Nordstrom 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

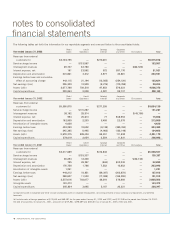

notes to consolidated

financial statements

40 NORDSTROM INC. AND SUBSIDIARIES

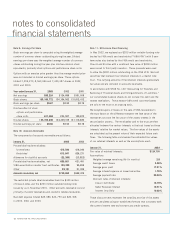

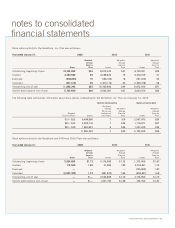

The following tables set forth the information for our reportable segments and a reconciliation to the consolidated totals:

Retail Credit Catalog/ Corporate

Year ended January 31, 2003 Stores Operations Internet and Other Eliminations Total

Revenues from external

customers (b) $5,704,795 — $270,281 — — $5,975,076

Service charge income — $133,587 — — — 133,587

Intersegment revenues 29,737 32,783 — — $(62,520) —

Interest expense, net 191 23,582 972 $57,176 — 81,921

Depreciation and amortization 201,861 3,212 4,977 23,881 — 233,931

Earnings before taxes and cumulative

effect of accounting change 442,115 21,194 (13,565) (254,120) — 195,624

Net earnings (loss) 256,339 12,929 (8,275) (170,769) — 90,224

Assets (a)(b) 2,677,790 750,510 97,853 570,223 — 4,096,376

Capital expenditures 230,864 2,058 4,507 90,737 — 328,166

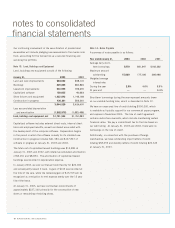

Retail Credit Catalog/ Corporate

Year ended January 31, 2002 Stores Operations Internet and Other Eliminations Total

Revenues from external

customers (b) $5,356,875 — $277,255 — — $5,634,130

Service charge income — $131,267 — — — 131,267

Intersegment revenues 20,192 25,514 — — $(45,706) —

Interest expense, net 994 25,013 77 $48,954 — 75,038

Depreciation and amortization 182,960 2,253 5,498 22,378 — 213,089

Amortization of intangible assets 4,630 — — — — 4,630

Earnings before taxes 402,299 10,652 (8,139) (200,324) — 204,488

Net earnings (loss) 245,305 6,495 (4,963) (122,149) — 124,688

Assets (a)(b) 2,570,375 699,454 69,457 711,893 — 4,051,179

Capital expenditures 379,819 2,054 2,554 11,621 — 396,048

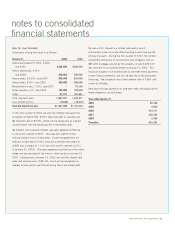

Retail Credit Catalog/ Corporate

Year ended January 31, 2001 Stores Operations Internet and Other Eliminations Total

Revenues from external

customers (b) $5,217,889 — $310,648 — — $5,528,537

Service charge income — $135,337 — — — 135,337

Intersegment revenues 30,294 12,440 — — $(42,734) —

Interest expense, net 795 29,267 (604) $33,240 — 62,698

Depreciation and amortization 176,758 1,786 7,552 16,952 — 203,048

Amortization of intangible assets 1,251 — — — — 1,251

Earnings before taxes 440,212 18,851 (29,367) (262,678) — 167,018

Net earnings (loss) 268,627 11,503 (17,920) (160,292) — 101,918

Assets (a)(b) 2,557,616 703,077 68,010 279,800 — 3,608,503

Intangible assets 143,473 — — — — 143,473

Capital expenditures 295,834 3,095 5,187 26,231 — 330,347

(a) Segment assets in Corporate and Other include unallocated assets in corporate headquarters, consisting primarily of land, buildings and equipment, and deferred

tax assets.

(b) Includes sales of foreign operations of $75,645 and $68,487 for the years ended January 31, 2003 and 2002, and $12,318 for the period from October 24, 2000,

the date of acquisition, to January 31, 2001, and assets of $219,861, $198,689 and $206,601 as of January 31, 2003, 2002 and 2001.