Panera Bread 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

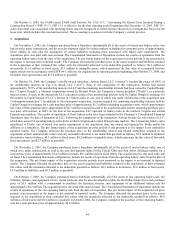

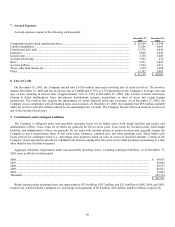

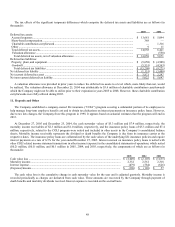

7. Accrued Expenses

Accrued expenses consist of the following (in thousands):

December 27,

2005

December 25,

2004

Compensation and related employment taxes.............................................................................................. $ 20,104 $ 12,540

Capital expenditures .................................................................................................................................... 15,208 9,066

Unredeemed gift cards................................................................................................................................. 13,576 8,044

Insurance...................................................................................................................................................... 8,948 3,642

Income taxes ................................................................................................................................................ 3,338 3,606

Accrued advertising ..................................................................................................................................... 3,102 270

Rent.............................................................................................................................................................. 2,351 3,443

Accrued utilities........................................................................................................................................... 1,832 1,011

Taxes, other than income tax ....................................................................................................................... 1,338 1,680

Other ............................................................................................................................................................ 11,762 5,603

$ 81,559 $ 48,905

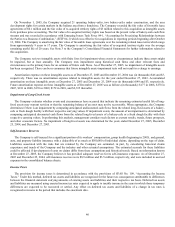

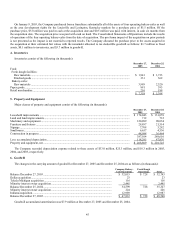

8. Line of Credit

On December 19, 2003, the Company entered into a $10.0 million unsecured revolving line of credit (revolver). The revolver

matures December 19, 2006 and has an interest rate of LIBOR plus 0.75% to 1.5% depending on the Company’s leverage ratio and

type of loan (resulting in interest rates of approximately 5.0% to 5.8% at December 27, 2005). The revolver contains restrictions

relating to future indebtedness, liens, investments, distributions, mergers, acquisitions, or sales of assets and certain leasing

transactions. The revolver also requires the maintenance of certain financial ratios and covenants. As of December 27, 2005, the

Company was in compliance with all financial ratios and covenants. At December 27, 2005, the Company had $9.8 million available

under the revolver with $0.2 million utilized by an outstanding letter of credit. The Company has not borrowed under its revolver in

any of the last three fiscal years.

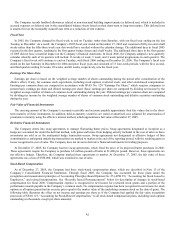

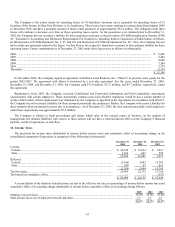

9. Commitments and Contingent Liabilities

The Company is obligated under non-cancelable operating leases for its bakery-cafes, fresh dough facilities and trucks, and

administrative offices. Lease terms for its trucks are generally for five to seven years. Lease terms for its bakery-cafes, fresh dough

facilities, and administrative offices are generally for ten years with renewal options at certain locations and generally require the

Company to pay a proportionate share of real estate taxes, insurance, common area, and other operating costs. Many bakery-cafe

leases provide for contingent rental (i.e., percentage rent) payments based on sales in excess of specified amounts. Certain of the

Company’s lease agreements provide for scheduled rent increases during the lease terms or for rental payments commencing at a date

other than the date of initial occupancy.

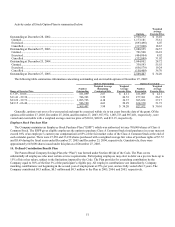

Aggregate minimum requirements under non-cancelable operating leases, excluding contingent liabilities, as of December 27,

2005, were as follows (in thousands):

2006 ........................................................................................................................................................................................ $ 40,953

2007 ........................................................................................................................................................................................ 40,992

2008 ........................................................................................................................................................................................ 40,357

2009 ........................................................................................................................................................................................ 40,032

2010 ........................................................................................................................................................................................ 39,603

Thereafter................................................................................................................................................................................ 305,314

$ 507,251

Rental expense under operating leases was approximately $33.0 million, $24.7 million, and $21.0 million in 2005, 2004, and 2003,

respectively, which included contingent (i.e. percentage rent) payments of $0.8 million, $0.6 million, and $0.6 million, respectively.