Panera Bread 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 49

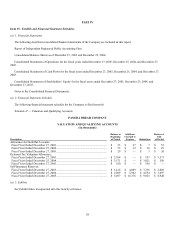

12. Stockholders’ Equity

Common Stock

The holders of Class A Common Stock are entitled to one vote for each share owned. The holders of Class B Common Stock are

entitled to three votes for each share owned. Each share of Class B Common Stock has the same dividend and liquidation rights as

each share of Class A Common Stock. Each share of Class B Common Stock is convertible, at the stockholder’s option, into Class A

Common Stock on a one-for-one basis. At December 27, 2005, the Company had reserved 4,908,102 shares of its Class A Common

Stock for issuance upon exercise of awards granted under the Company’s 1992 Equity Incentive Plan, Formula Stock Option Plan for

Independent Directors, and 2001 Employee, Director, and Consultant Stock Option Plan, and upon conversion of Class B Common

Stock.

Registration Rights

At December 27, 2005, over 90% of Class B Common Stock is owned by the Company’s Chairman and Chief Executive Officer

(“CEO”). Certain holders of Class B Common Stock, including the Company’s CEO, pursuant to stock subscription agreements, can

require the Company under certain circumstances to register their shares under the Securities Exchange Act of 1933, or have included

in certain registrations all or part of such shares at the Company’s expense.

Preferred Stock

The Company is authorized to issue 2,000,000 shares of Class B Preferred Stock with a par value of $.0001. The voting,

redemption, dividend, liquidation rights, and other terms and conditions are determined by the Board of Directors upon approval of

issuance. There were no shares issued or outstanding in 2005 and 2004.

Treasury Stock

In the third quarter of 2000, the Company repurchased 109,000 shares of Class A Common Stock at an average cost of $8.25 per

share.

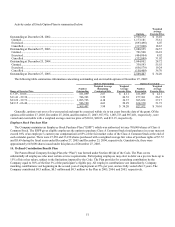

13. Stock-Based Compensation

The Company’s equity compensation plans consist of the 1992 Equity Incentive Plan, the Formula Stock Option Plan for

Independent Directors, and the 2001 Employee, Director, and Consultant Stock Option Plan.

Long-Term Incentive Program

In the third quarter of 2005, the Company adopted a Long-Term Incentive Program (LTIP) as a sub-plan under the Company’s

2001 Employee, Director, and Consultant Stock Option Plan (“2001 Plan”) and the Company’s 1992 Equity Incentive Plan (“1992

Plan”) under which certain directors, officers, employees, and consultants, subject to approval by the Company’s Compensation and

Stock Option Committee, may be selected as participants eligible to receive a percentage of their annual salary in future years, subject

to the terms of the 2001 Plan and the 1992 Plan. This percentage is based on the participant’s level in the Company. In addition, the

payment of this incentive can be made in several forms based on the participant’s level including performance awards (payable in cash

or common stock), restricted stock, choice awards of restricted stock or stock options, or deferred annual bonus match awards. For the

year ended December 27, 2005, compensation expense related to the LTIP was $1.6 million, which includes $0.3 million of restricted

stock amortization.

Performance awards under this LTIP are earned by participants based on achievement of performance goals established by the

Compensation and Stock Option Committee of the Company’s Board of Directors (Committee). The performance period relating to

the performance awards is a three fiscal year period. The performance goals, including each performance metric, weighting of each

metric, and award levels for each metric, for such awards are communicated to each participant and are based on various

predetermined earnings and operating metrics. The performance awards will be earned based on achievement of predetermined

earnings and operating performance metrics at the end of the three-fiscal-year performance period, assuming continued employment.

The performance awards range from 0% to 300% of the targeted percentage of the participants’ salary. The performance awards will

be payable 50% in cash and 50% in common stock unless the Committee otherwise determines. For the year ended December 27,

2005, compensation expense related to the performance awards was $1.0 million.