Nike 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

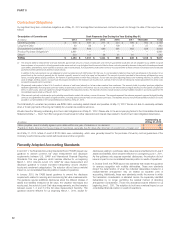

Fair Value Measurements

For financial assets and liabilities measured at fair value on a recurring basis,

fair value is the price we would receive to sell an asset or pay to transfer a

liability in an orderly transaction with a market participant at the measurement

date. In general, and where applicable, we use quoted prices in active

markets for identical assets or liabilities to determine the fair values of our

financial instruments. This pricing methodology applies to our Level 1

investments, including U.S. Treasury securities.

In the absence of active markets for identical assets or liabilities, such

measurements involve developing assumptions based on market observable

data, including quoted prices for similar assets or liabilities in active markets

and quoted prices for identical or similar assets or liabilities in markets that are

not active. This pricing methodology applies to our Level 2 investments such

as commercial paper and bonds, U.S. agency securities and money market

funds. Level 3 investments are valued using internally developed models with

unobservable inputs. Assets and liabilities measured using unobservable

inputs are an immaterial portion of our portfolio.

A majority of our available-for-sale securities are priced by pricing vendors and

are generally Level 1 or Level 2 investments, as these vendors either provide a

quoted market price in an active market or use observable inputs without

applying significant adjustments in their pricing. Observable inputs include

broker quotes, interest rates and yield curves observable at commonly

quoted intervals, volatilities and credit risks. Our fair value processes include

controls that are designed to ensure appropriate fair values are

recorded. These controls include an analysis of period-over-period

fluctuations and comparison to another independent pricing vendor.

Hedge Accounting for Derivatives

We use forward and option contracts to hedge certain anticipated foreign

currency exchange transactions as well as certain non-functional monetary

assets and liabilities. When the specific criteria to qualify for hedge accounting

has been met, changes in the fair value of contracts hedging probable

forecasted future cash flows are recorded in other comprehensive income,

rather than net income, until the underlying hedged transaction affects net

income. In most cases, this results in gains and losses on hedge derivatives

being released from other comprehensive income into net income some time

after the maturity of the derivative. One of the criteria for this accounting

treatment is that the forward and option contracts amount should not be in

excess of specifically identified anticipated transactions. By their very nature,

our estimates of anticipated transactions may fluctuate over time and may

ultimately vary from actual transactions. When anticipated transaction

estimates or actual transaction amounts decline below hedged levels, or if it is

no longer probable that a forecasted transaction will occur by the end of the

originally specified time period or within an additional two-month period of

time thereafter, we are required to reclassify the cumulative changes in fair

values of the over-hedged portion of the related hedge contract from other

comprehensive income to other expense (income), net during the quarter in

which such changes occur.

We use forward contracts to hedge our investment in the net assets of certain

international subsidiaries to offset foreign currency translation related to our

net investment in those subsidiaries. The change in fair value of the forward

contracts hedging our net investments is reported in the cumulative

translation adjustment component of accumulated other comprehensive

income within stockholders’ equity, to the extent effective, to offset the foreign

currency translation adjustments on those investments. As the value of our

underlying net investments in wholly-owned international subsidiaries is

known at the time a hedge is placed, the designated hedge is matched to the

portion of our net investment at risk. Accordingly, the variability involved in net

investment hedges is substantially less than that of other types of hedge

transactions and we do not expect any material ineffectiveness. We consider,

on a quarterly basis, the need to redesignate existing hedge relationships

based on changes in the underlying net investment. Should the level of our net

investment decrease below hedged levels, the cumulative change in fair value

of the over-hedged portion of the related hedge contract would be reported

directly to earnings in the period in which changes occur.

Stock-based Compensation

We account for stock-based compensation by estimating the fair value of

stock-based compensation on the date of grant using the Black-Scholes

option pricing model. The Black-Scholes option pricing model requires the

input of highly subjective assumptions including volatility. Expected volatility is

estimated based on implied volatility in market traded options on our common

stock with a term greater than one year, along with other factors. Our decision

to use implied volatility was based on the availability of actively traded options

on our common stock and our assessment that implied volatility is more

representative of future stock price trends than historical volatility. If factors

change and we use different assumptions for estimating stock-based

compensation expense in future periods, stock-based compensation expense

may differ materially in the future from that recorded in the current period.

Taxes

We record valuation allowances against our deferred tax assets, when

necessary. Realization of deferred tax assets (such as net operating loss

carry-forwards) is dependent on future taxable earnings and is therefore

uncertain. At least quarterly, we assess the likelihood that our deferred tax

asset balance will be recovered from future taxable income. To the extent we

believe that recovery is not likely, we establish a valuation allowance against

our net deferred tax asset, which increases our income tax expense in the

period when such determination is made.

In addition, we have not recorded U.S. income tax expense for foreign

earnings that we have determined to be indefinitely reinvested outside the

U.S., thus reducing our overall income tax expense. The amount of earnings

designated as indefinitely reinvested offshore is based upon the actual

deployment of such earnings in our offshore assets and our expectations of

the future cash needs of our U.S. and foreign entities. Income tax

considerations are also a factor in determining the amount of foreign earnings

to be indefinitely reinvested offshore.

We carefully review all factors that drive the ultimate disposition of foreign

earnings determined to be reinvested offshore and apply stringent standards

to overcome the presumption of repatriation. Despite this approach, because

the determination involves our future plans and expectations of future events,

the possibility exists that amounts declared as indefinitely reinvested offshore

may ultimately be repatriated. For instance, the actual cash needs of our U.S.

entities may exceed our current expectations, or the actual cash needs of our

foreign entities may be less than our current expectations. This would result in

additional income tax expense in the year we determined that amounts were

no longer indefinitely reinvested offshore. Conversely, our approach may also

result in a determination that accumulated foreign earnings (for which U.S.

income taxes have been provided) will be indefinitely reinvested offshore. In

this case, our income tax expense would be reduced in the year of such

determination.

On an interim basis, we estimate what our effective tax rate will be for the full

fiscal year. This estimated annual effective tax rate is then applied to the

year-to-date pre-tax income excluding infrequently occurring or unusual

items, to determine the year-to-date tax expense. The income tax effects of

infrequent or unusual items are recognized in the interim period in which they

occur. As the fiscal year progresses, we continually refine our estimate based

upon actual events and earnings by jurisdiction during the year. This continual

estimation process periodically results in a change to our expected effective

tax rate for the fiscal year. When this occurs, we adjust the income tax

provision during the quarter in which the change in estimate occurs.

On a quarterly basis, we reevaluate the probability that a tax position will be

effectively sustained and the appropriateness of the amount recognized for

uncertain tax positions based on factors including changes in facts or

circumstances, changes in tax law, settled audit issues and new audit activity.

Changes in our assessment may result in the recognition of a tax benefit or an

additional charge to the tax provision in the period our assessment changes.

We recognize interest and penalties related to income tax matters in income

tax expense.

NIKE, INC. Š2012 Form 10-K 35