Nordstrom 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion

and analysis

NORDSTROM INC. AND SUBSIDIARIES 15

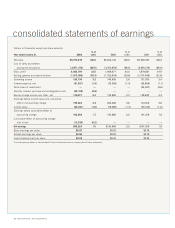

Diluted Earnings per Share

Earnings per share decreased in 2002 due to the write down

of the supply chain tool, the minority interest purchase and

reintegration costs and the cumulative effect of accounting change.

Excluding the impact of these charges, earnings per share would

have been $1.19, an increase from the prior year of 28.0%. This

increase was primarily driven by an increase in comparable store

sales, an improvement in gross profit percent and a decrease in

selling, general and administrative expenses as a percent of sales.

Earnings per share for 2001 were 19.2% higher than 2000 due to

charges recognized in 2000, which include the write-down of

Streamline, the management severance and the asset impairments.

Excluding the impact of these charges, 2000 earnings per share

would have been $1.04 resulting in a 2001 earnings per share

decrease of 10.6%. This decrease is primarily due to a decline in

comparable store sales and a decline in gross profit percent offset by

decreases in selling, general and administrative expenses as a

percent of sales.

Fourth Quarter Results

Fourth quarter 2002 earnings per share were $0.44 compared

with $0.38 in 2001. Total sales for the quarter increased by 7.3%

versus the same quarter in the prior year and comparable store

sales increased by 1.9%. The increase in sales was primarily due

to the opening of eight full-line stores and four Nordstrom Rack

stores during the year. Gross profit as a percentage of sales was

flat with the same quarter in the prior year.

Selling, general and administrative expenses as a percent of sales

decreased in the quarter compared to the prior year primarily due

to improved selling costs and reduced sales promotion offset by

higher distribution costs and information systems expense.

LIQUIDITY AND CAPITAL RESOURCES

We finance our working capital needs, capital expenditures,

acquisitions and share repurchase activity with a combination

of cash flows from operations and borrowings.

We believe that our operating cash flows, existing cash and available

credit facilities are sufficient to finance our operations and planned

growth for the foreseeable future.

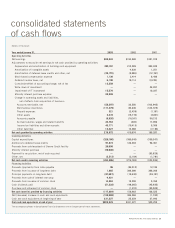

Operating Activities

Our operations are seasonal in nature. The second quarter, which

includes our Anniversary Sale, accounts for approximately 28%

of net sales, while the fourth quarter, which includes the holiday

season, accounts for about 29% of net sales. Cash requirements

are highest in the third quarter as we build our inventory for the

holiday season.

The decrease in net cash provided by operating activities between

2002 and 2001 was primarily due to increases in inventories and

accounts receivable partially offset by an increase in net earnings

before noncash items and an increase in our accrual for income

taxes. Inventory grew as we added stores during the year. Accounts

receivable increased as Nordstrom VISA credit sales improved. The

increased income tax accrual resulted from the timing of payments.

Net cash provided by operating activities increased approximately

$235 million in 2001 compared to 2000 primarily due to decreases

in inventories and accounts receivable. The inventories decreased

as a result of improved inventory management, while accounts

receivable declined due to lower credit sales.

In 2003, cash flows provided by operating activities are expected

to remain fairly consistent with 2002. Inventory increases from store

openings are expected to slow, offset by slower increases in accounts

payable. Accounts receivable should increase modestly as credit

sales grow.

Investing Activities

For the last three years, investing activities have primarily consisted

of capital expenditures, the minority interest purchase of

Nordstrom.com and the acquisition of Façonnable.

98 99 00 01 02

$1.60

$1.40

$1.20

$1.00

$0.80

$1.41

$1.46

$0.78

$0.93

$0.66

•

•

•

•

•