Nike 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

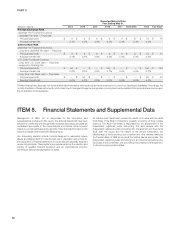

Liquidity and Capital Resources

Cash Flow Activity

Cash provided by operations was $1.9 billion for fiscal 2012 compared to

$1.8 billion for fiscal 2011. Our primary source of operating cash flow for fiscal

2012 was net income of $2.2 billion. Our working capital was a net cash

outflow of $799 million for fiscal 2012 as compared to a net cash outflow of

$708 million for fiscal 2011. Our investments in working capital increased

primarily due to an increase in inventory and prepaid expenses. Inventory at

the end of fiscal 2012 increased 23% compared to fiscal 2011, primarily due

to higher product input costs as well as changes in product mix, which more

than offset the favorable impact of changes in currency exchange rates.

Inventory units for the NIKE Brand grew 10% compared to the prior year,

driven by growth in futures orders and improved factory deliveries. The

increase in prepaid expenses was primarily driven by higher prepaid demand

creation expenses around the European Football Championships and

London Summer Olympics.

Cash provided by investing activities was $514 million during fiscal 2012,

compared to a use of cash of $1,021 million for fiscal 2011. The year-over-

year increase was primarily due to higher net sales and maturities of short-

term investments of $1,124 million (net of purchases) in fiscal 2012,

compared to net purchases of $537 million (net of sales and maturities) during

fiscal 2011.

Cash used by financing activities was $2.1 billion for fiscal 2012 compared to

$2.0 billion for fiscal 2011. The increase in cash used by financing activities

was primarily due to higher payments of long-term debt, notes payable, and

dividends, which was partially offset by an increase in the proceeds from the

exercise of stock options.

In fiscal 2012, we purchased 20.0 million shares of NIKE’s class B common

stock for $1.8 billion. These repurchases were made under the four-year,

$5 billion program approved by our Board of Directors in September 2008,

under which stock repurchase activities commenced in December 2009. As

of the end of fiscal 2012, we have repurchased 50.3 million shares for

$4.1 billion under this program. We continue to expect funding of share

repurchases will come from operating cash flow, excess cash, and/or debt.

The timing and the amount of shares purchased will be dictated by our capital

needs and stock market conditions.

Capital Resources

On November 1, 2011, we entered into a committed credit facility agreement

with a syndicate of banks which provides for up to $1 billion of borrowings

pursuant to a revolving credit facility with the option to increase borrowings to

$1.5 billon with lender approval. The facility matures in November 2016, with

a one-year extension option prior to both the second and third anniversary of

the closing date, provided that extensions shall not extend beyond

November 1, 2018. This facility replaces the prior $1 billion committed credit

facility agreement that would have expired in December 2012. As of and for

the year ended May 31, 2012, we had no amounts outstanding under our

new committed revolving credit facility.

We currently have long-term debt ratings of A+ and A1 from Standard and

Poor’s Corporation and Moody’s Investor Services, respectively. If our long-

term debt rating were to decline, the facility fee and interest rate under our

committed revolving credit facility would increase. Conversely, if our long-term

debt rating were to improve, the facility fee and interest rate would decrease.

Changes in our long-term debt rating would not trigger acceleration of

maturity of any then-outstanding borrowings or any future borrowings under

the committed credit facility. Under this committed revolving credit facility, we

have agreed to various covenants. These covenants include limits on our

disposal of fixed assets, the amount of debt secured by liens we may incur, as

well as a minimum capitalization ratio. In the event we were to have any

borrowings outstanding under this facility and failed to meet any covenant,

and were unable to obtain a waiver from a majority of the banks in the

syndicate, any borrowings would become immediately due and payable. As

of May 31, 2012, we were in full compliance with each of these covenants

and believe it is unlikely we will fail to meet any of these covenants in the

foreseeable future.

Liquidity is also provided by our $1 billion commercial paper program. As of

and for the year ended May 31, 2012, no amounts were outstanding under

this program. We may issue commercial paper from time to time during fiscal

2013 depending on general corporate needs. We currently have short-term

debt ratings of A1 and P1 from Standard and Poor’s Corporation and

Moody’s Investor Services, respectively.

Our previous $760 million shelf registration statement with the Securities and

Exchange Commission expired during fiscal 2012. No debt securities were

issued under that shelf registration prior to its expiry. We may issue debt

securities under a new shelf registration in fiscal 2013 depending on general

corporate needs.

As of May 31, 2012, we had cash, cash equivalents and short-term

investments totaling $3.8 billion, of which $2.5 billion was held by our foreign

subsidiaries. Cash equivalents and short-term investments consist primarily of

deposits held at major banks, money market funds, Tier-1 commercial paper,

corporate notes, U.S. Treasury obligations, U.S. government sponsored

enterprise obligations, and other investment grade fixed income

securities. Our fixed income investments are exposed to both credit and

interest rate risk. All of our investments are investment grade to minimize our

credit risk. While individual securities have varying durations, the average

duration of our entire cash equivalents and short-term investment portfolio is

less than 120 days as of May 31, 2012.

Despite recent uncertainties in the financial markets, to date we have not

experienced difficulty accessing the credit markets or incurred higher interest

costs. Future volatility in the capital markets, however, may increase costs

associated with issuing commercial paper or other debt instruments or affect

our ability to access those markets. We believe that existing cash, cash

equivalents, short-term investments and cash generated by operations,

together with access to external sources of funds as described above, will be

sufficient to meet our domestic and foreign capital needs in the foreseeable

future.

We utilize a variety of tax planning and financing strategies to manage our

worldwide cash and deploy funds to locations where they are needed. We

routinely repatriate a portion of our foreign earnings for which U.S. taxes have

previously been provided. We also indefinitely reinvest a significant portion of

our foreign earnings, and our current plans do not demonstrate a need to

repatriate these earnings. Should we require additional capital in the U.S., we

may elect to repatriate indefinitely reinvested foreign funds or raise capital in

the U.S. through debt. If we were to repatriate indefinitely reinvested foreign

funds, we would be required to accrue and pay additional U.S. taxes less

applicable foreign tax credits. If we elect to raise capital in the U.S. through

debt, we would incur additional interest expense.

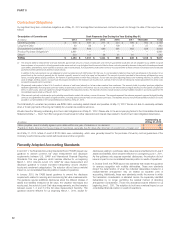

Off-Balance Sheet Arrangements

In connection with various contracts and agreements, we provide routine

indemnifications relating to the enforceability of intellectual property rights,

coverage for legal issues that arise and other items where we are acting as the

guarantor. Currently, we have several such agreements in place. However,

based on our historical experience and the estimated probability of future loss,

we have determined that the fair value of such indemnifications is not material

to our financial position or results of operations.

NIKE, INC. Š2012 Form 10-K 31