National Grid 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

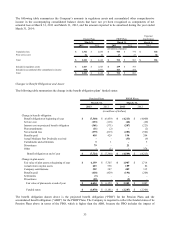

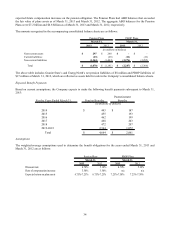

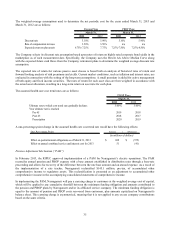

The weighted-average assumptions used to determine the net periodic cost for the years ended March 31, 2013 and

March 31, 2012 are as follows:

2013 2012 2013 2012

Discount rate 5.10% 5.90% 5.10% 5.90%

Rate of compensation increase 3.50% 3.50% n/a n/a

Expected return on plan assets 6.75%-7.25% 7.75% 7.25%-7.50% 7.25%-8.50%

PBOP PlansPension Plans

March 31, March 31,

The Company selects its discount rate assumption based upon rates of return on highly rated corporate bond yields in the

marketplace as of each measurement date. Specifically, the Company uses the Hewitt AA Above Median Curve along

with the expected future cash flows from the Company retirement plans to determine the weighted average discount rate

assumption.

The expected rate of return for various passive asset classes is based both on analysis of historical rates of return and

forward looking analysis of risk premiums and yields. Current market conditions, such as inflation and interest rates, are

evaluated in connection with the setting of the long-term assumptions. A small premium is added for active management

of both equity and fixed income securities. The rates of return for each asset class are then weighted in accordance with

the actual asset allocation, resulting in a long-term return on asset rate for each plan.

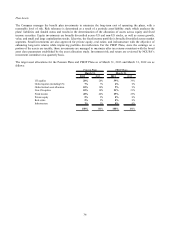

The assumed health care cost trend rates are as follows:

2013 2012

Ultimate rate to which cost trend rate gradually declines 5.00% 5.00%

Year ultimate rate is reached

Pre 65 2019 2018

Post 65 2018 2017

Prescription 2020 2019

PBOP Plans

March 31,

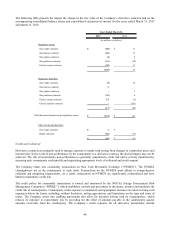

A one-percentage-point change in the assumed health care cost trend rate would have the following effects:

One-Percentage-Point Increase /(Decrease)

Effect on postretirement obligations as of March 31, 2013 688$ (575)$

Effect on annual combined service and interest cost for 2013 51 (41)

(in millions of dollars)

Pension Adjustment Mechanism (“PAM”)

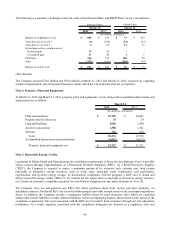

In February 2013, the RIPUC approved implementation of a PAM for Narragansett’ s electric operations. The PAM

reconciles annual pension and PBOP expense with a base amount established in distribution rates through a base-rate

proceeding and allows for recovery of the difference between the rate base amount and an annual expense. As a result of

the implementation of a rate tracker, Narragansett reclassified $145.1 million, pre-tax, of accumulated other

comprehensive income to regulatory assets. This reclassification is presented as an adjustment to accumulated other

comprehensive income in the accompanying consolidated statements of comprehensive income.

In implementing the PAM, Narragansett will pay a carrying charge to customers at the weighted average cost of capital,

which will be applied to any cumulative shortfall between the minimum funding obligation and amounts contributed to

the pension and PBOP plans by Narragansett and/or its affiliated service company. The minimum funding obligation is

equal to the amount of pension and PBOP costs recovered from customers, plus amounts capitalized on Narragansett's

balance sheet. This carrying charge is asymmetrical, meaning that it is not applied to any excess company contributions

based on the same criteria.