Panera Bread 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

PART IV

Item 15. Exhibits and Financial Statement Schedules

(a) 1. Financial Statements

The following described consolidated financial statements of the Company are included in this report:

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of December 27, 2005 and December 25, 2004.

Consolidated Statements of Operations for the fiscal years ended December 27, 2005, December 25, 2004, and December 27,

2003.

Consolidated Statements of Cash Flows for the fiscal years ended December 27, 2005, December 25, 2004, and December 27,

2003.

Consolidated Statements of Stockholders’ Equity for the fiscal years ended December 27, 2005, December 25, 2004, and

December 27, 2003.

Notes to the Consolidated Financial Statements.

(a) 2. Financial Statement Schedule

The following financial statement schedule for the Company is filed herewith:

Schedule II — Valuation and Qualifying Accounts

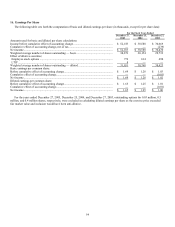

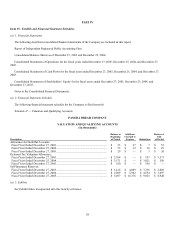

PANERA BREAD COMPANY

VALUATION AND QUALIFYING ACCOUNTS

(In thousands)

Description

Balance at

Beginning

of Period

Additions-

Charged to

Expense

Deductions

Balance at

End

of Period

Allowance for Doubtful Accounts:

Fiscal Year Ended December 27, 2003...................................................................... $ 33 $ 27 $ 7 $ 53

Fiscal Year Ended December 25, 2004...................................................................... $ 53 $ 12 $ 36 $ 29

Fiscal Year Ended December 27, 2005...................................................................... $ 29 $ — $ 3 $ 26

Deferred Tax Valuation Allowance:

Fiscal Year Ended December 27, 2003...................................................................... $ 3,768 $ — $ 197 $ 3,571

Fiscal Year Ended December 25, 2004...................................................................... $ 3,571 $ — $ 3,021 $ 550

Fiscal Year Ended December 27, 2005...................................................................... $ 550 $ — $ 550 $ —

Self-Insurance Reserves:

Fiscal Year Ended December 27, 2003...................................................................... $ 1,416 $ 4,009 $ 3,336 $ 2,089

Fiscal Year Ended December 25, 2004...................................................................... $ 2,089 $ 5,962 $ 4,554 $ 3,497

Fiscal Year Ended December 27, 2005...................................................................... $ 3,497 $ 15,376 $ 9,925 $ 8,948

(a) 3. Exhibits

See Exhibit Index incorporated into this item by reference.