National Grid 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

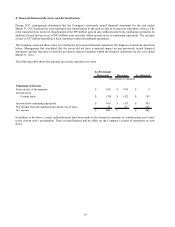

Alliance profit: This regulatory liability represents a portion of deferred margins from off-system sale transactions.

Under current rate orders, the Company is required to return 90% of margins earned from such optimization transactions

to firm customers. The amounts deferred at the balance sheet date will be refunded to customers over the next year.

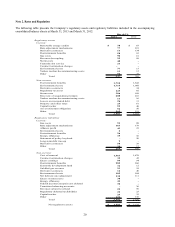

Capital tracker: Brooklyn Union and KeySpan Gas East have capital tracker mechanisms that reconcile their capital

expenditures to the amounts permitted in rates. The mechanism provides for a two way (upward and downward) tracker

for City and State Construction ("CSC") related expenditures and a one way (downward only) tracker for all other capital

expenditures. Brooklyn Union and KeySpan Gas East defer the full revenue requirement equivalent of CSC expenditures

above or below the CSC rate allowance and defer the revenue requirement equivalent of any other unspent capital

expenses below the rate allowance for all other capital expenditures. Brooklyn Union’ s recent rate settlement, discussed

below, eliminated the CSC tracker effective January 1, 2013. The effect of the tracker is to adjust the Company’ s return

on common equity capital (“ROE”) for the difference between actual capital expenditures and the amount provided in

rates.

Cost of removal: The Company’ s depreciation expense includes estimated costs to remove property, plant and

equipment, which is recovered through the rates charged to customers. This regulatory liability represents cumulative

costs recovered in excess of costs incurred. For a vast majority of its regulated utility plant assets, the Company uses

these funds to remove the asset so a new one can be installed in its place.

Environmental costs: This regulatory asset represents deferred costs associated with the Company’ s share of the

estimated costs to investigate and perform certain remediation activities at sites with which it may be associated. The

Company believes future costs, beyond the expiration of current rate plans, will continue to be recovered through rates.

Excess earnings: The base rates in Brooklyn Union’ s and KeySpan Gas East’ s rate plans (2008-12) provide for a 9.8%

ROE. At the end of each rate year (calendar year), these entities are required to provide the NYPSC with a computation

of its ROE. If the level of earned common equity in the applicable rate year exceeds 10.5%, the company is required to

defer a portion of the revenue equivalent associated with any over earnings for the benefit of customers. Brooklyn

Union’ s recent rate settlement modified its ROE and revenue sharing mechanism for the rate year beginning January 1,

2013, as described below.

Gas costs: The Company’ s regulated subsidiaries are subject to rate adjustment mechanisms for commodity costs,

whereby an asset or liability is recognized resulting from differences between actual revenues and the underlying cost

being recovered or differences between actual revenues and targeted amounts as approved by state authorities. These

amounts will be refunded to or recovered from customers over the next year.

Net delivery rate adjustment: A $15 million combined annual surcharge for the recovery of regulatory assets

(“Delivery Rate Surcharge” or “DRS”) was implemented in January 2008 and January 2009 for Brooklyn Union and

KeySpan Gas East, respectively. The Delivery Rate Surcharge increased by $5 million for the first five years of the

Brooklyn Union’ s rate plan and increased by $10 million per year in rate years 2010 through 2012 of KeySpan Gas

East’ s rate plan, resulting in the combined aggregate recovery of approximately $175 million. The first $25.2 million

collected from the DRS was used to offset deferred special franchise taxes with the remainder deferred and used to offset

future increases in rates for the costs such as Site Investigation and Remediation (“SIR”) or other costs deferrals. The

DRS expired on December 31, 2012. In January 2010, the New York Gas Companies submitted a filing on the status of

its regulatory deferrals so that the NYPSC could determine if the New York Gas Companies should adjust their revenue

levels under the rate plan so as to minimize outstanding deferral balances. On November 28, 2012, the NYPSC issued an

order authorizing the Companies to recover a combined $215.6 million of SIR deferral balances through the

implementation of an SIR surcharge that supersedes the expired DRS. The SIR surcharge is designed to collect a

combined $65.0 million per year beginning January 1, 2013, to amortize the SIR balance approved for recovery by the

NYPSC.

Postretirement benefits: The amount in regulatory assets primarily represents the excess costs of the Company’ s

pension and postretirement benefits plans over amounts received in rates that are deferred to a regulatory asset to be

recovered in future periods and the non-cash accrual of net actuarial gains and losses. The amount in regulatory liabilities

primarily represents accrued carrying charges as calculated in accordance with the Company’ s Pension and PBOP

internal reserve mechanism.

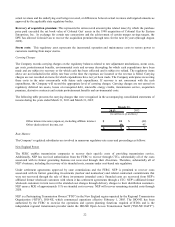

Rate adjustment mechanisms: The Company’ s regulated subsidiaries are subject to a number of rate adjustment

mechanisms such as for commodity costs, whereby an asset or liability is recognized resulting from differences between