Panera Bread 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

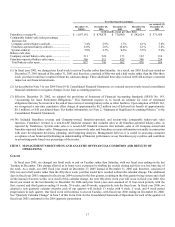

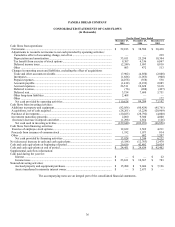

Operating Activities

Funds provided by operating activities for the fiscal year ended December 27, 2005, December 25, 2004, and December 27, 2003

were $110.6 million, $84.3 million, and $73.1 million, respectively. Funds provided by operating activities for all three fiscal years

primarily resulted from net income, depreciation and amortization, tax benefit from exercise of stock options, deferred rent, and

accrued expenses, partially offset by increased trade and other accounts receivable.

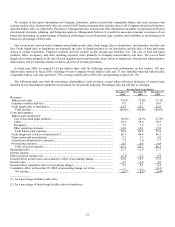

Investing Activities

Total capital expenditures for the fiscal year ended December 27, 2005 were $82.1 million and were primarily related to the

opening of 66 Company-owned bakery-cafes in 2005, costs incurred on Company-owned bakery-cafes to be opened in the first and

second quarter of 2006, and the maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally, we

acquired 21 operating cafes and two cafes under construction from a franchisee for $28.0 million. See Note 3 to the Consolidated

Financial Statements for further information on this transaction. Total capital expenditures were $80.4 million for the fiscal year ended

December 25, 2004 and were primarily related to the opening of 54 Company-owned bakery-cafes in 2004, costs incurred on

Company-owned bakery-cafes to be opened in the first and second quarter of 2005, and the maintaining or remodeling of existing

bakery-cafes and fresh dough facilities. Additionally, in 2004, we acquired one operating bakery-cafe from a franchisee for $0.2

million and acquired the membership interest of the former minority interest owner for $4.9 million plus the transfer of two operating

bakery-cafes and one bakery-cafe under construction. Total capital expenditures were $45.8 million for the fiscal year ended

December 27, 2003 and were primarily related to the opening of 29 Company-owned bakery-cafes in 2003, costs incurred on

Company-owned bakery-cafes to be opened in the first and second quarter of 2004, the opening of three fresh dough facilities, and the

maintaining or remodeling of existing bakery-cafes and fresh dough facilities. Additionally, in 2003, we acquired 15 operating bakery-

cafes, two closed bakery-cafes, and two bakery-cafes under construction from franchisees for $21.0 million.

As of December 27, 2005 and December 25, 2004, we had investments of $46.3 million and $28.4 million, respectively, in United

States treasury notes and government agency securities. Investments are classified as short or long-term in the accompanying

consolidated balance sheet based upon their stated maturity dates. As of December 27, 2005, all investments were classified as held-

to-maturity as we have the intent and ability to hold the securities to maturity. Held-to-maturity securities are stated at amortized cost,

adjusted for amortization of premiums to maturity, which approximates fair value at December 27, 2005.

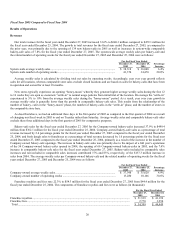

Financing Activities

On December 19, 2003, we entered into a $10.0 million unsecured revolving line of credit (revolver). The revolver matures

December 19, 2006 and has an interest rate of LIBOR plus 0.75% to 1.5% depending on our leverage ratio and type of loan (resulting

in interest rates of approximately 5.0% to 5.8% at December 27, 2005). The revolver contains restrictions relating to future

indebtedness, liens, investments, distributions, mergers, acquisition, or sale of assets and certain leasing transactions. The revolver

also requires the maintenance of certain financial ratios and covenants. As of December 27, 2005, we were in compliance with all debt

covenants. At December 27, 2005, we had $9.8 million available under the revolver with $0.2 million utilized by an outstanding letter

of credit. We have not borrowed under our revolver in any of the last three fiscal years.

Financing activities provided $13.8 million, $5.2 million, and $6.2 million for the fiscal years ended December 27, 2005,

December 25, 2004, and December 27, 2003, respectively. The financing activities in the fiscal year ended December 27, 2005

included $12.6 million from the exercise of stock options and $1.2 million from the issuance of common stock under employee benefit

plans. The financing activities for the fiscal year ended December 25, 2004 primarily included $3.6 million from the exercise of stock

options and $1.1 million from the issuance of common stock under employee benefit plans. The financing activities for the fiscal year

ended December 27, 2003 primarily included $4.2 million from the exercise of stock options and $1.2 million from capital

investments by our former minority interest owner.