchased the remaining 20% stake in our China

venture from our partner, Hutchison Whampoa China Ltd. (Hutchison),

giving us full ownership in our operations in China. The net purchase

price was $1.85 billion, which is the purchase price of $2.00 billion net

of minority interest and related obligations that were eliminated as a

result of the transaction. The acquisition was funded by debt.

Other minor business purchases and intangible asset acquisitions

totaled $395, $572 and $384 in 2006, 2005 and 2004, respectively.