Nordstrom 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion

and analysis

NORDSTROM INC. AND SUBSIDIARIES 13

In 2002, net sales increased 6.1% over the prior year. This growth

was primarily due to store openings. During 2002, we opened eight

full-line stores, four Nordstrom Rack stores and one Façonnable

boutique. We also closed one Nordstrom Rack location. The net

impact was an increase to our retail square footage of 8%.

Comparable store sales increased 1.4% due to increases at both

full-line stores and Nordstrom Rack stores. Sales at Nordstrom

Direct (formerly known as Nordstrom.com) declined slightly with

a planned reduction in catalog sales partially offset by an increase

in Internet sales.

Merchandise division sales were led by Women’s Designer, Cosmetics

and Accessories. Men’s Apparel and Shoes experienced small sales

declines. The Women’s Designer division benefited from the

addition of new vendors, close scrutiny of developing trends and

a targeted marketing plan. The increase in Cosmetics was primarily

due to the addition of product lines. Accessories improved by

differentiating its product and offering attractive values.

In 2001, net sales increased 1.9% due to store openings. During

2001, we opened four full-line stores, eight Nordstrom Rack stores

and three Façonnable boutiques. We also closed one Nordstrom

Rack store and one full-line store. The net impact was an increase

to our retail square footage of 6%. New store sales were partially

offset by negative comparable store sales and a decline in sales

at Nordstrom Direct. The most significant sales declines were in

Men’s Apparel and Shoes while Women’s Apparel was essentially flat.

In 2003, we plan to open four full-line stores and two Nordstrom

Rack stores, increasing retail square footage by approximately 4%.

Because of the continued challenging retail environment,

comparable store sales are expected to be flat to slightly positive.

Gross Profit

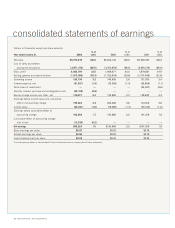

Fiscal Year 2000 2001 2002

Gross profit as a percent of net sales 34.0% 33.2% 33.5%

Gross profit as a percentage of net sales improved in 2002 due

to better inventory management. In our merchandising divisions,

improvement in gross profit rate offset lower sales in certain

categories. Merchandise division gross profit was led by both

Women’s and Men’s Apparel. Additionally, costs related to our

private label operations improved. Total inventory increased as

we added new stores, however, inventory per square foot declined

due to improved performance at full-line stores partially offset by

inventory increases at our Nordstrom Rack division. Total shrinkage

as a percentage of sales was even with the previous year.

Gross profit as a percentage of net sales declined in 2001 due

to increased markdowns and new store occupancy expenses.

The markdowns were taken to drive sales and to liquidate excess

inventory caused by the decrease in comparable store sales.

Inventory declines at comparable stores were partially offset by the

addition of new stores. The comparable stores inventory decrease

was due to a concerted effort to reduce inventory levels during the

year resulting in lower inventory per square foot. Total shrinkage as

a percentage of sales was even with the previous year.

In 2003, we anticipate continuing progress in our ability to improve

gross profit performance through better inventory management.

Selling, General and Administrative

Fiscal Year 2000 2001 2002

Selling, general and administrative

expense as a percent of net sales 31.6% 30.6% 30.3%

In 2002, we recognized a charge of $15.6 million to write-down

an investment in a supply chain tool intended to support our private

label division. Due to changes in business strategy, we determined

that this asset was impaired. This charge reduced this asset to its

estimated market value.

Excluding the effect of the write-down, selling, general and

administrative expenses as a percentage of net sales decreased

in 2002 to 30.1% from 30.6% in the prior year. This decrease

is the result of improvements in bad debt and selling expense and

reductions in sales promotion. These costs were partially offset

by higher distribution costs and higher information systems expense.

Bad debt expense decreased as both delinquency and write-off

trends stabilized. Selling expense decreased primarily due to

continued efficiencies in shipping costs at Nordstrom Direct.

Sales promotion decreased as Nordstrom Direct executed planned

reductions in catalog size and number of mailings consistent with

sales trends. Distribution costs increased primarily due to higher

merchandise volumes and temporary inefficiencies caused by the

implementation of our perpetual inventory system. The information