Nike 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

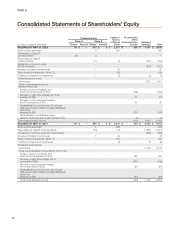

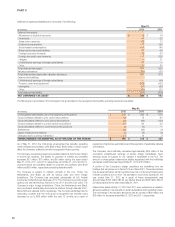

Earnings Per Share

Basic earnings per common share is calculated by dividing net income by the

weighted average number of common shares outstanding during the year.

Diluted earnings per common share is calculated by adjusting weighted

average outstanding shares, assuming conversion of all potentially dilutive

stock options and awards.

See Note 12 — Earnings Per Share for further discussion.

Management Estimates

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates, including

estimates relating to assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the date of

financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from these estimates.

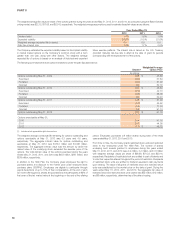

Recently Adopted Accounting Standards

In April 2011, the Financial Accounting Standards Board (“FASB”) issued new

guidance to achieve common fair value measurement and disclosure

requirements between U.S. GAAP and International Financial Reporting

Standards. This new guidance, which became effective for the Company

beginning March 1, 2012, amends current U.S. GAAP fair value

measurement and disclosure guidance to include increased transparency

around valuation inputs and investment categorization. The adoption did not

have a material impact on the Company’s consolidated financial position or

results of operations.

In January 2010, the FASB issued guidance to amend the disclosure

requirements related to recurring and nonrecurring fair value measurements.

The guidance requires additional disclosures about the different classes of

assets and liabilities measured at fair value, the valuation techniques and

inputs used, the activity in Level 3 fair value measurements, and the transfers

between Levels 1, 2, and 3 of the fair value measurement hierarchy (as

described in Note 6. —Fair Value Measurements). This guidance became

effective for the Company beginning March 1, 2010, except for disclosures

relating to purchases, sales, issuances and settlements of Level 3 assets and

liabilities, which became effective for the Company beginning June 1, 2011.

As this guidance only requires expanded disclosures, the adoption did not

have an impact on the Company’s consolidated financial position or results of

operations.

In October 2009, the FASB issued new standards that revised the guidance

for revenue recognition with multiple deliverables. These new standards

impact the determination of when the individual deliverables included in a

multiple-element arrangement may be treated as separate units of

accounting. Additionally, these new standards modify the manner in which

the transaction consideration is allocated across the separately identified

deliverables by no longer permitting the residual method of allocating

arrangement consideration. These new standards became effective for the

Company beginning June 1, 2011. The adoption did not have a material

impact on the Company’s consolidated financial position or results of

operations.

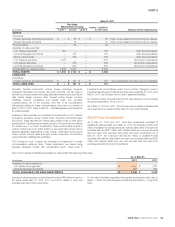

Recently Issued Accounting Standards

In December 2011, the FASB issued guidance enhancing disclosure

requirements surrounding the nature of an entity’s right to offset and related

arrangements associated with its financial instruments and derivative

instruments. This new guidance requires companies to disclose both gross

and net information about instruments and transactions eligible for offset in

the statement of financial position and instruments and transactions subject

to master netting arrangements. This new guidance is effective for the

Company beginning June 1, 2013. As this guidance only requires expanded

disclosures, the Company does not anticipate the adoption will have an

impact on its consolidated financial position or results of operations.

In September 2011, the FASB issued updated guidance on the periodic

testing of goodwill for impairment. This guidance will allow companies to

assess qualitative factors to determine if it is more-likely-than-not that goodwill

might be impaired and whether it is necessary to perform the two-step

goodwill impairment test required under current accounting standards. This

new guidance is effective for the Company beginning June 1, 2012. The

Company does not expect the adoption will have a material effect on its

consolidated financial position or results of operations.

In June 2011, the FASB issued guidance on the presentation of

comprehensive income. This new guidance eliminates the current option to

report other comprehensive income and its components in the statement of

shareholders’ equity. Companies will now be required to present the

components of net income and other comprehensive income in either one

continuous statement, referred to as the statement of comprehensive

income, or in two separate, but consecutive statements. This guidance also

required companies to present reclassification adjustments out of

accumulated other comprehensive income by component in both the

statement in which net income is presented and the statement in which other

comprehensive income is presented. However, in December 2011, the FASB

issued guidance which indefinitely defers the requirement related to the

presentation of reclassification adjustments. Both issuances on the

presentation of comprehensive income are effective for the Company

beginning June 1, 2012. As this guidance only amends the presentation of

the components of comprehensive income, the Company does not anticipate

the adoption will have an impact on its consolidated financial position or

results of operations.

NOTE 2 — Inventories

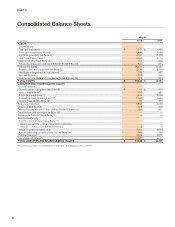

Inventory balances of $3,350 million and $2,715 million at May 31, 2012 and 2011, respectively, were substantially all finished goods.

50