Nordstrom 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

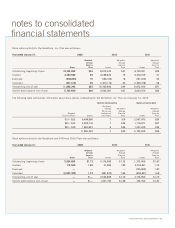

notes to consolidated

financial statements

28 NORDSTROM INC. AND SUBSIDIARIES

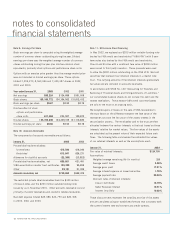

SFAS No. 142 “Goodwill and Other Intangible Assets” - Under SFAS

No. 142, goodwill and intangible assets having indefinite lives will

no longer be amortized but will be subject to annual impairment

tests. Other intangible assets will continue to be amortized over

their estimated useful lives. Adoption of SFAS No. 142 resulted

in an impairment charge and a reduction in amortization expense,

which is detailed in Note 2.

SFAS No. 144 “Accounting for the Impairment or Disposal of

Long-Lived Assets” - SFAS No. 144 retains the fundamental

provisions of SFAS No. 121, but establishes new criteria for asset

classification and broadens the scope of qualifying discontinued

operations. The adoption of this statement did not have a material

impact on our financial statements.

We adopted SFAS No. 145 “Rescission of FASB Statements No. 4,

44, and 64, Amendment of FASB Statement No. 13, and Technical

Corrections” in the second quarter of 2002. SFAS No. 145 updates,

clarifies and simplifies existing accounting pronouncements related

to extinguishments of debt, provisions of the Motor Carrier Act of

1980 and lease transactions. The adoption of this statement did

not have a material impact on our financial statements.

SFAS No. 146 “Accounting for Costs Associated with Exit or

Disposal Activities” was also adopted by us in the second quarter

of 2002. SFAS No. 146 nullifies EITF 94-3 “Liability Recognition

for Certain Employee Termination Benefits and Other Costs to Exit

an Activity (including Certain Costs Incurred in a Restructuring)”

by requiring that a liability for a cost associated with an exit or

disposal activity be recognized when the liability is incurred

versus when an entity is committed to an exit plan. The adoption

of this statement did not have a material impact on our

financial statements.

We adopted SFAS No. 148 “Accounting for Stock-Based

Compensation” in the fourth quarter of 2002. SFAS No. 148

amends SFAS No. 123 of the same name and provides alternative

transition methods for a voluntary change to fair value based

accounting for employee stock compensation. SFAS No. 148

also requires more prominent and frequent disclosures about the

effects of stock-based compensation. Adoption of SFAS No. 148

did not have a material impact on our financial statements.

In November 2002, the Emerging Issues Task Force reached a

consensus on certain issues discussed in EITF 02-16, “Accounting

by a Reseller for Cash Consideration Received from a Vendor.”

This pronouncement addresses the timing and classification

of cash payments received by a reseller from a vendor.

Adoption of EITF 02-16 did not have a material impact on

our financial statements.

In November 2002, the FASB issued FIN 45, “Guarantor’s

Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of the Indebtedness of Others.” FIN 45

elaborates on the disclosures made by a guarantor and also clarifies

that a guarantor is required to recognize, at the inception of a

guarantee, a liability for the fair value of the obligation undertaken

in issuing the guarantee. Adoption of FIN 45 in the fourth quarter

of 2002 did not have a material impact on our financial statements.

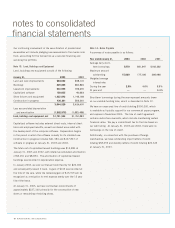

Note 2: Cumulative Effect of Accounting Change

Effective February 2002, we adopted SFAS No. 142, “Goodwill

and Other Intangible Assets,” which establishes new accounting

and reporting requirements for goodwill and other intangible assets.

Under SFAS No. 142, goodwill and intangible assets having

indefinite lives will no longer be amortized but will be subject

to annual impairment tests.

In connection with the adoption of SFAS No. 142, we reviewed

the classification and useful lives of our intangible assets.

Our intangible assets were determined to be either goodwill

or indefinite lived tradename.

As required by SFAS No. 142, we defined our reporting unit as

the Façonnable Business Unit, one level below our reportable Retail

Stores segment. We then tested our intangible assets for impairment

by comparing the fair value of the reporting unit with its carrying

value. Fair value was determined using a discounted cash flow

methodology. SFAS No. 142 requires us to perform these

impairment tests at adoption and at least annually thereafter.

We expect to perform our impairment test annually during our

first quarter or when circumstances indicate we should do so.

Our initial impairment test resulted in an impairment charge

to goodwill of $21,900 in the first quarter of 2002, while the

tradename was determined not to be impaired. The goodwill

impairment resulted from a reduction in management’s estimate

of future growth for this reporting unit. The impairment charge

is reflected as a cumulative effect of accounting change.