Nordstrom 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated

financial statements

NORDSTROM INC. AND SUBSIDIARIES 31

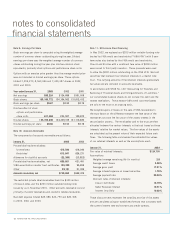

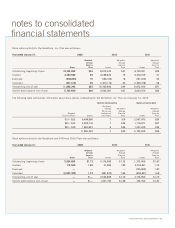

Note 8: Income Taxes

Income tax expense consists of the following:

Year ended January 31, 2003 2002 2001

Current income taxes:

Federal $76,901 $58,122 $79,778

State and local 10,633 6,142 11,591

Total current

income taxes 87,534 64,264 91,369

Deferred income taxes:

Current (4,225) (7,217) (11,215)

Non-current 8,732 22,753 (15,054)

Total deferred

income taxes 4,507 15,536 (26,269)

Total before cumulative effect

of accounting change 92,041 79,800 65,100

Deferred income taxes on

cumulative effect of

accounting change (8,541) ——

Total tax expense $83,500 $79,800 $65,100

A reconciliation of the statutory Federal income tax rate to the

effective tax rate on earnings before the cumulative effect of

accounting change is as follows:

Year ended January 31, 2003 2002 2001

Statutory rate 35.00% 35.00% 35.00%

State and local

income taxes, net of

Federal income taxes 3.78 3.93 3.93

Change in valuation allowance 8.45 ——

Other, net (0.18) .09 .05

Effective tax rate 47.05% 39.02% 38.98%

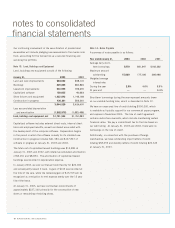

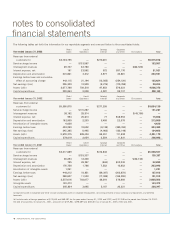

Deferred income taxes reflect the net tax effect of temporary

differences between amounts recorded for financial reporting

purposes and amounts used for tax purposes. The major

components of deferred tax assets and liabilities are as follows:

January 31, 2003 2002

Accrued expenses $35,480 $33,896

Compensation and

benefits accruals 52,969 48,584

Merchandise inventories 25,831 24,643

Capital loss carryforwards 7,406 13,399

Loss on minority interest purchase 16,532 —

Other 28,835 21,123

Total deferred tax assets 167,053 141,645

Land, buildings and

equipment basis and

depreciation differences (50,401) (49,978)

Employee benefits (9,657) (9,771)

Other (3,891) (3,195)

Total deferred tax liabilities (63,949)(62,944)

Valuation allowance (16,532)—

Net deferred tax assets $86,572 $78,701

In January 2003 we sold our Denver Credit facility, generating a

capital gain for tax purposes of $15,367 which was used to offset

a portion of our existing capital loss carryforwards. Capital loss

carryforwards of $18,990 remain available to offset capital gain

income in the next three years. No valuation allowance has been

provided because we believe it is probable that the full benefit

of these carryforwards will be realized.

Our purchase of the outstanding shares of Nordstrom.com, Inc.

series C preferred stock resulted in an expense of $40,389 which

we believe will not be deductible for tax purposes. As a result,

we have established a valuation allowance of $16,532 to offset

the deferred tax asset related to this purchase.