Nike 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

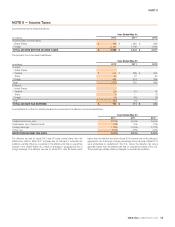

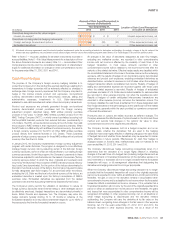

The Company has recorded deferred tax assets of $216 million at May 31, 2012 for foreign tax credit carry-forwards with expiration dates between 2020 and

2022.

The Company has available domestic and foreign loss carry-forwards of $247 million at May 31, 2012. Such losses, if not utilized, will expire as follows:

Year Ending May 31,

(In millions) 2013 2014 2015 2016 2017- 2032 Indefinite Total

Net Operating Losses $ — 8 3 8 131 97 $ 247

During the years ended May 31, 2012, 2011, and 2010, income tax benefits attributable to employee stock-based compensation transactions of $120 million,

$68 million, and $57 million, respectively, were allocated to shareholders’ equity.

NOTE 10 — Redeemable Preferred Stock

Sojitz America is the sole owner of the Company’s authorized Redeemable

Preferred Stock, $1 par value, which is redeemable at the option of Sojitz

America or the Company at par value aggregating $0.3 million. A cumulative

dividend of $0.10 per share is payable annually on May 31 and no dividends

may be declared or paid on the common stock of the Company unless

dividends on the Redeemable Preferred Stock have been declared and paid

in full. There have been no changes in the Redeemable Preferred Stock in the

three years ended May 31, 2012, 2011, and 2010. As the holder of the

Redeemable Preferred Stock, Sojitz America does not have general voting

rights but does have the right to vote as a separate class on the sale of all or

substantially all of the assets of the Company and its subsidiaries, on merger,

consolidation, liquidation or dissolution of the Company or on the sale or

assignment of the NIKE trademark for athletic footwear sold in the United

States.

NOTE 11 — Common Stock and Stock-Based Compensation

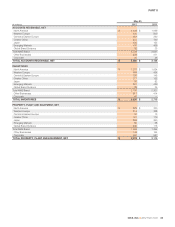

The authorized number of shares of Class A Common Stock, no par value,

and Class B Common Stock, no par value, are 175 million and 750 million,

respectively. Each share of Class A Common Stock is convertible into one

share of Class B Common Stock. Voting rights of Class B Common Stock are

limited in certain circumstances with respect to the election of directors. There

are no differences in the dividend and liquidation preferences or participation

rights of the Class A and Class B common stockholders.

In 1990, the Board of Directors adopted, and the shareholders approved, the

NIKE, Inc. 1990 Stock Incentive Plan (the “1990 Plan”). The 1990 Plan

provides for the issuance of up to 163 million previously unissued shares of

Class B Common Stock in connection with stock options and other awards

granted under the plan. The 1990 Plan authorizes the grant of non-statutory

stock options, incentive stock options, stock appreciation rights, restricted

stock, restricted stock units, and performance-based awards. The exercise

price for stock options and stock appreciation rights may not be less than the

fair market value of the underlying shares on the date of grant. A committee of

the Board of Directors administers the 1990 Plan. The committee has the

authority to determine the employees to whom awards will be made, the

amount of the awards, and the other terms and conditions of the awards.

Substantially all stock option grants outstanding under the 1990 Plan were

granted in the first quarter of each fiscal year, vest ratably over four years, and

expire 10 years from the date of grant.

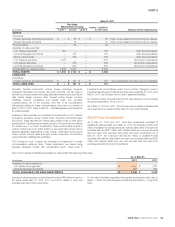

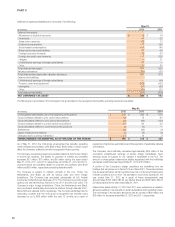

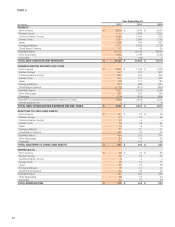

The following table summarizes the Company’s total stock-based compensation expense recognized in selling and administrative expense:

Year Ended May 31,

(In millions) 2012 2011 2010

Stock options(1) $ 96 $ 77 $ 135

ESPPs 16 14 14

Restricted stock 18 14 10

TOTAL STOCK-BASED COMPENSATION EXPENSE $ 130 $ 105 $ 159

(1) Expense for stock options includes the expense associated with stock appreciation rights. Accelerated stock option expense is recorded for employees eligible for accelerated stock option

vesting upon retirement. In the first quarter of fiscal 2011, the Company changed the accelerated vesting provisions of its stock option plan. Under the new provisions, accelerated stock

option expense for years ended May 31, 2012 and 2011 was $17 million and $12 million, respectively. The accelerated stock option expense for the year ended May 31, 2010 was $74

million.

As of May 31, 2012, the Company had $151 million of unrecognized compensation costs from stock options, net of estimated forfeitures, to be recognized as

selling and administrative expense over a weighted average period of 2.2 years.

NIKE, INC. Š2012 Form 10-K 57