Nordstrom 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated

financial statements

34 NORDSTROM INC. AND SUBSIDIARIES

Our continuing involvement in the securitization of private label

receivables will include pledging new receivables to the master note

trust, accounting for the transaction as a secured financing and

servicing the portfolio.

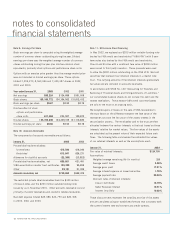

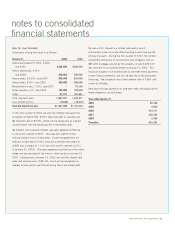

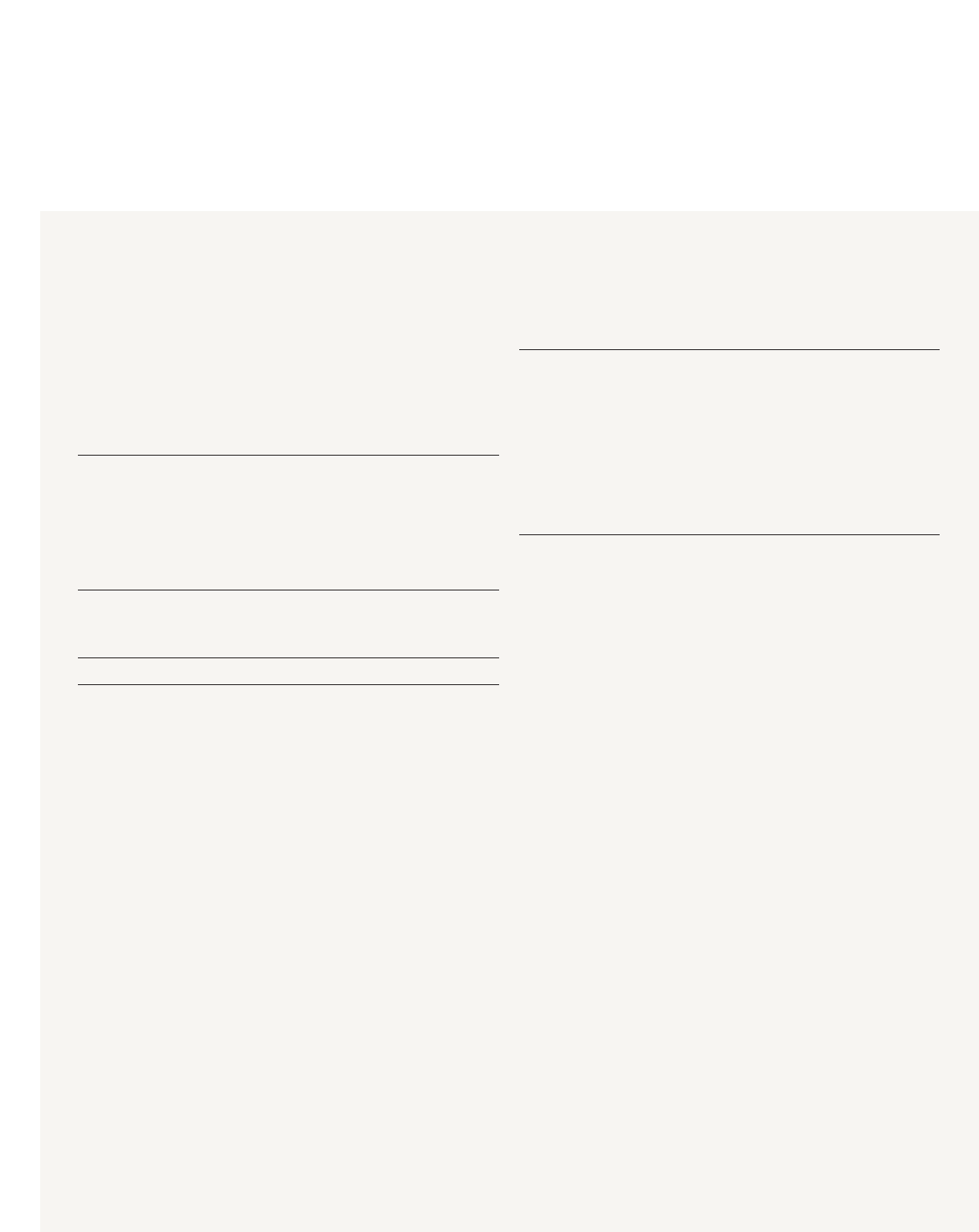

Note 13: Land, Buildings and Equipment

Land, buildings and equipment consist of the following:

January 31, 2003 2002

Land and land improvements $60,692 $59,141

Buildings 829,885 683,926

Leasehold improvements 943,555 910,291

Capitalized software 150,655 46,603

Store fixtures and equipment 1,222,842 1,142,169

Construction in progress 436,891 582,361

3,644,520 3,424,491

Less accumulated depreciation

and amortization (1,882,976) (1,663,409)

Land, buildings and equipment, net $1,761,544 $1,761,082

Capitalized software includes external direct costs, internal direct

labor and employee benefits, as well as interest associated with

the development of the computer software. Depreciation begins

in the period in which the software is ready for its intended use.

Construction in progress includes $61,384 and $127,847 of

software in progress at January 31, 2003 and 2002.

The total cost of capitalized leased buildings was $13,884 at

January 31, 2003 and 2002, with related accumulated amortization

of $9,261 and $8,854. The amortization of capitalized leased

buildings was recorded in depreciation expense.

In January 2003, we sold our Denver Credit facility for $20,000

and subsequently leased it back. A gain of $103 was recorded at

the time of the sale, while the remaining gain of $15,919 will be

recognized as a reduction to rent expense evenly over the 15 year

life of the lease.

At January 31, 2003, we have contractual commitments of

approximately $227,340 primarily for the construction of new

stores or remodeling of existing stores.

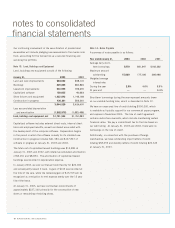

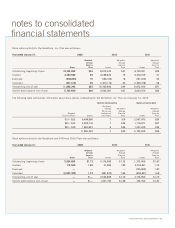

Note 14: Notes Payable

A summary of notes payable is as follows:

Year ended January 31, 2003 2002 2001

Average daily short-

term borrowings $370 $81,647 $192,392

Maximum amount

outstanding 15,000 177,100 360,480

Weighted average

interest rate:

During the year 2.0% 4.6% 6.6%

At year-end —— 6.4%

Short-term borrowings during the year represent amounts drawn

on our variable funding note, which is described in Note 12.

We have an unsecured line of credit totaling $300,000, which

is available as liquidity support for our commercial paper program,

and expires in November 2004. The line of credit agreement

contains restrictive covenants, which include maintaining certain

financial ratios. We pay a commitment fee for the line based on

our debt rating. At January 31, 2003 and 2002, there were no

borrowings on the line of credit.

Additionally, in connection with the purchase of foreign

merchandise, we have outstanding import letters of credit

totaling $58,059 and standby letters of credit totaling $20,649

at January 31, 2003.