Nike 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

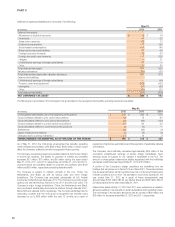

PART II

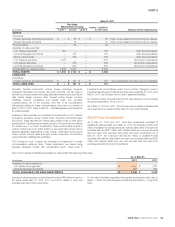

May 31, 2011

Fair Value

Measurements Using Assets / Liabilities

at Fair Value(In millions) Level 1 Level 2 Level 3 Balance Sheet Classification

ASSETS

Derivatives:

Foreign exchange forwards and options $ — $ 38 $ — $ 38 Other current assets and other long-term assets

Interest rate swap contracts — 15 — 15 Other current assets and other long-term assets

Total derivatives — 53 — 53

Available-for-sale securities:

U.S. Treasury securities 125 — — 125 Cash and equivalents

Commercial paper and bonds — 157 — 157 Cash and equivalents

Money market funds — 780 — 780 Cash and equivalents

U.S. Treasury securities 1,473 — — 1,473 Short-term investments

U.S. Agency securities — 308 — 308 Short-term investments

Commercial paper and bonds — 802 — 802 Short-term investments

Total available-for-sale securities 1,598 2,047 — 3,645

TOTAL ASSETS $ 1,598 $ 2,100 $ — $ 3,698

LIABILITIES

Derivatives:

Foreign exchange forwards and options $ — $ 197 $ — $ 197 Accrued liabilities and other long-term liabilities

TOTAL LIABILITIES $ — $ 197 $ — $ 197

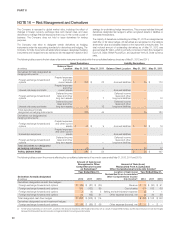

Derivative financial instruments include foreign exchange forwards,

embedded derivatives and interest rate swap contracts. The fair value of

derivative contracts is determined using observable market inputs such as the

daily market foreign currency rates, forward pricing curves, currency

volatilities, currency correlations and interest rates, and considers

nonperformance risk of the Company and that of its counterparties.

Adjustments relating to these nonperformance risks were not material at

May 31, 2012 or 2011. Refer to Note 16 — Risk Management and Derivatives

for additional detail.

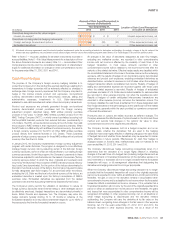

Available-for-sale securities are comprised of investments in U.S. Treasury

and agency securities, money market funds, corporate commercial paper

and bonds. These securities are valued using market prices on both active

markets (Level 1) and less active markets (Level 2). Pricing vendors are utilized

for certain Level 1 or Level 2 investments. These vendors either provide a

quoted market price in an active market or use observable inputs without

applying significant adjustments in their pricing. Observable inputs include

broker quotes, interest rates and yield curves observable at commonly

quoted intervals, volatilities and credit risks.

The Company’s Level 3 assets are comprised of investments in certain

non-marketable preferred stock. These investments are valued using

internally developed models with unobservable inputs. These Level 3

investments are an immaterial portion of our portfolio. Changes in Level 3

investment assets were immaterial during the year ended May 31, 2012. As of

May 31, 2011, the Company had no Level 3 assets and liabilities.

No transfers among the levels within the fair value hierarchy occurred during

the years ended May 31, 2012 or 2011.

As of May 31, 2012 and 2011, the Company had no assets or liabilities that

were required to be measured at fair value on a non-recurring basis.

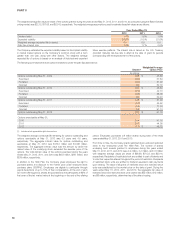

Short-Term Investments

As of May 31, 2012 and 2011, short-term investments consisted of

available-for-sale securities. As of May 31, 2012, the Company held $1,129

million of available-for-sale securities with maturity dates within one year from

purchase date and $311 million with maturity dates over one year and less

than five years from purchase date within short-term investments. As of

May 31, 2011, the Company held $2,253 million of available-for-sale

securities with maturity dates within one year from purchase date and $330

million with maturity dates over one year and less than five years from

purchase date within short-term investments.

Short-term investments classified as available-for-sale consist of the following at fair value:

As of May 31,

(In millions) 2012 2011

Available-for-sale investments:

U.S. treasury and agencies $ 1,157 $ 1,781

Commercial paper and bonds 283 802

TOTAL AVAILABLE-FOR-SALE INVESTMENTS $ 1,440 $ 2,583

Included in interest expense, net was interest income of $30 million for each of

the years ended May 31, 2012, 2011, and 2010, related to cash and

equivalents and short-term investments.

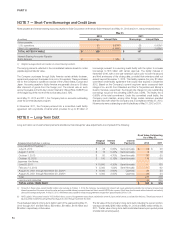

For fair value information regarding notes payable and long-term debt, refer to

Note 7 — Short-Term Borrowings and Credit Lines and Note 8 — Long-Term

Debt.

NIKE, INC. Š2012 Form 10-K 53