National Grid 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

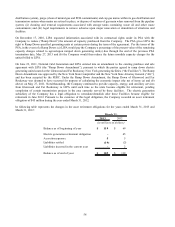

The Company is able to draw down on this facility in currencies other than the US dollar. The Company hedges the risk

associated with foreign currency debt instruments by using cross currency swaps which convert the interest and principle

payments into US dollars. These swaps are accounted for as fair value hedges or cash flow hedges, with fair value

movements recognized in other comprehensive income. As at March 31, 2013 the Company had $796.3 million of

foreign currency debt and $11 million of current derivative assets and $87 million of non-current derivative liabilities

designated in cash flow hedging relationships, with $5 million recognized in other comprehensive income for the period

ended March 31, 2013. The Company expects $2.6 million in other comprehensive income will be reclassified into

earnings within the next twelve months. The ineffective portion of the hedge for the year ended March 31, 2013 was $0.9

million.

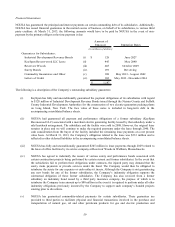

On June 3, 2011, the Company raised $667 million through the Program. These notes are due June 3, 2015 with a

weighted average interest rate of 2.604%. On June 25, 2012 and September 24, 2012, the Company raised an additional

$38.3 million and $96.1 million, respectively. These notes are due on June 25, 2014 and September 24, 2014 with a

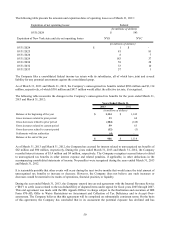

weighted average interest rate of 1.176%. At March 31, 2013 and March 31, 2012, $1.5 billion and $845 million,

respectively, of these notes were issued and outstanding, excluding the impact of interest rate and currency swaps.

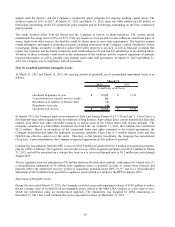

Notes Payable

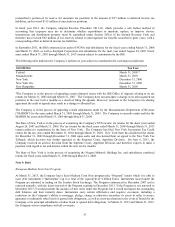

At March 31, 2013 and March 31, 2012 the Company had outstanding $7.1 billion and $6.2 billion, respectively, of

unsecured medium and long-term notes. In December 2012, Narragansett issued $250 million of unsecured long-term

debt at 4.17% with a maturity date of December 10, 2042. In November 2012, Niagara Mohawk issued $400 million of

unsecured long-term debt at 4.119% with a maturity date of November 28, 2042 and $300 million of unsecured long-

term debt at 2.721% with a maturity date of November 28, 2022. In February 2012, Boston Gas issued $500 million of

Senior Unsecured Notes at 4.487% due February 15, 2042. In March 2012, Colonial Gas issued two tranches of $25

million each of Senior Unsecured Notes at 3.296% due March 15, 2022 and 4.628% due March 15, 2042. The interest

rates on the unsecured notes range from 3.296% to 9.750% and maturity dates range from November 2012 through

December 2042.

On August 9, 2011, the Company entered into two loan agreements with Bank of Tokyo-Mitsubishi UFJ, Ltd. for $250

million with an interest rate of LIBOR plus a margin spread of 0.7%, maturing on August 9, 2013 and $500 million with

an interest rate of LIBOR plus a margin spread of 0.9%, maturing on October 29, 2014. On August 19, 2011, the

Company entered into a term loan agreement with the Mizuho Corporate Bank, Ltd. for $250 million with an interest

rate of LIBOR plus a margin spread of 0.7%, maturing on August 19, 2013.

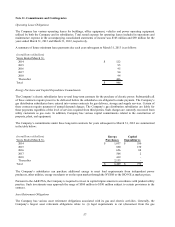

Gas Facilities Revenue Bonds

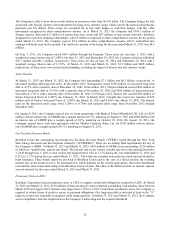

Brooklyn Union has outstanding tax-exempt Gas Facilities Revenue Bonds (“GFRB”) issued through the New York

State Energy Research and Development Authority (“NYSERDA”). There are no sinking fund requirements for any of

the Company’ s GFRB. At March 31, 2013 and March 31, 2012, $641 million of GFRBs were outstanding; $230 million

of which are variable-rate, auction rate bonds. The interest rate on the various variable rate series due starting December

1, 2020 through July 1, 2026 is reset weekly and ranged from 0.14% to 2.17% during the year ended March 31, 2013 and

0.21% to 2.17% during the year ended March 31, 2012. The bonds are currently in auction rate mode and are backed by

bond insurance. These bonds cannot be put back to Brooklyn Union and in the case of a failed auction, the resulting

interest rate on the bonds revert to the maximum rate which depends on the current appropriate, short term benchmark

rates and the senior unsecured rating of the Brooklyn Union’ s bonds. The effect of the failed auctions on interest expense

was not material for the years ended March 31, 2013 and March 31, 2012.

Promissory Notes to LIPA

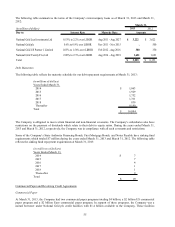

KeySpan Corporation issued promissory notes to LIPA to support certain debt obligations assumed by LIPA. At March

31, 2013 and March 31, 2012, $155 million of these promissory notes remained outstanding with maturity dates between

March 2016 and August 2025. Interest rates range from 5.15% to 5.30%. Under these promissory notes, the Company is

required to obtain letters of credit to secure its payment obligations if its long-term debt is not rated at least in the “A”

range by at least two nationally recognized credit rating agencies. At March 31, 2013 and March 31, 2012, the Company

was in compliance with this requirement as the Company’ s debt rating met the required threshold.