Nordstrom 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated

financial statements

NORDSTROM INC. AND SUBSIDIARIES 35

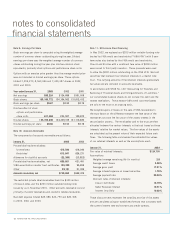

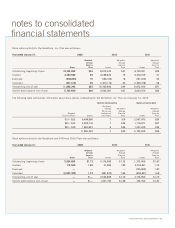

Note 15: Long-Term Debt

A summary of long-term debt is as follows:

January 31, 2003 2002

Receivable-backed PL Term, 4.82%,

due 2006 $300,000 $300,000

Senior debentures, 6.95%,

due 2028 300,000 300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Senior notes, 8.95%, due 2005 300,000 300,000

Medium-term notes, 7.25%, due 2002 — 76,750

Notes payable, 6.7%, due 2005 100,000 100,000

Other 97,371 102,521

Total long-term debt 1,347,371 1,429,271

Less current portion (5,545) (78,227)

Total due beyond one year $1,341,826 $1,351,044

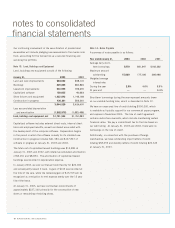

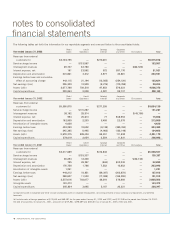

In the third quarter of 2002, we sold the interest rate swap that

converted our $300,000, 8.95% fixed-rate debt to variable rate.

We received cash of $4,931, which will be recognized as interest

income evenly over the remaining life of the related debt.

We entered into a variable interest rate swap agreement effective

in the fourth quarter of 2002. The swap had a $250 million

notional amount and a six-year term. Under the agreement, we

received a fixed rate of 5.63% and paid a variable rate based on

LIBOR plus a margin of 1.31% set at six-month intervals (3.25%

at January 31, 2003). The swap agreement qualified as a fair value

hedge and was recorded at fair value in other assets at January 31,

2003. Subsequent to January 31, 2003, we sold the interest rate

swap and received cash of $2,341, which will be recognized as

interest income evenly over the remaining life of the related debt.

We own a 49% interest in a limited partnership which

constructed a new corporate office building in which we are the

primary occupant. During the first quarter of 2002, the limited

partnership refinanced its construction loan obligation with an

$85,000 mortgage secured by the property, of which $79,319

was included on our balance sheet at January 31, 2003. This

financial obligation will be amortized as we make rental payments

to the limited partnership over the 18 year life of the permanent

financing. The obligation has a fixed interest rate of 7.68% and

a term of 18 years.

Required principal payments on long-term debt, excluding capital

lease obligations, are as follows:

Year ended January 31,

2004 $5,226

2005 4,683

2006 403,171

2007 303,538

2008 3,584

Thereafter 618,232