Nike 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

Contingent Payments under Endorsement

Contracts

A significant portion of our demand creation expense relates to payments

under endorsement contracts. In general, endorsement payments are

expensed uniformly over the term of the contract. However, certain contract

elements may be accounted for differently, based upon the facts and

circumstances of each individual contract.

Some of the contracts provide for contingent payments to endorsers based

upon specific achievements in their sports (e.g., winning a championship). We

record selling and administrative expense for these amounts when the

endorser achieves the specific goal.

Some of the contracts provide for payments based upon endorsers

maintaining a level of performance in their sport over an extended period of

time (e.g., maintaining a top ranking in a sport for a year). These amounts are

reported in selling and administrative expense when we determine that it is

probable that the specified level of performance will be maintained throughout

the period. In these instances, to the extent that actual payments to the

endorser differ from our estimate due to changes in the endorser’s athletic

performance, increased or decreased selling and administrative expense may

be reported in a future period.

Some of the contracts provide for royalty payments to endorsers based upon

a predetermined percentage of sales of particular products. We expense

these payments in cost of sales as the related sales occur. In certain

contracts, we offer minimum guaranteed royalty payments. For contractual

obligations for which we estimate we will not meet the minimum guaranteed

amount of royalty fees through sales of product, we record the amount of the

guaranteed payment in excess of that earned through sales of product in

selling and administrative expense uniformly over the remaining guarantee

period.

Property, Plant and Equipment and Definite-

Lived Assets

Property, plant and equipment, including buildings, equipment, and

computer hardware and software are recorded at cost (including, in some

cases, the cost of internal labor) and are depreciated over the estimated

useful life. Changes in circumstances (such as technological advances or

changes to our business operations) can result in differences between the

actual and estimated useful lives. In those cases where we determine that the

useful life of a long-lived asset should be shortened, we increase depreciation

expense over the remaining useful life to depreciate the asset’s net book value

to its salvage value.

We review the carrying value of long-lived assets or asset groups to be used

in operations whenever events or changes in circumstances indicate that the

carrying amount of the assets might not be recoverable. Factors that would

necessitate an impairment assessment include a significant adverse change

in the extent or manner in which an asset is used, a significant adverse

change in legal factors or the business climate that could affect the value of

the asset, or a significant decline in the observable market value of an asset,

among others. If such facts indicate a potential impairment, we would assess

the recoverability of an asset group by determining if the carrying value of the

asset group exceeds the sum of the projected undiscounted cash flows

expected to result from the use and eventual disposition of the assets over the

remaining economic life of the primary asset in the asset group. If the

recoverability test indicates that the carrying value of the asset group is not

recoverable, we will estimate the fair value of the asset group using

appropriate valuation methodologies that would typically include an estimate

of discounted cash flows. Any impairment would be measured as the

difference between the asset group’s carrying amount and its estimated fair

value.

Goodwill and Indefinite-Lived Intangible Assets

We perform annual impairment tests on goodwill and intangible assets with

indefinite lives in the fourth quarter of each fiscal year, or when events occur or

circumstances change that would, more likely than not, reduce the fair value

of a reporting unit or an intangible asset with an indefinite life below its carrying

value. Events or changes in circumstances that may trigger interim

impairment reviews include significant changes in business climate, operating

results, planned investments in the reporting unit, planned divestitures or an

expectation that the carrying amount may not be recoverable, among other

factors. The impairment test requires us to estimate the fair value of our

reporting units. If the carrying value of a reporting unit exceeds its fair value,

the goodwill of that reporting unit is potentially impaired and we proceed to

step two of the impairment analysis. In step two of the analysis, we measure

and record an impairment loss equal to the excess of the carrying value of the

reporting unit’s goodwill over its implied fair value if any.

We generally base our measurement of the fair value of a reporting unit on a

blended analysis of the present value of future discounted cash flows and the

market valuation approach. The discounted cash flows model indicates the

fair value of the reporting unit based on the present value of the cash flows

that we expect the reporting unit to generate in the future. Our significant

estimates in the discounted cash flows model include: our weighted average

cost of capital; long-term rate of growth and profitability of the reporting unit’s

business; and working capital effects. The market valuation approach

indicates the fair value of the business based on a comparison of the reporting

unit to comparable publicly traded companies in similar lines of business.

Significant estimates in the market valuation approach model include

identifying similar companies with comparable business factors such as size,

growth, profitability, risk and return on investment, and assessing comparable

revenue and operating income multiples in estimating the fair value of the

reporting unit.

Indefinite-lived intangible assets primarily consist of acquired trade names and

trademarks. In measuring the fair value for these intangible assets, we utilize

the relief-from-royalty method. This method assumes that trade names and

trademarks have value to the extent that their owner is relieved of the

obligation to pay royalties for the benefits received from them. This method

requires us to estimate the future revenue for the related brands, the

appropriate royalty rate and the weighted average cost of capital.

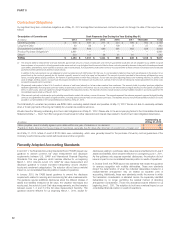

On May 31, 2012, we announced our intention to divest of the Cole Haan and

Umbro businesses. As of May 31, 2012, Cole Haan had no goodwill or

indefinite-lived intangible assets on our balance sheet, while Umbro had

$70 million of goodwill and $164 million of trademark and other intangible

assets. As of May 31, 2012, both asset groups for Cole Haan and Umbro did

not quality as “assets-held-for-sale” under applicable accounting guidance.

The decision to divest these businesses was deemed a triggering event to

perform an impairment analysis of Umbro’s intangible assets at that date and

was considered in our fourth quarter impairment analysis. We are currently in

the process of preparing the businesses for divestiture and identifying

potential acquirers. Therefore, we believe the weighted use of discounted

cash flows and the market valuation approach is the best method for

determining the fair value of the Umbro reporting unit because these are the

most common valuation methodologies used within our industry; and the

blended use of both models compensates for the inherent risks associated

with either model if used on a stand-alone basis. As discussed above, the

asset groups for Umbro did not qualify as “assets-held-for-sale”; therefore,

we did not consider potential disposition costs or cumulative translation

adjustments in the carrying value of the Umbro reporting unit in our fiscal 2012

fourth quarter impairment analysis. Because we are still in the preliminary

stages of the divestiture process and have not yet identified potential

acquirers or the likely deal structure, these methods represent our best

estimate of the fair value of the Umbro business. Our analysis determined

there was no impairment of intangible assets or goodwill related to Umbro. If

the sales process indicates a fair value that is below the current carrying value

of the reporting unit, an analysis would be required to determine if impairment

charges exist at that point.

34