Nike 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

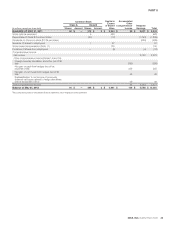

PART II

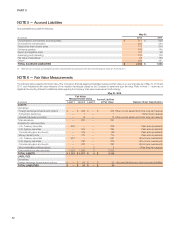

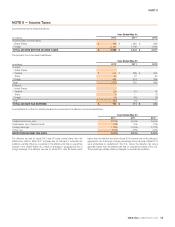

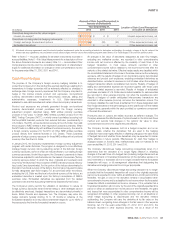

NOTE 5 — Accrued Liabilities

Accrued liabilities included the following:

May 31,

(In millions) 2012 2011

Compensation and benefits, excluding taxes $ 711 $ 628

Endorsement compensation 294 284

Taxes other than income taxes 179 214

Dividends payable 165 145

Import and logistics costs 133 98

Advertising and marketing 132 139

Fair value of derivatives 55 186

Other(1) 384 291

TOTAL ACCRUED LIABILITIES $ 2,053 $ 1,985

(1) Other consists of various accrued expenses with no individual item accounting for more than 5% of the balance at May 31, 2012 and 2011.

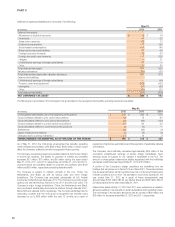

NOTE 6 — Fair Value Measurements

The following table presents information about the Company’s financial assets and liabilities measured at fair value on a recurring basis as of May 31, 2012 and

2011, and indicates the fair value hierarchy of the valuation techniques utilized by the Company to determine such fair value. Refer to Note 1 – Summary of

Significant Accounting Policies for additional detail regarding the Company’s fair value measurement methodology.

May 31, 2012

Fair Value

Measurements Using Assets/Liabilities

at Fair Value

(In millions) Level 1 Level 2 Level 3 Balance Sheet Classification

ASSETS

Derivatives:

Foreign exchange forwards and options $ — $ 265 $ — $ 265 Other current assets and other long-term assets

Embedded derivatives — 1 — 1 Other current assets

Interest rate swap contracts — 15 — 15 Other current assets and other long-term assets

Total derivatives — 281 — 281

Available-for-sale securities:

U.S. Treasury securities 226 — — 226 Cash and equivalents

U.S. Agency securities — 254 — 254 Cash and equivalents

Commercial paper and bonds — 159 — 159 Cash and equivalents

Money market funds — 770 — 770 Cash and equivalents

U.S. Treasury securities 927 — — 927 Short-term investments

U.S. Agency securities — 230 — 230 Short-term investments

Commercial paper and bonds — 283 — 283 Short-term investments

Non-marketable preferred stock — — 3 3 Other long-term assets

Total available-for-sale securities 1,153 1,696 3 2,852

TOTAL ASSETS $ 1,153 $ 1,977 $ 3 $ 3,133

LIABILITIES

Derivatives:

Foreign exchange forwards and options $ — $ 55 $ — $ 55 Accrued liabilities and other long-term liabilities

TOTAL LIABILITIES $—$55$—$ 55

52