Panera Bread 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Operating Profit

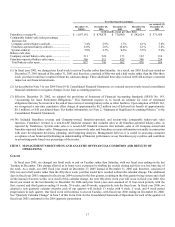

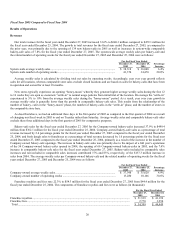

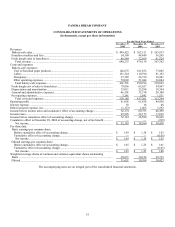

Operating profit for the fiscal year ended December 25, 2004 increased to $61.8 million, or 12.9% of total revenue, from $49.9

million, or 13.7% of total revenue, for the fiscal year ended December 27, 2003. Operating profit as a percentage of total revenues for

the fiscal year ended December 25, 2004 declined as a result of the factors described above.

Other Income and Expense

Other expense for the fiscal year ended December 25, 2004 decreased to $1.1 million, or 0.3% of total revenue, from $1.6 million,

or 0.4% of total revenue, for the fiscal year ended December 27, 2003. The decrease in other expense results primarily from increased

interest income in 2004.

Income Taxes

The provision for income taxes increased to $22.2 million for the fiscal year ended December 25, 2004 compared to $17.6 million

for the fiscal year ended December 27, 2003. The tax provisions for the fiscal year ended December 25, 2004 and December 27, 2003

reflected a consistent combined federal, state, and local effective tax rate of 36.5%.

Income Before Cumulative Effect of Accounting Change

Income before cumulative effect of accounting change for the fiscal year ended December 25, 2004 increased $7.9 million, or

25.7%, to $38.6 million, or $1.25 per diluted share, compared to income before cumulative effect of accounting change of $30.7

million, or $1.01 per diluted share, for the fiscal year ended December 27, 2003. The 2004 increase in income before cumulative effect

of accounting change was primarily due to an increase in bakery-cafe sales, franchise royalties and fees, and fresh dough sales to

franchisees partially offset by higher costs as described above.

Net Income

Net income for the fiscal year ended December 25, 2004 increased $8.2 million, or 27.0%, to $38.6 million, or $1.25 per diluted

share, compared to net income of $30.4 million, or $1.00 per diluted share, for the fiscal year ended December 27, 2003. The increase

in net income in 2004 resulted from the factors described above.

Critical Accounting Policies & Estimates

The Company’s discussion and analysis of its financial condition and results of operations is based upon the Consolidated

Financial Statements and Notes to the Consolidated Financial Statements, which have been prepared in accordance with generally

accepted accounting principles in the United States. The preparation of these consolidated financial statements requires management

to make estimates, judgments and assumptions, which management believes to be reasonable, based on the information available.

These estimates and assumptions affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures of

contingent assets and liabilities. Variances in the estimates or assumptions used could yield materially different accounting results.

The Company believes the following critical accounting policies involve additional management judgment due to the sensitivity of the

methods, assumptions, and estimates necessary in determining the related asset and liability amounts.

Revenue Recognition

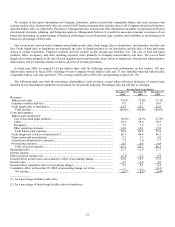

We recognize revenue upon delivery of product or performance of services as follows. Bakery-cafe sales are recorded upon

delivery of food and other products to a customer. In addition, fresh dough sales to franchisees are recorded upon delivery of fresh

dough to franchisees. Also, a liability is recorded in the period in which a gift card is issued and proceeds are received. As gift cards

are redeemed, this liability is reduced and revenue is recognized as a sale. Further, franchise fees are the result of sales of area

development rights and the sale of individual franchise locations to third parties. The initial franchise fee is $35,000 per bakery-cafe to

be developed under the Area Development Agreement (ADA). Of this fee, $5,000 is paid at the time of signing of the ADA and is

recognized as revenue when it is received as it is non-refundable and we have to perform no other service to earn this fee. The

remaining $30,000 is paid at the time an individual franchise agreement is signed and is recognized as revenue upon the

commencement of franchise operations of the bakery-cafes. Royalties are paid weekly based on a percentage of sales, ranging from

4% to 5%, as defined in the agreement. Royalties are recognized as revenue when they are earned.