Nike 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

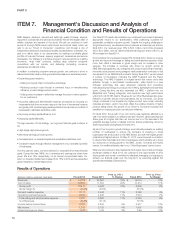

PART II

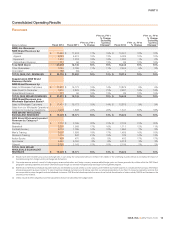

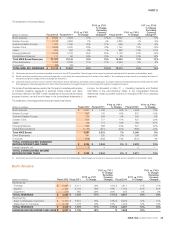

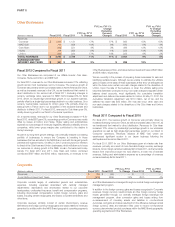

Other Businesses

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11 %

Change

Excluding

Currency

Changes Fiscal 2010

FY11 vs. FY10

% Change

FY11 vs. FY10

% Change

Excluding

Currency

Changes

Revenues

Converse $ 1,324 $ 1,131 17% 17% $ 983 15% 15%

NIKE Golf 726 658 10% 9% 670 -2% -3%

Cole Haan 535 521 3% 3% 466 12% 12%

Hurley 248 252 -2% -1% 222 14% 13%

Umbro 262 224 17% 14% 223 0% 2%

TOTAL REVENUES $ 3,095 $ 2,786 11% 11% $ 2,564 9% 8%

EARNINGS BEFORE

INTEREST AND TAXES $ 341 $ 335 2% $ 298 12%

Fiscal 2012 Compared to Fiscal 2011

Our Other Businesses are comprised of our affiliate brands; Cole Haan,

Converse, Hurley and Umbro; and NIKE Golf.

For fiscal 2012, revenues for our Other Businesses increased 11%, reflecting

growth across most businesses, led by Converse. The revenue growth at

Converse was primarily driven by increased sales in North America and China,

as well as increased revenues in the U.K. as we transitioned that market to

direct distribution in the second half of fiscal 2011. Excluding changes in

currency exchange rates, revenues for NIKE Golf increased 9% for fiscal

2012, driven by double-digit percentage growth in our apparel business,

partially offset by a single-digit percentage decline in our club business. On a

currency neutral basis, revenues for Umbro grew 14% primarily driven by

sales growth in France due to our acquisition of the exclusive licensee and

distributor in March 2011. For fiscal 2012, revenues for Cole Haan grew 3%,

mostly driven by growth in our Direct to Consumer operations.

On a reported basis, revenues for our Other Businesses increased 11% for

fiscal 2012, while EBIT grew 2%, as earnings growth at Converse was mostly

offset by losses at Umbro and Hurley. Higher selling and administrative

expense as a percentage of revenues negatively affected profitability at both

companies, while lower gross margins also contributed to the decline in

Hurley’s earnings.

As part of our long-term growth strategy, we continually evaluate our existing

portfolio of businesses to ensure the Company is investing in those

businesses that are accretive to the NIKE Brand, and with the largest growth

potential and highest returns. On May 31, 2012, we announced our intention

to divest of the Cole Haan and Umbro businesses, which will allow us to focus

our resources on driving growth in the NIKE, Jordan, Converse and Hurley

brands. For fiscal 2012 and 2011, Cole Haan and Umbro combined

contributed $797 million and $745 million, respectively, in revenues to the

Other Businesses portfolio, and losses before interest and taxes of $43 million

and $18 million, respectively.

We are currently in the process of preparing these businesses for sale and

identifying suitable buyers. Although we are unable to estimate the ultimate

gains or losses on the sales of these businesses at this time, we anticipate we

will in the future incur certain non-cash charges related to the divestiture of

Umbro. Upon the sale of the business, or when the ultimate selling price

becomes estimable, we expect to incur non-cash charges to liquidate certain

balance sheet accounts, most significantly the cumulative translation

adjustment and deferred tax assets related to Umbro. At May 31, 2012, the

cumulative translation adjustment was $110 million, net of tax, and the

deferred tax asset was $32 million. We may also incur other cash and

non-cash charges related to the divestiture of the Cole Haan and Umbro

businesses.

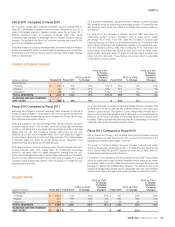

Fiscal 2011 Compared to Fiscal 2010

For fiscal 2011, the revenue growth at Converse was primarily driven by

increased licensing revenue in China, as well as increased sales in the U.K. as

we transitioned that market to direct distribution. Revenues for Cole Haan

increased 12%, driven by double-digit percentage growth in our wholesale

operations as well as high-single-digit percentage growth in our Direct to

Consumer operations. Revenues declined at NIKE Golf, where we

experienced significant erosion in our Japan business following the

earthquake and tsunami in March 2011.

For fiscal 2011, EBIT for our Other Businesses grew at a faster rate than

revenues, primarily as a result of more favorable foreign currency exchange

impacts. Gross margin remained relatively flat for fiscal 2011, as the favorable

impact from improved product mix was offset by a lower mix of licensee

revenues. Selling and administrative expense as a percentage of revenues

remained relatively flat for fiscal 2011.

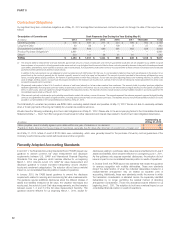

Corporate

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change Fiscal 2010

FY11 vs. FY10

% Change

Revenues $ (39) $ (69) — $ 7 —

(Loss) Before Interest and Taxes (916) (805) -14% (841) 4%

Corporate consists largely of unallocated general and administrative

expenses, including expenses associated with centrally managed

departments; depreciation and amortization related to our corporate

headquarters; unallocated insurance, benefit and compensation programs,

including stock-based compensation; certain foreign currency gains and

losses, including certain hedge gains and losses; corporate eliminations and

other items.

Corporate revenues primarily consist of certain intercompany revenue

eliminations and foreign currency hedge gains and losses related to revenues

generated by entities within the NIKE Brand geographic operating segments

and Other Businesses but managed through our central foreign exchange risk

management program.

In addition to the foreign currency gains and losses recognized in Corporate

revenues, foreign currency results include all other foreign currency hedge

results generated through our centrally managed foreign exchange risk

management program, other conversion gains and losses arising from

re-measurement of monetary assets and liabilities in non-functional

currencies, and gains and losses resulting from the difference between actual

foreign currency rates and standard rates used to record non-functional

currency denominated product purchases within the NIKE Brand geographic

operating segments and Other Businesses.

28