Nike 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

The reported futures orders growth is not necessarily indicative of our

expectation of revenue growth during this period. This is due to year-over-

year changes in shipment timing and because the mix of orders can shift

between futures and at-once orders, and the fulfillment of certain orders may

fall outside of the schedule noted above. In addition, exchange rate

fluctuations as well as differing levels of order cancellations and discounts can

cause differences in the comparisons between futures orders and actual

revenues. Moreover, a significant portion of our revenue is not derived from

futures orders, including at-once and close-out sales of NIKE Brand footwear

and apparel, sales of NIKE Brand equipment, sales from our Direct to

Consumer operations, and sales from our Other Businesses.

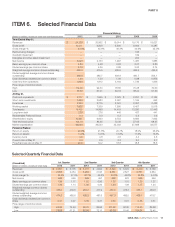

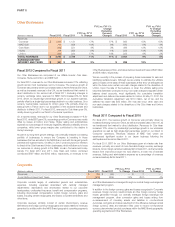

Gross Margin

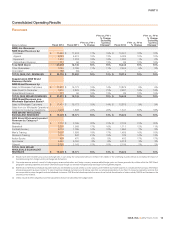

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change Fiscal 2010

FY11 vs. FY10

% Change

Gross Profit $ 10,471 $ 9,508 10% $ 8,800 8%

Gross Margin % 43.4% 45.6% (220) bps 46.3% (70) bps

Fiscal 2012 Compared to Fiscal 2011

For fiscal 2012, our consolidated gross margin was 220 basis points lower

than the prior year period, primarily driven by higher product input costs,

including materials and labor, across most businesses. Also contributing to

the decrease in gross margin were higher customs duty charges, discounts

on close-out sales and an increase in investments in our digital business and

infrastructure. Together, these factors decreased consolidated gross margin

by approximately 390 basis points. Partially offsetting this decrease were

positive impacts from product price increases, lower air freight costs, the

growth of our NIKE Brand Direct to Consumer business, and benefits from

our ongoing product cost reduction initiatives.

Fiscal 2011 Compared to Fiscal 2010

For fiscal 2011, our consolidated gross margin percentage was 70 basis

points lower than the prior year, primarily driven by higher input costs,

transportation costs, including additional air freight incurred to meet strong

demand for NIKE Brand products across most businesses, and a lower mix

of licensee revenue as distribution for certain markets within our Other

Businesses transitioned from licensees to operating units of NIKE, Inc.

Together, these factors decreased consolidated gross margins by

approximately 130 basis points for fiscal 2011, with the most significant

erosion in the second half of the fiscal year. These decreases were partially

offset by the positive impact from the growth and expanding profitability of our

NIKE Brand Direct to Consumer business, a higher mix of full-price sales and

favorable impacts from our ongoing product cost efficiency initiatives.

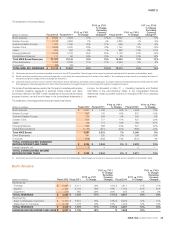

Selling and Administrative Expense

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change Fiscal 2010

FY11 vs. FY10

% Change

Demand creation expense(1) $ 2,711 $ 2,448 11% $ 2,356 4%

Operating overhead expense 4,720 4,245 11% 3,970 7%

Selling and administrative

expense $ 7,431 $ 6,693 11% $ 6,326 6%

% of Revenues 30.8% 32.1% (130) bps 33.3% (120) bps

(1) Demand creation consists of advertising and promotion expenses, including costs of endorsement contracts.

Fiscal 2012 Compared to Fiscal 2011

Overall, selling and administrative expense grew at a slower rate than

revenues for fiscal 2012.

Demand creation expense increased 11% compared to the prior year, mainly

driven by an increase in sports marketing expense, marketing support for key

product initiatives, including the NIKE Fuelband and NFL uniforms, as well as

an increased level of brand event spending around the European Football

Championships and London Summer Olympics. For fiscal 2012, changes in

currency exchange rates increased the growth of demand creation expense

by 1 percentage point.

Compared to the prior year, operating overhead expense increased 11%,

primarily attributable to increased investments in our Direct to Consumer

operations, higher personnel costs as well as travel expenses to support the

growth of our overall business. For fiscal 2012, changes in currency exchange

rates increased the growth of operating overhead expense by 1 percentage

point.

Fiscal 2011 Compared to Fiscal 2010

In fiscal 2011, the effect of changes in foreign currency exchange rates did not

have a significant impact on selling and administrative expense.

Demand creation expense increased 4% compared to the prior year, primarily

driven by a higher level of brand event spending around the World Cup and

World Basketball Festival in the first half of fiscal 2011, as well as increased

spending around key product initiatives and investments in retail product

presentation with wholesale customers.

Operating overhead expense increased 7% compared to the prior year. This

increase was primarily attributable to increased investments in our Direct to

Consumer operations as well as growth in our wholesale operations, where

we incurred higher personnel costs and travel expenses as compared to the

prior year.

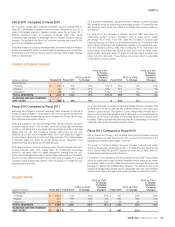

Other Expense (Income), net

(In millions) Fiscal 2012 Fiscal 2011 Fiscal 2010

Other expense (income), net $ 54 $ (33) $ (49)

NIKE, INC. Š2012 Form 10-K 21