Panera Bread 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

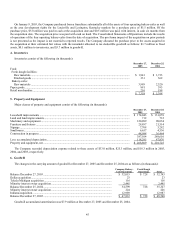

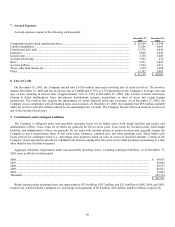

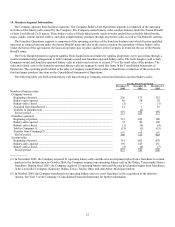

Fiscal Year Ended

December 27,

2005

December 25,

2004

December 27,

2003

Net income, as reported ....................................................................................................... $ 52,183 $ 38,580 $ 30,430

Add:

Total stock-based compensation expense included in reported net income, net of tax...... 513 — —

Deduct:

Total stock-based compensation expense determined under the fair value-based

method for all awards, net of tax...................................................................................... 5,861 3,958 2,626

Pro forma net income........................................................................................................... $ 46,835 $ 34,622 $ 27,804

Net income per share:

Basic, as reported............................................................................................................... $ 1.69 $ 1.28 $ 1.02

Basic, pro forma................................................................................................................. $ 1.52 $ 1.15 $ 0.94

Diluted, as reported............................................................................................................ $ 1.65 $ 1.25 $ 1.00

Diluted, pro forma.............................................................................................................. $ 1.52 $ 1.15 $ 0.94

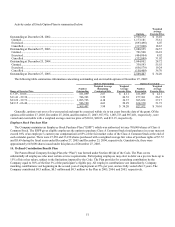

The weighted average fair value of the options granted during 2005, 2004, and 2003 was $21.19 per share, $13.49 per share, and

$15.81 per share, respectively, on the date of grant using the Black-Scholes option-pricing model with the following assumptions:

expected dividend yield of 0%, expected volatility of 36% in 2005 and 2004 and 41% in 2003, risk-free interest rate of 4.04% in 2005,

3.42% in 2004, and 3.53% in 2003, and an expected life of 5 years in 2005 and 2004 and 6 years in 2003.

Adoption of SFAS 143

Effective December 29, 2002, the Company adopted the provisions of SFAS No. 143, “Accounting for Asset Retirement

Obligations.” SFAS 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-

lived assets and the associated asset retirement costs. This Statement requires the Company to record an estimate for costs of

retirement obligations that may be incurred at the end of lease terms of existing bakery-cafes or other facilities.

Beginning December 29, 2002, the Company recognizes the future cost to comply with lease obligations at the end of a lease as it

relates to tangible long-lived assets in accordance with the provisions of SFAS 143. A liability for the fair value of an asset retirement

obligation along with a corresponding increase to the carrying value of the related long-lived asset is recorded at the time a lease

agreement is executed. The Company amortizes the amount added to property and equipment and recognizes accretion expense in

connection with the discounted liability over the life of the respective lease. The estimated liability is based on experience in closing

bakery-cafes and the related external cost associated with these activities. Revisions to the liability could occur due to changes in

estimated retirement costs or changes in lease term.

Upon adoption of SFAS 143, the Company recorded a discounted liability of approximately $0.8 million, increased net property

and equipment by approximately $0.4 million, and recognized a one-time cumulative effect charge of approximately $0.2 million (net

of deferred tax benefit of approximately $0.1 million). The liability as of December 27, 2005 and December 25, 2004 was $2.0 million

and $1.4 million, respectively, and is included in other long-term liabilities in the Consolidated Balance Sheets.

Recently Issued Pronouncements

In December 2004, the FASB issued SFAS No. 123R, “Share-Based Payment” (“SFAS 123R”), a revision of SFAS No. 123,

“Accounting for Stock-Based Compensation.” SFAS 123R will require the Company to, among other things, measure employee

stock-based compensation awards where applicable using a fair value method and record related expense in the Company’s

consolidated financial statements. The provisions of SFAS 123R are effective for public companies for annual periods beginning after

June 15, 2005. The Company anticipates it will adopt SFAS 123R effective December 28, 2005 using the modified prospective

transition approach and estimates adoption of the expensing requirements will reduce the Company’s diluted earnings per share by

$0.13 in 2006.

In December 2004, the FASB issued FASB Staff Position No. FAS 109-1, “Application of SFAS No. 109, Accounting for Income

Taxes, to the Tax Deduction on Qualified Production Activities provided by the American Jobs Creation Act of 2004” (“FSP 109-1”).

FSP 109-1 states that qualified domestic production activities should be accounted for as a special deduction under SFAS No. 109,

“Accounting for Income Taxes.” The provisions of FSP 109-1 are effective immediately. Adoption of this pronouncement did not

have a significant impact on the Company’s financial statements.