Nike 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

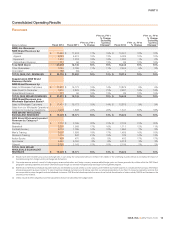

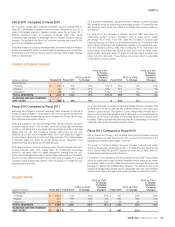

Emerging Markets

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes Fiscal 2010

FY11 vs. FY10

% Change

FY11 vs. FY10

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 2,386 $ 1,897 26% 27% $ 1,458 30% 24%

Apparel 815 657 24% 25% 577 14% 9%

Equipment 209 182 15% 15% 163 12% 7%

TOTAL REVENUES $ 3,410 $ 2,736 25% 26% $ 2,198 24% 19%

EARNINGS BEFORE INTEREST

AND TAXES $ 853 $ 688 24% $ 521 32%

Fiscal 2012 Compared to Fiscal 2011

Excluding the changes in currency exchange rates, revenues for the

Emerging Markets increased 26% for fiscal 2012 as all territories in the

geography reported double-digit revenue growth, led by Argentina, Brazil,

Mexico and Korea.

For fiscal 2012, revenue growth for both footwear and apparel in the

Emerging Markets was driven by double-digit percentage growth in unit sales

and mid-single-digit percentage growth in average selling price per unit,

primarily reflective of product price increases. The overall increase in

Emerging Markets’ footwear and apparel sales was driven by strong demand

in nearly all key categories, led by Running and Sportswear.

The increase in Emerging Markets’ EBIT for fiscal 2012 was primarily the

result of revenue growth and selling and administrative expense leverage,

which more than offset a lower gross margin. Gross margin declined 150

basis points for the fiscal year, primarily due to higher product input costs,

customs duty charges and inventory obsolescence expense. These factors

were partially offset by the favorable impact of changes in standard currency

exchange rates and product price increases. Selling and administrative

expense as a percentage of revenues decreased 140 basis points, as both

demand creation expense and operating overhead grew at a slower rate than

revenues.

Fiscal 2011 Compared to Fiscal 2010

Excluding the changes in currency exchange rates, revenues for Emerging

Markets increased 19% for fiscal 2011. Most territories in the geography

reported double-digit revenue growth for the fiscal year, led by Brazil,

Argentina, Mexico, and Korea.

For fiscal 2011, both footwear and apparel revenue growth in the Emerging

Markets was driven by strong demand in nearly all key categories, most

notably Sportswear and Running.

For fiscal 2011, EBIT for Emerging Markets grew at a faster rate than revenue

as a result of higher gross margin percentage, improved leverage on selling

and administrative expense and favorable foreign currency translation. The

increase in the gross margin percentage was primarily due to a higher mix of

in-line product sales, lower warehousing costs and favorable year-over-year

standard currency rates, which more than offset the increase in product input

costs and higher full-price discounts.

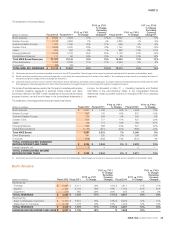

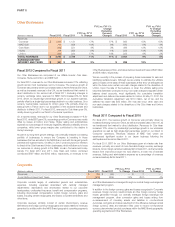

Global Brand Divisions

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes Fiscal 2010

FY11

vs. FY10

% Change

FY11 vs. FY10

% Change

Excluding

Currency

Changes

Revenues $ 111 $ 96 16% 13%$ 86 12% 16%

(Loss) Before Interest and Taxes (1,177) (971) -21% (866) -12%

Global Brand Divisions primarily represent demand creation and operating

overhead expenses that are centrally managed for the NIKE Brand. Revenues

for the Global Brand Divisions are attributable to NIKE Brand licensing

businesses that are not part of a geographic operating segment.

Fiscal 2012 Compared to Fiscal 2011

For fiscal 2012, Global Brand Divisions’ loss before interest and taxes

increased $206 million, primarily driven by increased investments in our digital

business and infrastructure for our Direct to Consumer operations, higher

sports marketing expense as well as higher personnel costs to support our

global brand functions.

Fiscal 2011 Compared to Fiscal 2010

For fiscal 2011, the increase in Global Brand Divisions’ loss before interest

and taxes was primarily due to an increase in both operating overhead and

centrally managed demand creation expense. The increase in operating

overhead expense was mainly driven by increased investments in our Direct

to Consumer infrastructure along with higher wages and travel expense. The

increase in demand creation expense was primarily driven by a higher level of

brand event spending around the World Cup and World Basketball Festival in

the first half of fiscal 2011, as well as increased investments in sports

marketing.

NIKE, INC. Š2012 Form 10-K 27