Nordstrom 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated

financial statements

NORDSTROM INC. AND SUBSIDIARIES 29

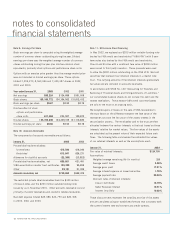

The changes in the carrying amount of our intangible assets for the

year ended January 31, 2003, are as follows:

Catalog/

Retail Stores Internet

Segment Segment

Goodwill Tradename Goodwill Total

February 1, 2002 $38,198 $100,133 $ — $138,331

Goodwill impairment (21,900) — — (21,900)

Goodwill acquired

through purchase of

minority interest

(see Note 21) — — 24,057 24,057

January 31, 2003 $16,298 $100,133 $24,057 $140,488

The following table shows the actual results of operations as well as

pro-forma results adjusted to exclude intangible amortization and the

cumulative effect of accounting change.

Year ended January 31, 2003 2002 2001

Reported net earnings $90,224 $124,688 $101,918

Intangible amortization,

net of tax —2,824 763

Cumulative effect of

accounting change,

net of tax 13,359 ——

Adjusted net earnings $103,583 $127,512 $102,681

Basic and diluted earnings per share:

Year ended January 31, 2003 2002 2001

Earnings per share: Basic Diluted Basic and Diluted

Reported net earnings $0.67 $0.66 $0.93 $0.78

Intangible amortization,

net of tax ——

0.02 —

Cumulative effect of

accounting change,

net of tax 0.10 0.10 ——

Adjusted net earnings $0.77 $0.76 $0.95 $0.78

Before adoption of SFAS No. 142, we amortized our intangible

assets over their estimated useful lives on a straight-line basis

ranging from 10 to 35 years. Accumulated amortization of

intangible assets was $5,881 as of January 31, 2003 and 2002.

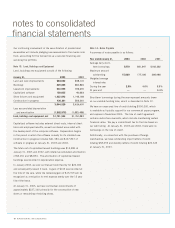

Note 3: Acquisition

In 2000, we acquired Façonnable, S.A.S., of Nice, France, a

designer, wholesaler and retailer of high quality men’s and women’s

apparel and accessories. We paid $87,685 in cash and issued

5,074,000 shares of our common stock for a total consideration

of $168,868. The purchase provides for a contingent payment to

a former owner that may be paid after five years from the acquisition

date. If the former owner continues to have involvement in the

business and performance targets are met, the contingent payment

could approximate $12,000. The contingent payment will be

expensed when it becomes probable that the targets will be met.

Note 4: Employee Benefits

We provide a profit sharing plan and 401(k) plan for our employees.

The profit sharing plan is non-contributory and is fully funded by us.

The Board of Directors establishes our contribution to the profit

sharing plan each year. The 401(k) plan is funded by voluntary

employee contributions. In addition, we provide matching

contributions up to a stipulated percentage of employee

contributions. Our contributions to the profit sharing plan and

matching contributions to the 401(k) plan totaled $35,162,

$28,525 and $29,113 in 2002, 2001 and 2000.