Panera Bread 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

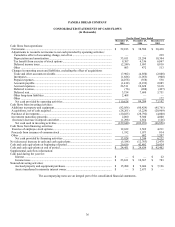

Contractual Obligations and Other Commitments

We currently anticipate total capital expenditures for fiscal year 2006 of approximately $120 million to $130 million principally

for the opening of 70 to 75 new Company-owned bakery-cafes, the costs incurred related to early 2007 openings, the remodeling of

existing bakery-cafes, the opening of 3 new fresh dough facilities, and the remodeling and expansion of existing fresh dough facilities.

We expect future bakery-cafes will require, on average, an investment per bakery-cafe (excluding pre-opening expenses which are

expensed as incurred) of approximately $0.9 million, which is net of landlord allowances. We expect to fund these expenditures

principally through internally generated cash flow and cash from the exercise of employee stock options supplemented, where

necessary, by borrowings on our revolver.

In addition to our capital expenditure requirements, we have certain other contractual and committed cash obligations. Our

contractual cash obligations consist of noncancelable operating leases for our bakery-cafes, fresh dough facilities and trucks, and

administrative offices. Lease terms for our trucks are generally for five to seven years. Lease terms for our bakery-cafes, fresh dough

facilities, and administrative offices are generally for ten years with renewal options at most locations and generally require us to pay a

proportionate share of real estate taxes, insurance, common area, and other operating costs. Many bakery-cafe leases provide for

contingent rental (i.e., percentage rent) payments based on sales in excess of specified amounts. Certain of our lease agreements

provide for scheduled rent increases during the lease terms or for rental payments commencing at a date other than the date of initial

occupancy. See Note 2 to the Consolidated Financial Statements for further information on our accounting for leases. We expect cash

expenditures under these lease obligations to be as follows:

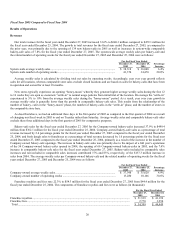

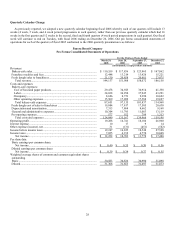

Payments Due by Period as of December 27, 2005 (in thousands)

Total In 2006 2007-2008 2009-2010 After 2010

Operating Leases(1)................................................................. $ 507,251 $ 40,953 $ 81,349 $ 79,635 $ 305,314

____________

(1) See Note 9 to the Consolidated Financial Statements for further information.

Off-Balance Sheet Arrangement — We are the prime tenant for operating leases of 14 franchisee locations and a guarantor for

operating leases of 32 locations of the former Au Bon Pain Division, or our franchisees. These leases have terms expiring on various

dates from January 2006 to December 2018 and have a potential amount of future rental payments of approximately $32.2 million.

The obligation from these leases will continue to decrease over time as these operating leases expire. As the guarantees were initiated

prior to December 31, 2002, we have not recorded a liability for these guarantees pursuant to the provisions of FASB Interpretation

Number (FIN) 45, “Guarantor’s Accounting and Disclosure Requirements For Guarantees, Including Indirect Guarantees of

Indebtedness of Others, an Interpretation of FASB Statements No. 5, 57, and 107 and Rescission of FASB Interpretation No. 34.”

Also, we have not had to make any payments related to the leases. Au Bon Pain or the respective franchisees continue to have primary

liability for these operating leases. Potential future commitments consist of:

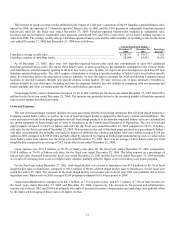

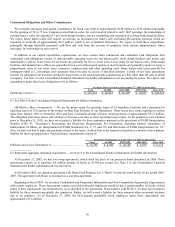

Potential Commitments as of December 27, 2005 (in thousands)

Total In 2006 2007-2008 2009-2010 After 2010

Subleases and Lease Guarantees(1)........................................... $ 32,199 $ 6,946 $ 10,140 $ 5,939 $ 9,174

____________

(1) Represents aggregate minimum requirement — see Note 9 to the Consolidated Financial Statements for further information.

At December 27, 2005, we had two swap agreements, which fixed the price of our projected butter purchases in 2006. These

agreements require us to purchase 6.8 million pounds of butter at $1.488 per pound. See Note 2 to the Consolidated Financial

Statements for further information on our derivatives.

In November 2002, we signed an agreement with Dawn Food Products, Inc. (“Dawn”) to provide sweet goods for the period 2003-

2007. The agreement with Dawn is structured as a cost plus agreement.

Beginning in fiscal 2003, we executed Confidential and Proprietary Information and Non-Competition Agreements (Agreements)

with certain employees. These Agreements contain a provision whereby employees would be due a certain number of weeks of their

salary if their employment was terminated by us as specified in the Agreement. In accordance with SFAS 5, we have not recorded a

liability for these amounts potentially due employees. Rather, we will record a liability for these amounts when an amount becomes

due to an employee. As of December 27, 2005, the total amount potentially owed employees under these Agreements was

approximately $7.6 million.