Nike 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

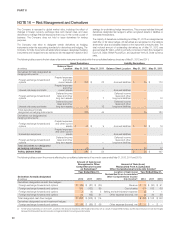

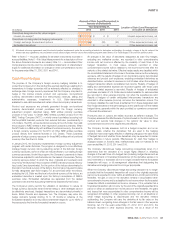

NOTE 16 — Risk Management and Derivatives

The Company is exposed to global market risks, including the effect of

changes in foreign currency exchange rates and interest rates, and uses

derivatives to manage financial exposures that occur in the normal course of

business. The Company does not hold or issue derivatives for trading

purposes.

The Company may elect to designate certain derivatives as hedging

instruments under the accounting standards for derivatives and hedging. The

Company formally documents all relationships between designated hedging

instruments and hedged items as well as its risk management objective and

strategy for undertaking hedge transactions. This process includes linking all

derivatives designated as hedges to either recognized assets or liabilities or

forecasted transactions.

The majority of derivatives outstanding as of May 31, 2012 are designated as

cash flow or fair value hedges. All derivatives are recognized on the balance

sheet at fair value and classified based on the instrument’s maturity date. The

total notional amount of outstanding derivatives as of May 31, 2012 was

approximately $7 billion, which is primarily comprised of cash flow hedges for

Euro/U.S. Dollar, British Pound/Euro, and Japanese Yen/U.S. Dollar currency

pairs.

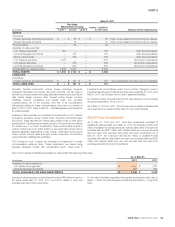

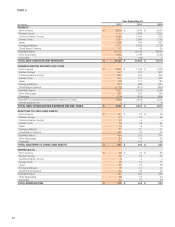

The following table presents the fair values of derivative instruments included within the consolidated balance sheets as of May 31, 2012 and 2011:

Asset Derivatives Liability Derivatives

(In millions)

Balance Sheet

Location May 31, 2012 May 31, 2011 Balance Sheet Location May 31, 2012 May 31, 2011

Derivatives formally designated as

hedging instruments:

Foreign exchange forwards and

options

Prepaid expenses

and other

current assets $ 203 $ 22 Accrued liabilities $ 35 $ 170

Interest rate swap contracts

Prepaid expenses

and other

current assets — — Accrued liabilities — —

Foreign exchange forwards and

options

Deferred income

taxes and other

long-term assets 7 7

Deferred income

taxes and other

long-term liabilities — 10

Interest rate swap contracts

Deferred income

taxes and other

long-term assets 15 15

Deferred income

taxes and other

long-term liabilities — —

Total derivatives formally

designated as hedging instruments 225 44 35 180

Derivatives not designated as

hedging instruments:

Foreign exchange forwards and

options

Prepaid expenses

and other current

assets $ 55 $ 9 Accrued liabilities $ 20 $ 16

Embedded derivatives

Prepaid expenses

and other current

assets 1 — Accrued liabilities — —

Foreign exchange forwards and

options

Deferred income

taxes and other

long-term assets — —

Deferred income

taxes and other

long-term liabilities — 1

Total derivatives not designated

as hedging instruments 56 9 20 17

TOTAL DERIVATIVES $ 281 $ 53 $ 55 $ 197

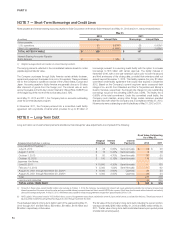

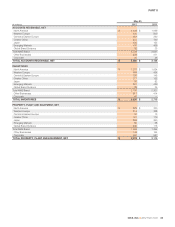

The following tables present the amounts affecting the consolidated statements of income for years ended May 31, 2012, 2011 and 2010:

Derivatives formally designated

(In millions)

Amount of Gain (Loss)

Recognized in Other

Comprehensive Income

on Derivatives(1)

Amount of Gain (Loss)

Reclassified From Accumulated

Other Comprehensive Income into Income(1)

Year Ended May 31, Location of Gain (Loss)

Reclassified From Accumulated

Other Comprehensive Income

Into Income(1)

Year Ended May 31,

2012 2011 2010 2012 2011 2010

Derivatives designated as cash flow hedges:

Foreign exchange forwards and options $ (29) $ (87) $ (30) Revenue $ 5 $ (30) $ 51

Foreign exchange forwards and options 253 (152) 89 Cost of sales (57) 103 60

Foreign exchange forwards and options 3 (4) 5 Selling and administrative expense (2) 1 1

Foreign exchange forwards and options 36 (65) 51 Other expense (income), net (9) 34 56

Total designated cash flow hedges $ 263 $ (308) $ 115 $ (63) $ 108 $ 168

Derivatives designated as net investment hedges:

Foreign exchange forwards and options $ 45 $ (85) $ 66 Other expense (income), net $ — $ — $ —

(1) For the years ended May 31, 2012, 2011, and 2010, the amounts recorded in other expense (income), net as a result of hedge ineffectiveness and the discontinuance of cash flow hedges

because the forecasted transactions were no longer probable of occurring were immaterial.

60