Panera Bread 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 50

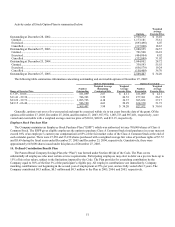

Stock options under this LTIP are granted with an exercise price equal to the quoted market value of the Company’s common

stock on the date of grant. In addition, stock options vest over five years and must be exercised within six years from date of grant.

Restricted stock of the Company under this LTIP are granted at no cost to participants. Plan participants are generally entitled to

cash dividends on restricted stock, although the Company does not currently pay a dividend, and has no current plans to do so, and

voting rights for their respective shares. For awards of restricted stock to date under the LTIP, restrictions limit the sale or transfer of

these shares during a five year period whereby the restrictions lapse on 25% of these shares after two years and thereafter 25% each

year for the next three years. Upon issuance of restricted stock under the LTIP, unearned compensation equivalent to the market value

at the date of grant is charged to stockholders’ equity and subsequently amortized to expense over the five year restriction period. For

the year ended December 27, 2005, the Company granted approximately 94,000 restricted shares, approximately 1,300 shares of

which have been forfeited, with a weighted average grant date fair value of $52.88 per share. As of December 27, 2005 the Company

had recorded $4.6 million in unearned deferred compensation related to restricted stock.

Under the deferred annual bonus match award portion of the LTIP, eligible participants receive an additional 50% of their annual

bonus which is paid three years after the date of the original bonus. For the year ended December 27, 2005, compensation expense

related to the deferred annual bonus match award was $0.3 million.

1992 Equity Incentive Plan

In May 1992, the Company adopted its Equity Incentive Plan (“Equity Plan”) to replace its Non-Qualified Incentive Stock Option

Plan. Under the Equity Plan, a total of 1,900,000 shares of Class A Common Stock were initially reserved for awards under the Equity

Plan. The Equity Plan was subsequently amended by the Board of Directors and the stockholders to increase the number of shares

available thereunder from 1,900,000 to 8,600,000. Awards under the Equity Plan can be in the form of stock options (both qualified

and non-qualified), stock appreciation rights, performance shares, restricted stock, or stock units.

Formula Stock Option Plan for Independent Directors

On January 27, 1994, the Company’s Board of Directors authorized the Formula Stock Option Plan for Independent Directors, as

defined in the related agreement. This plan authorized a total of 300,000 shares and was adopted by stockholders on May 25, 1994.

The plan authorized a one-time grant of an option to purchase 20,000 shares of the Company’s Class A Common Stock at its closing

price on January 26, 1994 for each independent director. Each independent director who is first elected as such after the effective date

of the Directors’ Plan shall receive, as of the date he or she is so elected, a one-time grant of an option to purchase 10,000 shares of

Class A Common Stock at a price per share equal to the closing price of the Class A Common Stock as reported by the

NASDAQ/National Market System for the trading day immediately preceding the date of the person’s election to the board.

Annually and prior to fiscal year 2005, all independent directors serving in such capacity as of the last day of each fiscal year

receive an option to purchase up to 10,000 shares of Class A Common Stock at the closing price for the day prior to the close of the

fiscal year. Each option granted to the independent directors is fully vested at the grant date, and is exercisable, either in whole or in

part, for 6 years following the grant date. There have been no grants under this plan since fiscal 2002, however, as of December 27,

2005 there were approximately 69,000 options outstanding under this plan. In fiscal 2006, the Board of Directors authorized a new

compensation plan for independent directors which, consistent with the Company’s LTIP, compensates directors at a fixed dollar

amount, with payment made through a combination of cash, stock options, and restricted stock.

2001 Employee, Director, and Consultant Stock Option Plan

At the annual meeting of stockholders on June 12, 2001, the Company’s 2001 Employee, Director, and Consultant Stock Option

Plan was approved. Under the Company’s 2001 Employee, Director, and Consultant Stock Option Plan, a total of 3,000,000 shares of

Class A Common Stock were authorized for issuance.