Panera Bread 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

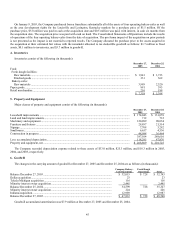

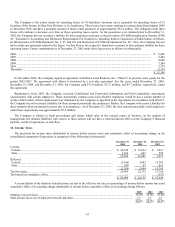

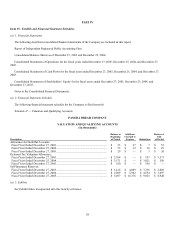

Activity under all Stock Option Plans is summarized below:

Options

Weighted

Average

Exercise Price

Outstanding at December 28, 2002............................................................................................................... 2,918,272 $ 15.10

Granted........................................................................................................................................................ 1,173,181 35.61

Exercised..................................................................................................................................................... (693,498) 6.07

Cancelled..................................................................................................................................................... (317,000) 18.67

Outstanding at December 27, 2003............................................................................................................... 3,080,955 24.57

Granted........................................................................................................................................................ 701,500 36.18

Exercised..................................................................................................................................................... (404,804) 8.82

Cancelled..................................................................................................................................................... (332,849) 31.02

Outstanding at December 25, 2004............................................................................................................... 3,044,802 28.72

Granted........................................................................................................................................................ 339,593 55.55

Exercised..................................................................................................................................................... (656,579) 19.24

Cancelled..................................................................................................................................................... (158,409) 36.70

Outstanding at December 27, 2005............................................................................................................... 2,569,407 $ 34.20

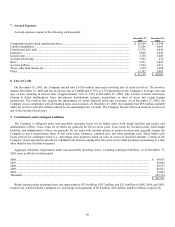

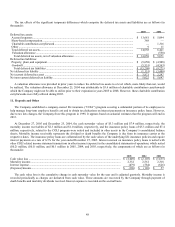

The following table summarizes information concerning outstanding and exercisable options at December 27, 2005:

Options Outstanding Options Exercisable

Range of Exercise Price

Number

Outstanding

Weighted Average

Remaining

Contractual Life

Weighted

Average

Exercise Price

Number

Exercisable

Weighted

Average

Exercise Price

$ 3.19 - 10.06................................................................. 181,099 2.67 $ 4.11 181,099 $ 4.11

$11.41 - 29.30................................................................ 746,393 3.52 26.53 277,101 26.17

$33.22 - 39.73................................................................ 1,095,725 4.18 36.37 305,652 37.17

$43.15 - 66.40................................................................ 546,190 4.63 50.29 164,120 51.73

2,569,407 3.98 $ 34.20 927,972 $ 30.01

Generally, options vest over a five-year period and must be exercised within six to ten years from the date of the grant. Of the

options at December 27, 2005, December 25, 2004, and December 27, 2003, 927,972, 1,003,723 and 897,481, respectively, were

vested and exercisable with a weighted average exercise price of $30.01, $20.85, and $13.15, respectively.

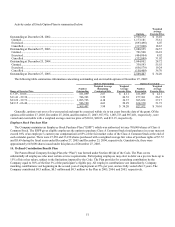

Employee Stock Purchase Plan

The Company maintains an Employee Stock Purchase Plan (“ESPP”) which was authorized to issue 700,000 shares of Class A

Common Stock. The ESPP gives eligible employees the option to purchase Class A Common Stock (total purchases in a year may not

exceed 10% of an employee’s current year compensation) at 85% of the fair market value of the Class A Common Stock at the end of

each calendar quarter. There were 27,258 and 33,238 shares purchased with a weighted average fair value of purchase rights of $7.72

and $5.69 during the fiscal years ended December 27, 2005 and December 25, 2004, respectively. Cumulatively, there were

approximately 645,000 shares issued under this plan as of December 27, 2005.

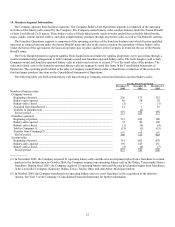

14. Defined Contribution Benefit Plan

The Panera Bread Company Savings Plan (the “Plan”) was formed under Section 401(k) of the Code. The Plan covers

substantially all employees who meet certain service requirements. Participating employees may elect to defer on a pre-tax basis up to

15% of his or her salary, subject to the limitations imposed by the Code. The Plan provides for a matching contribution by the

Company equal to 50% of the first 3% of the participant’s eligible pay. All employee contributions vest immediately. Company

matching contributions vest beginning in the second year of employment at 25% per year, and are fully vested after 5 years. The

Company contributed $0.5 million, $0.3 million and $0.3 million to the Plan in 2005, 2004, and 2003, respectively.